Australian Home Loans – Why Analytic Pricing is Essential in 2019

Blog: Enterprise Decision Management Blog

The Australian Competition and Consumer Commission (ACCC) handed down its final report on the Residential Mortgage Pricing Inquiry and it certainly had a lot to say about the current pricing of Australian home loans. The inquiry was initially set up to monitor the implementation of the Commonwealth Government’s Major Bank Levy in May 2017. The inquiry tasked the ACCC with monitoring Australia’s five largest mortgage lenders, each of whom was subject to the levy.

Whilst their primary remit was to the monitor the conduct of the banks during the Bank Levy monitoring period, the ACCC also took a more holistic review of pricing practices throughout the industry and responses to regulatory events over the same period. The findings of the report centred on the following themes:

- The use of discretionary pricing and its lack of transparency

- Larger discounts going to those customers who are willing to shop around

- The additional costs and complexity for lenders when managing regulations governing mortgages

Pricing is one of the most complicated tasks in any organisation and this is particularly so for any financial institution. Pricing strategies are required to simultaneously meet customer needs, regulatory obligations, financial plans and internal risk controls. Meanwhile, the competition for established mortgage lending has intensified as mortgage system growth slowed over the last few years.

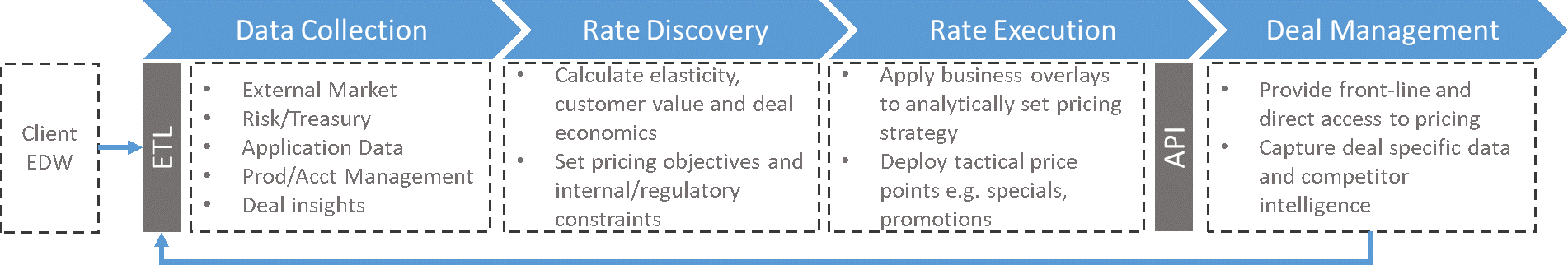

The appropriate pricing strategy can only succeed where back-office agility and front-line enablement are a priority. Investing in data is key to achieving both. Synthesising insights from a large number of sources allows the pricing teams to quickly tweak their strategy to market trends, continue to meet internal KPIs and deliver the right price to the right customer, at the right time. This is achieved through an integrated stack of purpose-built applications addressing each point in the pricing value chain.

Australian Home Loans: Analytic Pricing Value Chain

Australian Home Loans: Discretionary Pricing

The ACCC is concerned that discretionary pricing practices are ‘opaque’ and lead to a high cost of discovery for consumers, which means that consumers limit their search to a small number of providers. Discretionary pricing, however, plays an important role in allowing banks to apply more granularity in their pricing to address specific customer segments and regulatory concerns. It also allows banks to change their pricing dynamically, as regulatory caps or risk controls are met.

These concerns can be met very simply. Rate sheet segmentation should use values that are easy for customers to understand and compare across lenders. Building the data and insights around prospective business gives customers access to pricing at any point in the sales conversation. Better front-line enablement allows bankers to access tailored pricing in a timely fashion.

Australian Home Loans: Price Sensitive Customers

That idea that customers who are willing to shop around will receive greater discounts, should not come as a surprise. The sources of new lending at any bank consist of customers with a new home purchase, those who are moving from another lender or are looking to buy an investment property. The latter group typically have greater levels of lending and are very cognizant of market conditions.

The ACCC report notes that borrowers choose a lender for a range of reasons, not just price. Product packaging and service proposition are also important factors when consumers are considering lenders. The more sensitive consumers are to proposition and product features, the less sensitive they are to price. The marginal return on a mortgage is typically very good, higher than a bank’s overall return on equity. High costs to acquire and heavy discounting certainly hurt the deal economics in certain channels but business will usually remain and return growth to the business.

A more holistic view of a customers’ value to the business would consider their broader relationship, their risk profile and tenure. Building up a profile of the broader portfolio economics over a longer horizon provides a better view of the contribution of invested customers and where pricing can better reflect their value.

Australian Home Loans: Regulatory Flux

Regulation has traditionally focussed on capital adequacy, liquidity and credit standards. More recently, The Australian Prudential Regulation Authority (APRA) has been actively monitoring credit approvals in areas of concern in the mortgage market. For example, the Federal Government and APRA have requested that banks cap growth in investor lending, interest-only lending and secured lending to foreign property owners.

Capital adequacy and liquidity measures add to the fund and provisioning costs of a portfolio and can change the economics of individual deals. It is important to ensure that these costs are captured in your price models. Linking pricing decisions to return on equity and risk-adjusted return provides useful insight when pricing marginal business and will see pricing favour less capital intensive segments of the portfolio.

Regulatory monitoring and caps on credit growth provide a different challenge. The government and regulators have made it clear that they don’t want to stop banks lending to segments such as the investors, they simply want to moderate it. Meeting these caps is difficult in practice. In 2015 APRA set a 10% cap on growth in investor loans. Most banks made some fairly drastic price changes in response only to see their growth in investor loans almost disappear altogether. Understanding the volume/margin trade-off is vital when responding to changes in regulatory caps. Ultimately, this can only be achieved by modelling the price elasticity of each of your strategic portfolio segments across the account lifecycle.

Australian Home Loans: Dynamic Landscape

The mortgage market has been incredibly dynamic since the GFC and the attention on pricing from all quarters is intense. As larger lenders have responded to various inquiries and changes in the regulatory landscape, the market for mortgages amongst smaller lenders has intensified with many introducing aggressive, price-led strategies. Lending to shadow banks has grown at twice the pace of the market in the last year.

In January 2019 APRA announced that they are going to cease actively monitoring the investor and interest-only lending caps. Further to this the Reserve Bank of Australia (RBA) and the Federal Government have expressed concern about the availability of lending. Lenders are now left in the position where credit standards are under close scrutiny but they are expected to improve access to credit for desirable customer segments. Pricing will play a very important role in this transition.

Managing such a large range of competing priorities is a complex problem, one that will require investment in data, analytics and capability. A robust, integrated system provides the ability to synthesise all the pertinent market insights into pricing framework that considers the customer, the business and the system. Prescriptive analytics provides the perfect answer. Prescriptive Analytics allows the pricing team to set their objectives, define all of their internal and regulatory constraints and then discover the most appropriate rates for any set of market conditions. It requires investment across the value chain, in data, back office capability and front-line enablement. Given the complexity of the problem all lenders are faced with, it is certainly time to begin the journey.

+++

While you’re here, why not check out this short video where Josh Brougham, Head of Pricing for Mortgages at National Australia Bank, explains why pricing optimization was a priority for the bank.

Also watch FICO’s Phil Norman explain how pricing optimization is changing the mortgage market in Australia and New Zealand.

https://www.youtube.com/watch?v=kTdOhqaRCyQ

The post Australian Home Loans – Why Analytic Pricing is Essential in 2019 appeared first on FICO.

Leave a Comment

You must be logged in to post a comment.