Energy and Utilities

Blog: Capgemini CTO Blog

Now, with the impact of the global COVID-19 pandemic to contend with as well, this blog looks at how Energy and Utilities (E&U) companies can ensure cost resilience going forward.

The E&U landscape prior to COVID-19

First, a quick recap on the changes over the past two decades. In electricity generation, the increase in renewable energy production and exit from certain technologies in some countries (e.g. nuclear power) have led to changes in what’s known as the merit order, by which available sources of energy, especially electricity, are ranked based on the market price. Capgemini’s World Energy Markets Observatory (WEMO) 2019 reported that while renewable remained the fastest-growing worldwide energy source in 2018 at 14.5%, investment in clean energy fell at the start of 2019.

WEMO noted that fossil fuel remained dominant, with oil, gas, and coal accounting for three quarters of the growth in energy demand in 2019.

What’s interesting here is that in recent years favorable coal prices have made many highly developed gas power plants unprofitable, leading to massive depreciation on investments and low planning security.

Energy grids are under regulatory supervision and must meet continuously increasing efficiency requirements. This has led to increased cost awareness, with the growing rollout of new technologies such as artificial intelligence (AI), digital twin and robotic process automation (RPA) being proof of this.

In energy sales, already low margins either stagnate or decrease in highly competitive market areas, such as commodity B2B for power and gas, as well as solutions for B2C and B2B. At the same time, the pressure on the strong long-standing customer base is constantly high due to new market players. Maintaining a healthy customer portfolio and highly efficient churn management on the one hand, and massive reductions in unit costs for standard order-to-cash (O2C) processes on the other, has been a balancing act for years. For example, we see several companies targeting cost-to-serve (CTS) per end customer of less than €10 in the planning horizon.

These trends have led to many organizations pursuing massive reductions in their cost bases through reorganizing, reducing fixed costs and realizing process efficiency. Classic levers now seem to have been exhausted in certain instances.

The impact of COVID-19 for energy suppliers

There has been a decrease in energy demand in some markets (but not all) during the corona virus lockdown, along with a sudden change in consumption patterns, both of which will have a lasting effect.

Energy trading prices have slumped massively, far beyond all planning covered in risk scenarios. Suppliers who mainly adopt a long-term trading position to manage their portfolios have limited potential to sell these quantities to customers profitably. In addition, relevant quantity quotas have had to be sold with massive losses on the spot market.

Large quantities of B2B purchases, especially from manufacturing and core industries, were eliminated immediately when the lockdown began. Compared to the same period in the previous year, we have seen many utilities in this segment (and depending on the individual B2B portfolio) face declines of up to 35%, with dramatic consequences:

- Massive drop in cash flows from B2B business

- Massive drop in absolute contribution margins by up to 85%

- A drop in revenue streams from volume-related network charges in the network

- The risk of payment defaults for the remaining quantities has risen drastically in industries that have been severely affected by COVID-19

On the other hand, the lockdown has not had such a big impact on revenue streams in the B2C segment. Here, we have seen a slight rise in energy demand, alongside heightened competition for customers. Targeted sales push campaigns by enthusiastic energy suppliers and more knowledgeable customers have added to the pressure on margin positions in the profitable segment of long-term customers. Indeed, many markets have experienced steadily rising churn rates, which are being countered by increased efforts to capture after-sales revenue and a focus on retention.

As with B2B, the B2C segment also focuses on receivables management. Individual suppliers are already experiencing a deterioration in leading KPIs (e.g. many are facing outstanding amounts> 30 days, etc.) and it can be assumed that this will intensify significantly throughout 2020 and beyond.

Tackling the post-lockdown challenges

Overall, energy suppliers have not been as badly hit by the global crisis as other industries. However, several COVID-related challenges remain for the foreseeable (short-term) future and non-COVID related challenges in the medium- to long-term 3-year planning horizon:

Short-term challenges

- Cost optimization: A need to adjust short-, medium- and long-term cost items; and to maximize AI and digitalization in all operational and admin tasks

- Liquidity management: Review of liquidity planning, identification of measures to cover liquidity deficits, etc.

- Receivables management for both B2B and B2C: A need to manage customers that are increasingly struggling to pay their bills in difficult times

- Adjustment of forecasts: Companies must respond to a new economic forecast evoked by the impact of COVID-19 on the broader economy.

Medium-term challenges

- Adapting the customer interface: Digitalization, new ways of communication, customer journey adaptation/creation

- IT-infrastructure adaptation: More flexible, scalable, fully enabled remote, higher data traffic volumes

- IT-cost optimization

- Strategy adjustments throughout the whole value chain

Long-term challenges

- Process adaptations: Process digitalization, definition of new standards, procedures, and rules of cooperation

- Strengthening digital remote cooperation: Train employees on new tools and ways of working

- Strengthening of multi-project management: Catching up on and accelerating abandoned projects

- Adaptation of energy trading/purchasing strategy: Long/short term trading strategies and processes must be reworked and new risk calculations made in response to sudden and unexpected impacts, such as COVID-19

A new approach to cost

What’s clear to us is that classic cost-out programs or restructuring can only go so far against the background of fast and continuous cost base optimization. So, how should companies in this sector reshape their cost resilience strategy? Based on our experience of implementing numerous cost-reduction programs for energy suppliers, we recommend the following three steps as a starting point:

- Step 1: Aim for fast and reliable results

Avoid long-term projects with noticeable cost impact only after one year. Focus on rapid development of short-term quick wins in parallel with medium and long-term concepts for permanent costs improvement. Begin with an analysis of cost structures and drivers to identify these potential quick wins, which might include reduction of license costs, optimization of sales costs (CTA) by realigning channel mix, spend optimization of hardware and external labor, rationalization of service portfolio in admin functions, etc.

- Step 2: Adopt fact-based target setting

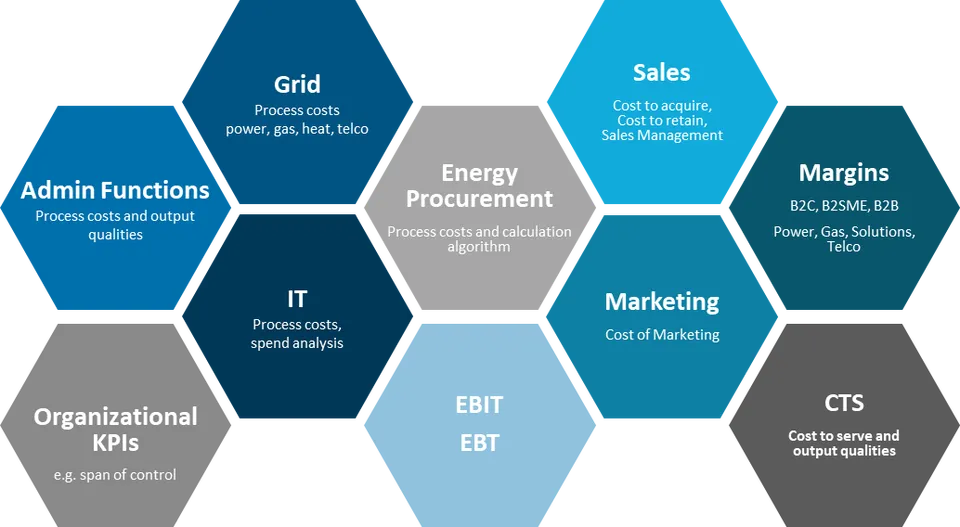

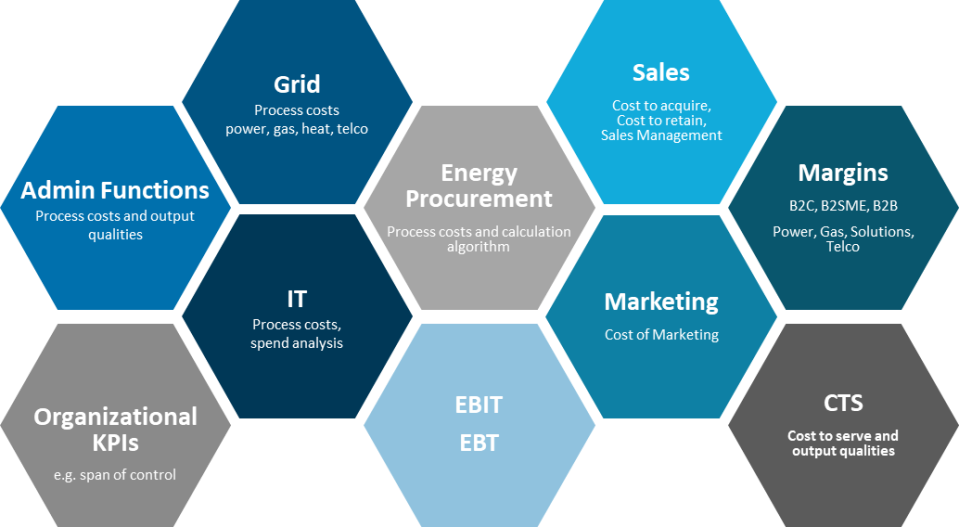

At Capgemini Invent we use our own benchmarks. These support meaningful cost analysis, allowing us to identify high potential targets. It is based on numerous projects in the E&U sector and covers data relating to main processes (such as CTS per customer), sub processes (such as grid operating costs medium voltage per km) and other activities (such as HR, Legal, etc.). We also benchmark comparative values for different cost types, such as FTE, material, external services, and IT. We’ve used our benchmarks for many leading E&U companies to build up a fact-based target costing approach both for selected functions and for all functions in group-wide cost optimization programs.

meaningful cost analysis, allowing us to identify high potential targets. It is based on numerous projects in the E&U sector and covers data relating to main processes (such as CTS per customer), sub processes (such as grid operating costs medium voltage per km) and other activities (such as HR, Legal, etc.). We also benchmark comparative values for different cost types, such as FTE, material, external services, and IT. We’ve used our benchmarks for many leading E&U companies to build up a fact-based target costing approach both for selected functions and for all functions in group-wide cost optimization programs.

- Step 3: Make use of ready-to-use levers along the whole value chain

Levers should focus on the three key areas of digitalization, AI and spend optimization. At Capgemini Invent, we have developed a database of more than 500 levers. For example, our digitalization levers include intelligent generation management using Internet of Things capability, end-to-end workforce digitalization, digital grid monitoring, and RPA O2C. Our AI levers include price modeling and forecasting, active churn management, value-base make-or-buy, and harmonized on-call duty. Spend optimization levers include in-sourcing critical skills, warehouse pooling, technical standardization, and service portfolio rationalization.

We run this process as a complete end-to-end service, from the conceptional phase with our fact-based target setting, through designing and quantifying the individual levers. We then bring to life what’s next, taking responsibility for realizing the identified savings through the operational implementation of business services and apps as required.

We followed our own recommendations and used our proprietary Smart Cost Out approach when we ran one of the biggest performance optimization programs in the utilities sector in the last three years.

A process of re-organization, process optimization, digitalization, outsourcing, offshoring, activity dumping (non-profitable actions) and governance re-setting yielded impressive results:

- 35% cost reduction (15% in the first year)

- EBIT increase by more than 250%

- Around 80% of functions/employees reorganized for cost efficiency

Rapid action – right now

The economic effect of the lockdown might not be as stark as in other industries, but it will have a long-term impact on energy suppliers. Getting to grips with these financial challenges sooner rather than later should be a business imperative. Future viability and independence cannot be guaranteed without quick and consistent action.

Find out more

Click here to find out how Capgemini Invent can help you achieve Strategic Cost Resilience.

Or get in touch with Michael Kässer.