Can Alternative Data Score More Consumers?

Blog: Enterprise Decision Management Blog

In my last blog post, I showed why using credit bureau data alone is insufficient to safely measure the creditworthiness of the millions of US consumers who don’t currently have FICO® Scores. To reliably assess risk for these “unscorable” consumers, we must fill in the partial or missing picture of current financial behavior available from credit bureau files.

Can alternative data fill in these gaps?

We recently completed research to find out. It showed that with the right alternative data, we can accurately score more than 50% of previously unscorable credit applicants. The scores were significantly more predictive than using bureau data alone and designed to demonstrate repayment odds consistent with traditional FICO® Scores.

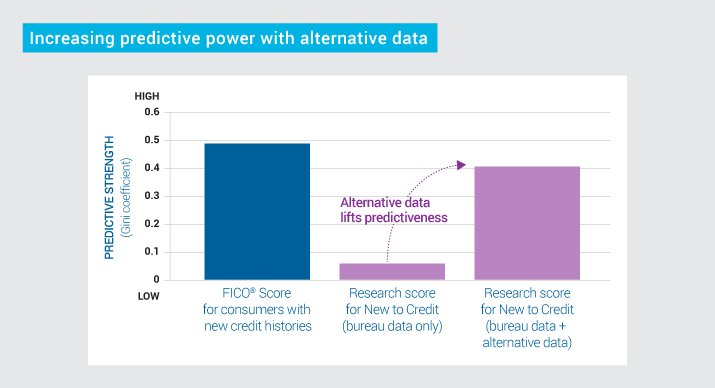

As part of our study, we built a research model and scored New to Credit consumers using bureau data only (which generally consisted of only one or more credit inquiries). We then compared the model’s performance when bureau data was complemented with alternative data. As a reference, we also included a closely comparable group of consumers with traditional FICO® Score—those with new credit histories (five years or less).

Alternative data did indeed offer a performance lift. While the Gini index for the research score based on bureau data alone was very low, the Gini index for the score based on both bureau and alternative data increased substantially, bringing the model’s predictive strength into the range of a traditional FICO® Score for consumers with new credit histories.

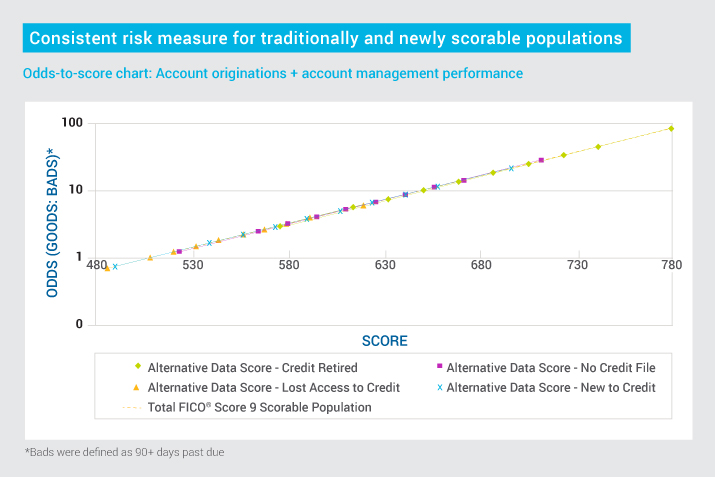

We also found that alternative data can be used to create scores that provide a consistent measure of risk across all consumer populations. You’ll see in the chart below that the dotted line showing the odds-to-score relationship for the FICO® Score 9 population is indistinguishable from the solid lines representing populations scored with the addition of alternative data. The precise alignment observed in this analysis means a score of 700, for instance, represents the same risk odds regardless of whether the consumer is in a traditionally scorable or newly scorable population.

It’s important to note that a key finding of our study was that not all alternative data drives a more predictive credit score. So what are the “right” types of alternative data? I’ll cover that in my next post. Until then, you can get more details on our research from our Insights white paper: Can Alternative Data Expand Credit Access?

Our research has led us to conclude that there is demand and value in offering a score for lenders based on alternative data and the principles discussed in this white paper. To learn more, see the FICO® Score XD press release.

The post Can Alternative Data Score More Consumers? appeared first on FICO.

Leave a Comment

You must be logged in to post a comment.