DeFi high USD Deposit rates on Stablecoins

Blog: NASSCOM Official Blog

While anything growing exponentially these days, can be characterized as Bubbly and could actually be Wobbly, the question to ask yourself is whether you are compensated for the risks you are taking. This is no new insight or something that applies to one class of investable assets and not to another.

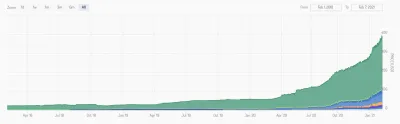

Today I won’t talk about public stocks or private market valuations or cryptocurrencies. I want to focus on stablecoins and more so on the currently dominant share which is stablecoins backed by the US dollar. The reason is that USD backed stablecoins have been growing at an exponential rate (not Wobbly at all) and there are several companies that offer extremely high-interest rates for your USD backed stablecoin deposits, to the point that you may claim they are Bubbly.

Growth of Stablecoins

Source: https://stablecoinindex.com/marketcap

There is an undeniable fact in the cryptocurrency market. Bitcoin used to be the reserve currency in the cryptocurrency market, which meant that when crypto traders took profits, they would hold Bitcoins and not fiat. Bitcoin has lost this reserve currency status to Stablecoins. I won’t say forever but I can confidently say that will not change in 2021.

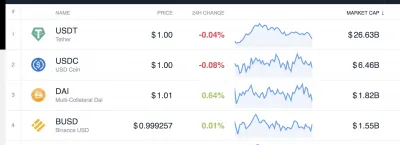

Source https://coincodex.com/cryptocurrencies/sector/stablecoins/ 7/2/2021

There are four stablecoins with a market capitalization of over $1billion and the three of them are USD pegged. The demand for such stablecoins is largely institutional rather than retail. The reason is that stablecoins are the way to borrow Bitcoin and profit from the arbitrage no-brainer trade between Spot markets and Derivatives. As the Ethereum derivatives market also grows, there will be demand for that arb trade too.

Genesis claimed that the Bitcoin arbitrage trade offered a 15% annualized return which is huge. I would not characterize it as Wobbly, even though it may disappear and of course, it will eventually but for now it has enough juice in it.

We can safely say, that as long as there is a demand to borrow Digital Dollars and engage in this kind of crypto arbitrage, we will continue to see growth in stablecoins. I am not saying that this is the only factor of stablecoin growth. However, it is the main factor behind the High-Yield deposit rates that several companies are offering if you deposit your stablecoins.

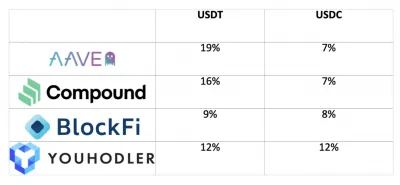

Savings rates on USD pegged Stablecoins

Data 21/1/2021

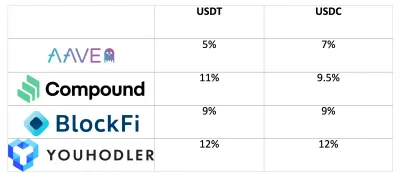

Data 7/2/2021

Source: https://bitcompare.net/

In addition to the arbitrage explanation, for these high yielding deposits, we also see a significant difference between Tether (USDT) rates and USDC. The continuous large demand for Tether (despite the multiple regulatory risks [1] around its questionable practices of issuing large amounts of Tether without audited reserves of 100%) points to an additional hidden factor that can explain these high yields (high and unsaturated demand). The word on the street has been that Tether is the way crypto natives obtain huge leverage on their crypto portfolios on unregulated exchanges (like Binance or ByBit).

Think of the spread between the 15% annual return from the arbitrage trade and the 6%-8% you can earn on USD backed Stablecoins. There is enough margin for the otherwise classic business model deployed by deposit-taking institutions that make loans at a spread.

These high-interest paying deposits are also no different than the usual higher deposit rates from neo banks that want to attract customers. Only neo banks can’t sustain these high rates for long. Their marketing budget can’t last for that long. In the Crypto world, the companies that are well funded by VCs can count these high deposit rates as CAC.

Funding of Companies that offer high-interest rates

From the investor`s point of view, the high interest reflects the main counterparty risks.

These are not FDIC insured deposit-taking institutions. The risk management of their lending activities is important (due diligence and collateral requirements). If the stablecoins are used to buy cryptocurrencies that in turn are going to be used to leverage up crypto positions at rates that are clearly risky (x50 or x100), then the counterparty risk is very high.

There is also additional counterparty risk to be considered, with the companies (typically more than one for diversification purposes) that custody the stablecoins.

The interest-paying companies engage in hedging activities in the regulated futures markets. There is the risk of a change in withdrawal limits if extraordinary market conditions require it.

For traditional investors, the benchmark may be the USD savings rates you can get. According to BankRate, these range from 40bps-60bps.

Others may benchmark off high yield short term debt.

Another benchmark is the 3% interest rate paid on USD by Crescofin who uses blockchain technology to manage short term telco invoices payable. This savings has monthly liquidity and is insured by Lloyds. [2]

In conclusion, high yield savings rates have persisted overall and DeFi growth has supported them too. The support from the arbitrage trade is a risk that I would be comfortable to take and would consider the current levels of compensation fine. The support from the indirect and hidden leverage risks (especially on Tether) honestly scares me. Having said that since none of this is investment advice, for some being paid 19+% may make sense.

I hope I gave you some pointers to decide for yourself what feels Bubbly from your point of view and whether you are paid for the event of a major flash crash — not just a Wobble which goes with the territory anyway.

[1] Imagine Regulators Shutting Tether Down — What Happens to Bitcoin?

[2] Read more details about Crescofin and other companies that are using Blockchain to change the asset management business https://thewealthmosaic.docsend.com/view/cv8vmwrg6xq6tmne

The post DeFi high USD Deposit rates on Stablecoins appeared first on NASSCOM Community |The Official Community of Indian IT Industry.