Collectors: Don’t Let IFRS 9 Blindfold You

Blog: Enterprise Decision Management Blog

There’s a clear pecking order when it comes to the IFRS 9 accounting standard that goes into effect in January. It’s an accounting standard, not a piece of banking regulation, so the hierarchy is Finance, Risk and then Collections.

This makes sense, but for debt managers it will cause problems. It’s likely that many debt managers will be blind next year on how they can influence impairments.

Here’s how things will happen. Your Finance team will talk to your organization’s accounting firm and auditors, and they will agree how IFRS 9 should be implemented. They will probably work your Risk department when it comes to preparing the predictive models that are required to determine expected loss under IFRS 9. Once that’s done, the rules for your organization will be binding.

It’s unlikely that the Collections team will be part of the process. And if you’re in Collections, you might think that’s fine. Who needs more meetings, right?

I have talked to organizations where the Collections team is just beginning to learn what has been agreed. And they are surprised at how fundamental some of the changes are to the way they do business.

Hidden Stages and Impairments

For example, today, when impairments are calculated, each account is in an arrears bucket based on its days past due. These buckets have provision percentages per product that translate into impairments based on the amount owed. When an account moves from one bucket to another, you know what you have in terms of provisions.

This is important because some of your segmentation will be done around the likelihood of an account moving from one bucket to another, and you measure roll rates in terms of what portions of balances move in which direction. You also have an impairment budget, and you know exactly what your targets are and can track your progress and made adjustments.

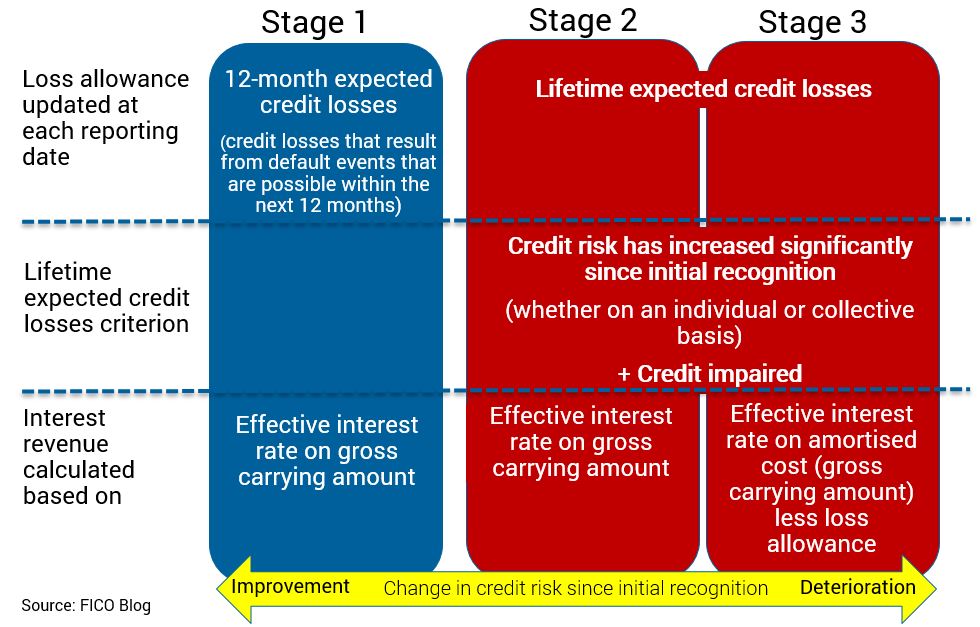

Under IFRS 9, as noted in Bruce Curry’s posts on this topic, risk on an account will be determined for the individual account, rather than for all accounts in the same arrears bucket, and the impairment will be based on expected loss over a defined period of time. That period changes from 12 months to account lifetime when an account moves from Stage 1 to Stage 2, the risk categories defined by IFRS 9 (see below).

But rolling from one stage to another isn’t as clear-cut as rolling from one bucket to another:

- An account will move from Stage 1 to Stage 2 when it’s 31 days past due, but it could also move to Stage 2 earlier because of other risk indicators, such as a lower credit score, even if it is not in arrears.

- When a Stage 2 account pays what it owes, it doesn’t necessarily move back to Stage 1. Each organization will have its own rules (agreed, as noted above, between Finance and your auditors) about when an account no longer represents heightened risk since origination. As a result, you will have Stage 2 accounts that are past due and Stage 2 accounts that are not past due.

- When you look at the accounts you’re working, you may not know which are in Stage 1, Stage 2 or Stage 3. That information probably won’t be in your collections system. You won’t know what level of impairment an account has, or how the impairment will change if the account repays. Your (delinquency) Bucket 1 will have accounts that are at Stage 1 and when they roll to Bucket 2 they will be in Stage 2. But Bucket 1 will have other accounts that are already in Stage 2, and if they roll to Bucket 2, it might do less harm because their impairments might change less.

As a result, it will be much harder to know how to drive impairments down and on which accounts to focus, and therefore how to manage your impairments budget. When impairments are worse than expected, you will receive calls or sit in meetings and be asked to bring down impairments with no clear view on which accounts to prioritise in order to make the biggest impact.

Restructures Count as Defaults

Here’s another example of change under IFRS 9. Organizations have different restructuring tools, and IFRS 9 has something to say about this.

Under IFRS 9, every measure you take that deviates from contractual obligations to the customer’s benefit might count as default and move the account to Stage 3. You will need to understand which triggers can get a restructured account out of Stage 3 again, and that will be agreed between your company and its auditor.

Doing restructures may still be the right thing to do, but not in all cases. You probably won’t want to restructure an account “just in case the customer needs it,” or to test whether it’s going to be kept by the customer or not. Restructuring someone again and again is unlikely to be a good idea from an impairment perspective. You’re going to need to be much more clever and realistic with expectations on whether the customer will skip or not skip, and that’s where predictive analytics can help.

Ask Now

What can you and your collections team do now? Start asking questions.

- First, find out how the triggers that move accounts between Stages are defined. Based on that, you can start to understand how your treatments can impact your impairment goals and budgets.

- Then, work out how your system can determine what Stage accounts are in. That way you will be able to decide how to treat an account, how moving an account backward or forward impacts impairments, and therefore how to segment and prioritize accounts.

- Also, find out what your company and auditor have agreed can get a restructured account out of Stage 3.

One More Challenge

Here’s a tricky one. As I’ve noted, an account can be in Stage 2 or Stage 3 without being in arrears. That account could have a low credit score – through their own fault or an error. Or they could have been restructured, by in Stage 3 but current.

So who owns these customers, who might carry heavy impairment but are not in collections? Who owns the actions taken on these customers to try to get them back into Stage 1? What about Stage 1 accounts at risk of moving into Stage 2? Does the responsibility sit with account management or collections?

There’s no best practice for this yet. If you’ve set one up, we’d love to hear from you!

For more on this topic, see our other IFRS 9 posts.

The post Collectors: Don’t Let IFRS 9 Blindfold You appeared first on FICO.

Leave a Comment

You must be logged in to post a comment.