Banking As a Service platform – similarity or competitive advantage

Blog: End to End BPM

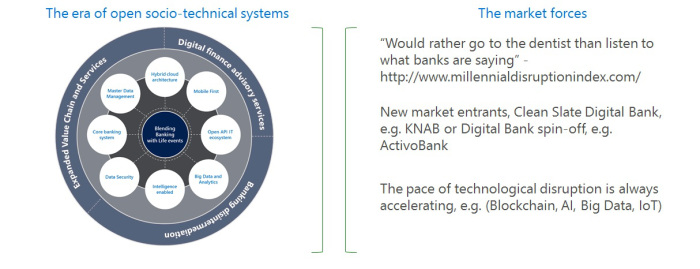

Banks that are embracing their digital transformation journey are becoming open and designed to encourage new business models, using Open Socio-technical Systems during the transformation journey.

Three concepts emerge here:

- Digital finance advisor: deliver tailored, personalized advice that meets the customer’s financial needs taking into consideration, the unique customer profile – the digital twin – based on customer life style, aspirations, appetite for risk, existing and upcoming transactions.

- Banking disintermediation: developing special alliances and partnerships that enable them to provide offers that appeal to customers. Doing banking without the customer feels that is doing banking.

- Expanded value chain and services: connect the customers with other service providers – e.g. wellness providers, retail companies – becoming part of customers’ needs and lifestyles. The more the customer interacts with the customer ecosystem, the more the ecosystem benefits in terms of shared customer profile data and business transactions.

The current status-quo of banking industry in competitive markets

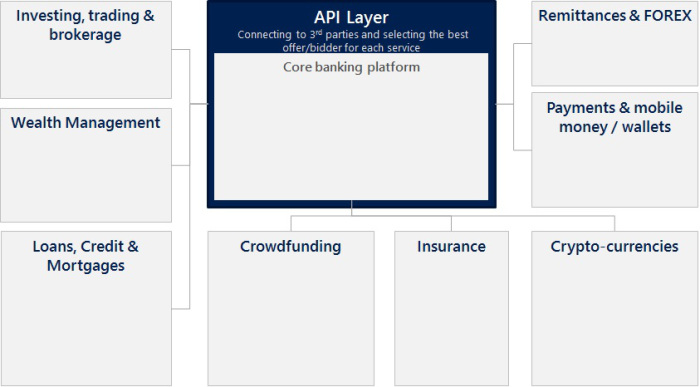

The realization of these three concepts is via the bank as a platform with a connected ecosystem in which integration is the core component and where an API-enabled platform and marketplace is a key strategic consideration. However, the API capability, combined with strategic partnerships is not enough. With most of the new IT capabilities combined with new “micro-business models” being already available in the market, Banks are partnering, investing, going on tour to multiple venture forums for shopping new IT capabilities, or discover new ones by organizing hackathon events.

There are some important consequences of this shift:

- IT reduced expenditure. IT departments will no longer need to develop applications. They already exist in the market. They will continue to be focused on core banking systems, the middle-ware and the classics banking channels (web/mobile/social/wearable).

- The CIO will focus on building and evolving the banking platform, but he will need to become a business changer, otherwise, we will only be solely focused on supporting the business.

- Solution providers will start to loose importance in the market unless they can offer an unique or distinguished capability.

- Ultimately, the bank can implement the concept of the “bank of me”, which the customer chooses what kind of capabilities he wants to use, relevant to its needs, rather than play with the ones the bank offer via channels.

The era of open socio-technical systems

Under this new paradigm, designing, implementing and make available a banking as a service platform – like a cloud computing provider – is becoming a mainstream trend in banks that are embracing digital transformation, offering complementary third party financial or non-financial services alongside with the bank’s core products. The bank becomes a catalyst of third party providers to provide a more appealing spectrum of services and offers as co-branded products.

There is however, a fundamental design flaw in this approach. Under the concept of the “bank of me”, customers do not want to be forced to consume what is made available by the banking platform, the reason for this, is by the same way a couple of years ago we entered in the era of the customer – by the collision of forces of mobile, social, cloud, data – that shift operations control to the hand of the customer, so does such principle apply when designing the banking platform.

As Damian Madray [1] expressed:

When we design, our designs generate behaviors that in turn shape our collective experiences through culture. The concept is fairly simple but the feedback loops are all — encompassing: essentially all of the things that we design and that surround us, from our language, to our dwellings, our cities, tools, aircrafts, bedrooms, kitchens, religions, sports, design us back. It all feeds back. And this feedback has been coined Ontological Design [2] by Anne-Marie Willis.

What this means is the customer wants to have the freedom to design interaction on his own terms. As I wrote some years ago:

People will be over connected naturally without the need to request for connection.

But such connection must be related with with whom I really am, not a profile or customer segment I belong to, or personas, as it is labeled user design or in change management methodologies.

Ontologies providing meaning to the data manipulated thus no one needs anymore to learn […] its meaning

Elizabeth Tunstall [3], provides another interesting perspective, as our universal individuality is cannot separated by the sacred, profane and spirituality. The flow of other people, nature, environment and ancestor influence that provided us the life principle guidelines we adopt or tend to ignore that is a consequence of what surround us and make us unique individuals. Investec, embedded this principle in one of the latest marketing campaign, more than data.

Investec’s – More than data – from the customer profile to who you really are as an individual

Despite the bank as a service platform brings advantage to consume or offer products or

services through the APIs ecosystem, most of the banks will ultimately adopt this strategy bringing all around similarly and the new digital bank will soon become the same old bank it used to be. Allowing the customer to design its own banking experience based on habits of mind, personality, selfish goals, personal interests leveraged on the platform capabilities will make the bridge between the customer and the bank as separated self-contained entities.

References:

[1] The Evolution of Design with Culture Thinking – Why we should think about culture before we design – Damian Madray, 2017

[2] Ontological Designing – Anne-Marie Willis

[3] Design Anthropology, Indigenous Knowledge, and the Decolonization of Design –

Elizabeth Tunstall, Fabrica, 2011.

Filed under: BANKS, Digital Transformation, Enterprise Architecture Tagged: Banks, BPM, Enterprise Architecture

![]()

Leave a Comment

You must be logged in to post a comment.