Banks’ value-added propositions generate trust, loyalty from corporate treasurers

Blog: Capgemini CTO Blog

I have had a close-up view of the payments landscape for years, especially the corporate side. Throughout this time, and particularly in the aftermath of the pandemic, I’ve seen corporations grow more digitally astute, embrace emerging technology, and come to expect innovative value propositions from their bank partners.

The numbers are compelling. As part of our World Payments Report 2020 executive survey, 60% of treasurers said they expect their banking partners to provide enhanced treasury and corporate connectivity solutions, while 50% said they expect robust risk management services.

It goes without saying that if banks do not meet corporate expectations, clients will seek support elsewhere. Hence, banks must continuously monitor evolving customer demands to deliver relevant services. I believe that client trust and loyalty are vital for banks to gain/retain corporate business and keep competitors at bay. Trust and loyalty directly impact revenue and profitability. However, trust and loyalty are subject to change based on competitive value-added propositions from FinTechs, BigTechs, and challenger banks.

Non-traditional players are encroaching on the corporate client base

In retail payments, BigTechs have successfully leveraged the latest technological tools, keen ability to draw insights from customer data, a vast customer base, and positive brand recognition to gain trust. And now they are expanding into the B2B/wholesale payments space. Challenger banks are also capitalizing on retail payments success to capture corporate mindshare. New-age players’ technology acumen and cloud power are streamlining banking/payments processes to disrupt the B2B space.

- FinTech unicorn Airwallex – a cross-border payments specialist based in Hong Kong and Melbourne – raised USD200 million to fund its 2021 payments platform rollout across the United States.

- Early this year, British challenger bank Revolut rolled out touch-free QR-code-based payments across Europe for business clients.

- Silicon Valley FinTech Brex, a provider of business credit cards and cash-management accounts for startups, applied for a charter to open an industrial bank in Utah. US industrial banks do not need to be owned by a bank holding company.

- Google expanded its plans to offer digital bank accounts through Google Pay in the United States by partnering with eight banks, including Citi, BBVA USA, and Bank Mobile.

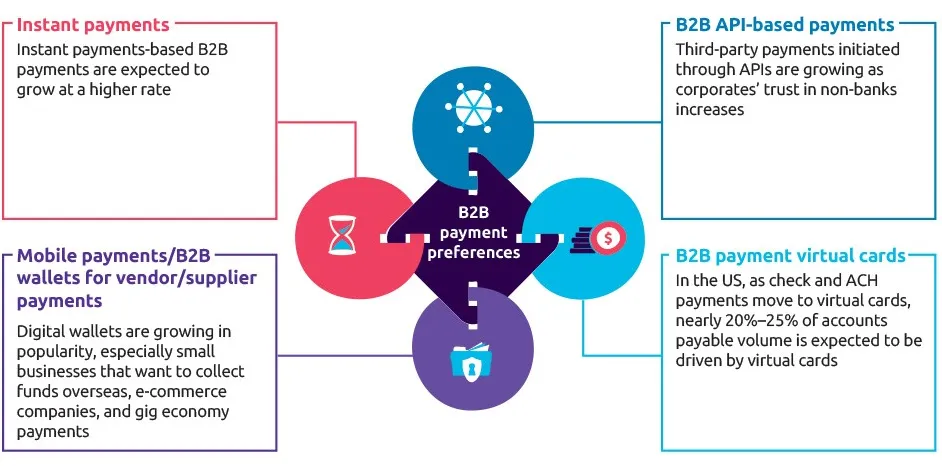

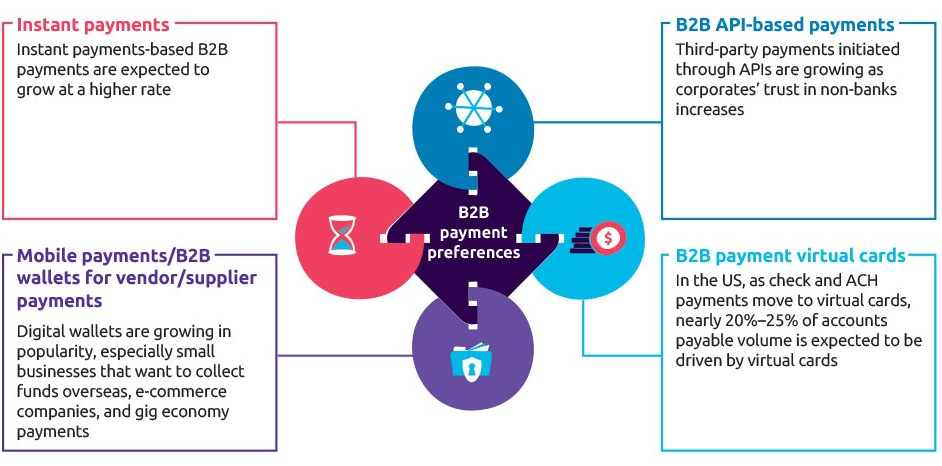

Non-traditional players are meeting treasurers’ rising demands for new digital payments and technology innovations. Automation and other tech advancements are helping treasurers mitigate risk sparked by geopolitical uncertainty and escalating cyber and phishing attacks. Our survey respondents listed instant payments, API-based payments, B2B virtual cards, and mobile payments among their strategic treasury priorities.

Corporate treasurers want banks to offer innovative B2B payment methods

Digital mastery is critical for end-to-end customer engagement

Now more than ever, hyper-personalized value propositions, payments automation, and cybersecurity solutions are attractive to corporate clients.

Not surprisingly, future-focused banks have prioritized technology transformation, as 68% say that the loss of existing clients and prospects is the most significant threat to their plan.

- Deutsche Bank opened a cash management business for multinational clients in Australia in Q4 2020. The bank now operates cash management services in 35 locations globally, 14 in Asia Pacific.

- Similarly, HSBC launched treasury APIs covering payments in 27 markets. Using HSBC APIs, treasurers can transfer funds from their workstations without logging into a proprietary bank platform.

As new-age competitors progressively chip at the bedrock supporting traditional banks, incumbents are compelled to revamp their value propositions and offerings. Firms that deliver innovation and personalized service are perceived to be engaged, customer-centric corporate partners.

How are incumbents earning loyalty from corporate treasurers?

Many are:

- Collaborating with technologically-advanced and digitally-agile non-traditional players, specialists, and third-party providers

- Exploring low- to no-cost banking

- Rewriting the customer value proposition

- Embracing an open ecosystem-based model.

An ecosystem-based open API model fosters end-to-end customer engagement, enables data monetization through advanced data analytics, and helps banks partner with technologically-advanced non-traditional players to provide superior value-added propositions.

You will find more details about how banks can meet and exceed corporate treasurers’ changing expectations in the World Payments Report 2020. Published in October, the report maps out how ecosystem-based models can be payments industry game-changers. It also offers insights on global and regional non-cash payments and the latest key regulatory and industry initiatives (KRIIs).

Download a free copy at www.worldpaymentsreport.com, and connect with me on social media.