Banking Royal Commission An Opportunity For Digital Innovation

Blog: Enterprise Decision Management Blog

Australia’s Banking Royal Commission delivered its final report at the start of February; the culmination of 14 months, 10,232 submissions and 7 rounds of public hearings into the banking, superannuation and financial services industry. The Commission uncovered a number of issues relating to account lifecycle management by banks, remuneration and incentive schemes that disadvantage customers and some serious examples of misconduct in a number of industries.

The findings made by Kenneth Hayne will have serious consequences for organisations both now and into the future. Volume 1 of the final report runs to about 500 pages with an expansive list of recommendations. The enquiry looked into misconduct and the issue of culture and governance in each industry and the execution of regulation by both industry bodies and regulators.

Banks and other financial institutions will need to demonstrate more rigour around the decisions they make and their key delegates will need to take more accountability. Indeed, NAB lost both its CEO and Chair in the wake for the final report for such perceptions. The regulators overseeing these industries also came in for criticism, with APRA and ASIC expected to play a more adversarial role in the post-Hayne financial industry.

Amongst the enquiry’s findings, some distinct themes have emerged for the banking industry. Intermediated lending received a lot of attention concerning broker remuneration, the nature of advice given and handling of misconduct. The Commission took a black letter interpretation of the NCCP Act calling on banks to take greater steps to assess customer’s suitability and capacity for credit. The identification of errors and whether the banks took accountability for their remediation has also come into question.

I agree with Mike Cutter at Equifax, that innovation holds the key to the path beyond the Royal Commission. Given the extent of the findings, I will take a brief look at each of the themes highlighted above and some of the trends that have emerged in the month following. I will revisit each of these themes in more detail in future posts and what innovations exist to address them.

Banking Royal Commission – Intermediated Lending

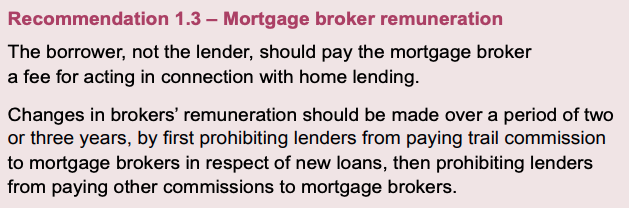

Broker-originated loans are a large source of growth for most of the major banks accounting for nearly half of all new loans written in some cases. Brokers receive upfront commissions based on the size of the loan and a trailing commission levied on the outstanding balance whilst the loan remains with a lender. Kenneth Hayne found that trail commissions serve to bind a customer to a lender, ensuring that brokers avoid churning customers once placed with a lender.

The Federal Opposition recently announced its policy on broker commissions rejecting the commission’s calls to move to a borrower pays system. Instead, they have opted to cap upfront commissions whilst prohibiting trail commissions.

The commission also calls for the nature of the broker-client relationship to change. Brokers in the post-Hayne industry will be regulated just like other financial advisors with strict rules around disclosure and a need to articulate their advice. Any recommendations made will need to be properly justified and provided in writing.

These changes will see a number of brokers exit the market creating room for other advisors, such as financial planners, to offer brokerage services. This all creates fertile ground for digital entrants into the market. Consumers looking to undertake their own search for credit will be drawn to lenders with a strong online presence and a seamless digital fulfilment process. We have already seen several offerings emerge over the last few years in the unsecured space with the launch of MoneyPlace and SocietyOne. More recently, the market for secured lending is beginning to heat up with the launch of Fintech Athena in the wake of the Royal Commision.

Banking Royal Commission – NCCP Act

The way customers are assessed for lending has long been governed by the National Consumer Credit Protection (NCCP) Act. The act regulates the way lenders and brokers assess the suitability of products offered to each customer and the enquiries lenders must make into their customer’s financial position and effort required to verify the information provided. The commission largely focussed on the steps banks took to verify customers’ income and expenses and whether they were making separate enquiries to assess their unsuitability of any offer of credit.

Income verification is very straightforward by requesting payslips, tax returns and profit and loss statements as documentary proof. Verifying a customer’s expenses is more challenging and lenders have typically taken customers at their word in credit applications. Benchmarks such as the Household Expenditure Measure (HEM) are used to provide a hard floor when calculating customers’ serviceability. Concern was expressed during the enquiry about how frequently this measure was relied upon when assessing credit applications in the final report Kenneth Hayne found that this amounted to non-compliance with the Act.

Each of the Big Four Banks has started taking steps to improve their capture and verification of customer expenses. There is a long way to go but the move to Open Banking in Australia will certainly provide opportunities to better assess customers past spending habits and lenders will need to start investing in tools that make better use the data that customers volunteer along with the data banks already hold on their customers.

Similarly, consumers will need to take greater care of their financial position as more scrutiny is applied to their past behaviour. Australia has already moved to a Comprehensive Credit Reporting regime and consumers and lenders have more access to credit data than ever before. Transparency is the key to making sure that consumers are still able to access credit when they need it. It is vital to make sure consumers understand the criteria for accessing a loan, what their current financial and creditworthiness position looks like and the steps they can take to improve this. FICO has a long history of providing the tools required to help educate consumers about their credit behaviour in markets across the world.

As mentioned earlier, the stipulation in the NCCP Act that lenders assess whether a product is ‘not unsuitable’ for a customer came in for particular attention. Hayne found that the practice of sending unsolicited offers of credit limit increases and new loans to existing customers typically fails this test. The provision of shadow limits or temporary overdrafts are likely to fall into the same category. Whilst banks have largely moved to an ‘opt-in’ approach for determining when to send out offers to customers, there is still a ways to go in this space. Understanding the holistic needs of customers is vital and improving the time to open when requests are made will be key. Customers’ need for these sorts of facilities won’t just disappear and, often, this need is immediate. The challenge for banks in the future will be ensuring that they have access to all the pertinent data to satisfy their NCCP obligations when any request is made.

Banking Royal Commission – Accountability for Errors

There were numerous examples provided to the Banking Royal Commission of fees being incorrectly charged to customers. Banks spoke of several contributing factors such as ‘number and complexity of products’ and the lack of ‘end-to-end accountability.’ Commisioner Hayne puts it very plainly in his report saying ‘entities should not offer to sell what they cannot deliver.’ One of the most public examples of this failure was one bank’s failure to correctly setup offset accounts for their mortgage customers. However, the Commissioner also identifies other examples where the contractually agreed rate on an account was not applied or fees being incorrectly charged and not reversed. While it is impossible to completely eliminate the chance of such errors happening in the future, Hayne expects financial institutions to improve their remediation processes and introduce single points of accountability.

Identifying such errors and determining who is impacted is often very difficult as much of the data on day-to-day account management sits on legacy systems with limited access to business stakeholders. These remediation processes often become large scale projects with long lead times. Providing the correct data access to the people with an understanding of the product terms and conditions is fundamental to providing an agile response to such issues.

Most organisations are facing some big challenges following the Banking Royal Commission. A lot of the work that lies ahead for these companies will be reviewing their internal oversight and compliance regimes. As we highlighted earlier, many banks have already got on the front foot seeking to improve their NCCP compliance and understanding how they need to operate under the changes to intermediated lending market. Many of these challenges will need to be met with structural and cultural changes made from within, technology will be a key enabler to ensure that customer experience doesn’t suffer. Technology will also ensure that key decision makers have the necessary insights at hand to discharge their duties with confidence. Our next blog post will dive into how some of the prevailing challenges can be overcome with the right technology.

The post Banking Royal Commission An Opportunity For Digital Innovation appeared first on FICO.

Leave a Comment

You must be logged in to post a comment.