Are regional firms and credit unions ready to bank on artificial intelligence?

Blog: Capgemini CTO Blog

The disruptive forces of artificial intelligence (AI) are revolutionizing the banking world. Large banks and financial institutions are actively investing in AI-based solutions to improve their operations and to enhance customer experience through personalized services. However, the scope of AI is not limited to large financial institutions. Regional banks and credit unions can also significantly benefit from investing in and building AI-related capabilities.

Regional banks and credit unions face multiple challenges

Credit unions and regional banks grow and maintain business by building personal relationships with their local communities.[1] However, relationship building is not always an easy process considering the various challenges smaller firms face.

- Today, multi-pronged competition is ongoing from major banks and FinTechs in payments, online lending, and wealth management.

- The 2008 global recession spurred government regulations that burdened small banks with additional costs and translated into margin erosion.

- Convenience-seeking bank customers find multiple visits to branch offices and excessive documentation requirements for loan applications to be inefficient.

- Established banks’ legacy IT systems are not compatible with the latest technology trends and customer expectations.

Source: Capgemini Financial Services Analysis, 2019.

AI can cut costs and boost revenue

Recently, the CEO of California-based startup Fintel Labs, Vik Ramesh, discussed the value of AI for regional banks and credit unions. Because these entities have comparatively small customer bases, they do not have access to the vast data sets required for insight-yielding analysis. And their budgets for technology-related investments are often limited.

However, AI could play multiple roles in transforming these firms, Ramesh said.

For instance, it can help retain customers/members by enriching and differentiating experience. Retention is essential because 60–70% of current customers are likely to purchase bank services compared with 5–20% of newly-acquired customers, according to market intelligence firm Hüify.[2]

Moreover, artificial intelligence-based automation tools can reduce workforce requirements, errors, and waste associated with manual work. AI also can be used to predict potential loan defaults to mitigate subsequent losses.

Until now, it has been large, resource-flush banks that have been building artificial intelligence capabilities. Bank of America has digital assistant Erica. Digital assistant Eno allows Capital One customers to access their accounts via Amazon’s Alexa service on any Alexa-enabled device. The Wells Fargo chatbot uses AI and Facebook Messenger to answer users’ natural language messages, including queries about account balances or the location of the nearest bank ATM.[3]

Considering the typically tight operational budgets of regional banks, is building AI competencies a realistic goal? Yes. FinTech firms offer ready-to-consume solutions that enable small entities to leverage the power of AI. Instead of building AI solutions from scratch, regional banks can buy customize off-the-shelf programs.

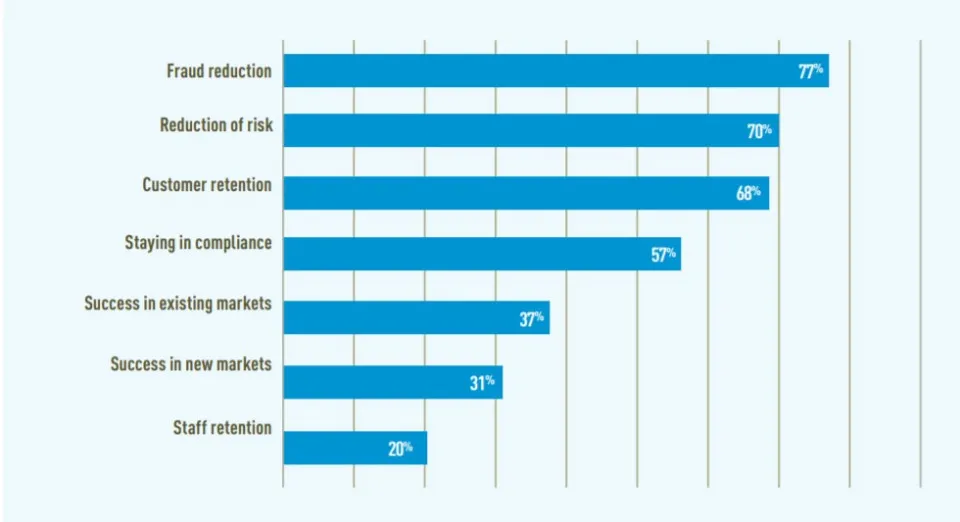

% of potential achievable business outcomes via the use of AI

Source: Finextra, April 2018.

Data is the new oil

Data fuels artificial intelligence. For example, in India, 59% of bank executives said data availability was a crucial factor when deciding whether to implement AI-enabled use cases, according to a 2019 Capgemini report.[4] Financial services enterprises need clean data (converted into a standard format and imported into a common system) to use AI capabilities that deliver differentiated experiences to customers. Regional banks and credit unions must build the right set of models and algorithms to reap the most benefits from AI applications.

Legacy systems store customer information in siloes, which prevents firms from leveraging data-based insights across the enterprise. Therefore, regional banks and credit unions will need to invest in standard AI application approaches to compatibly incorporate solutions.

AI solutions can augment back-office operations by automating mundane tasks and improving overall business productivity. Fintel Labs’ Ramesh added, “30% to 40% of service center calls are repeat requests.” Automated responses to basic questions lead to fewer transferred calls, better-utilized staff, and slashed customer wait times.

A 2018 report from Capgemini’s Digital Transformation Institute predicted that the financial services sector could add $512 billion to its global revenues by 2020 by leveraging automation. It also claimed that automation could increase cost savings by 10–25%.[5]

AI must not be confused with robotic process automation (RPA), however. RPA does a great job handling repetitive, rules-based tasks. But it doesn’t learn as it goes to automate full end-to-end processes. AI learns as it goes, puts intelligence to use, and makes judgments. As RPA advances as a result of cloud-based APIs and standard data formats, it is likely to be deployed more often in concert with AI technologies.

Collaboration with FinTechs

No longer considered a competitive threat, FinTech firms can offer regional banks resources when it comes to innovative partnerships. Agile new-age firms are adept at data handling and can help incumbents prepare customer information for use with AI tools.

“If a traditional bank needs to build an innovative solution, 12 to 18 months may be required to handle the project in-house. However, many FinTechs can offer a 60-day turnaround time,” Ramesh said. Fintel’s AI-powered cloud enables financial institutions to deliver AI-based solutions and is in talks with dozens of banks seeking to fast track their end-user process upgrades.

As large banks realize the need to bolster their AI capabilities, they are acquiring FinTechs firms. The rationale is for both inorganic growth and to create innovation labs that showcase startups’ competencies. Investment size often depends on the type of solution and the extent of its complexity.

Digital masters focus on collaborative models with third-party players, and they support open APIs to offer customers new services, according to a Capgemini Research Institute report. To co-develop solutions, 64% of banks actively work with an extensive ecosystem of partners (startups, incubators, technology firms, and even competitors).[6]

Artificial intelligence for all

Employees’ lack of AI-related skills can be a challenge. However, to leverage the power of artificial intelligence, employees in regional banks and credit unions don’t necessarily require up-skilling programs to learn how code works. FinTechs have begun creating plug-and-play solutions that require only necessary tech skills from staff. These solutions make it viable for smaller enterprises to leverage AI without the considerable research and development expenses needed to build competencies from scratch.

AI use cases and savings

Source: Business Insider Intelligence, Autonomous NEXT, 2019.

By 2023, the aggregate potential cost savings for banks from AI applications is estimated at USD447 billion, with front and middle offices accounting for USD416 billion of that total.[7] AI has the potential to enable significant savings in front, middle, and back offices, which makes use cases particularly relevant for regional banks and credit unions.

Investment and AI-readiness

Digital leaders at regional banks and credit unions understand the need for AI investment and are confident in its ROI potential. Chatbots have proven their value in reducing call center volumes for routine query resolution. And, now, banks are moving from natural language processing (NLP) bots to intelligence-driven AI assistants.

Governments are also providing crucial support to ensure AI investment success. In the United States, regulatory compliance laws promote ethical AI standards that consider ethnic, cultural, gender, age, geographic, and economic diversity. Moreover, VC funding in the United States is flowing as investors underwrite promising late-stage FinTechs.

The way forward

As AI becomes a banking sector norm, late adopters may be left behind. Credit unions and regional banks must be ready to face the challenges of an AI-driven market by taking the necessary preparatory steps.

Identify opportunities

AI solutions can be deployed successfully within a variety of financial services applications, from chatbots to wealth management, from anti-money laundering and KYC, to credit underwriting. Regional banks and credit unions must identify the avenues best suited to their services and business strategy.

- The State Bank of India’s Intelligent Assistant (SIA) is a smart chat artificial intelligence solution to resolve queries around the migration of individuals from India to other countries.[8]

- With more than 3,000 branches across India, Allahabad Bank will add chatbot and AI-based e-commerce features to its customer app emPower.[9]

- AI fuels the JPMorgan Chase Contract Intelligence (COiN) chatbot to analyze legal documents and extract vital clauses and data points. COiN completes the review within seconds, while manual analysis of 12,000 annual commercial credit agreements took approximately 360,000 hours previously.[10]

- UK bank NatWest partnered with payments company Vocalink Analytics (a Mastercard company) in 2018 to tackle B2B invoice fraud. Together they developed, tested, and launched a solution that integrates artificial intelligence and machine learning to identify potential fraud. The tool, which only flags suspicious payments if they are non-real time, aims to prevent invoice redirection fraud.[11]

Build robust data sets

Artificial intelligence tools require clean data to learn and perfect processes. Therefore, regional banks and credit unions must collect volumes of historical data on customers/members and transactions. The more considerable the amount of information, the more accurate the detected patterns and behaviors. That is why banks need to be able to rely on enormous amounts of data and to process it quickly.

It is no surprise, then, why more and more regional banks are investing in technology innovation and FinTech collaboration.

- The need to beef up their technology game spurred regional banks BB&T and Sun Trust to announce their merger in early 2019. The union will form the sixth-largest commercial bank in the United States, but executives said technology was the impetus for the deal. The transaction – the most significant bank deal since the financial crisis – will allow the former rivals to develop better technology together than they could on their own. They plan to reinvest $1.6 billion in projected cost savings from the merger into technology and innovation.[12]

- California startup Superb AI creates customized data sets to help firms meet project requirements and uses AI to speed up the tagging process. The firm’s solutions automate data cleaning and collection. The integration of human intelligence with AI drastically decreases the labor intensity of data cleaning.[13]

Be sensitive to employees’ concerns

Whether a bank implements AI-powered solutions to improve service, intelligent algorithms for better business analysis, or automation to streamline manual processes, it must proceed with caution and sensitivity.

Why? Along with all the buzz about AI comes inevitable employee fears that it may lead to staff redundancy.

- Artificial intelligence isn’t expected to replace jobs that require a high degree of critical thinking. But it may empower professionals to perform better and make more productive data-driven decisions.

- It will create jobs for AI specialists, both on a technical and application level, who also have soft skills, according to the World Economic Forum. Soft skills include critical thinking, listening, leadership, communication, and maintaining a positive attitude. These skills are difficult to code and are more valuable for humans to master.[14]

- Artificial intelligence will create opportunities for those who can create, apply, and optimize AI technologies. It will depend on professionals with strong communication abilities who can use their high-level technical achievements in production and daily life.

First National Bank of Omaha (FNBO) was an early adopter of AI in the area of consumer lending. In summer 2019, the firm (the largest, privately-held bank in the United States) successfully launched an AI-based personal loan product powered by Upstart, a Silicon Valley FinTech.

Within months, FNBO was providing convenient and affordable personal loans to thousands of borrowers in 45 states, totaling tens of millions in loan originations. FNBO says that once six to 12 months of loans are on the books, more accurate price-to-risk predictions will be possible.

Before the launch of FNBO’s digital loan product, the bank’s in-house innovation team trained on agile/lean design concepts. Bank executives said Upstart was a positive catalyst for cultural change within the organization. The team focused on customers, the problems they encounter, and how to resolve them. It also researched technology developments and identified how to link these trends with customer research.[15]

What’s next?

AI is creating a disruptive wave in the financial services sector. FinTechs are collaborating with large banks to create an ecosystem of innovative services. Government regulations and VC investments are clearing the path for uniquely-skilled tech startups to establish transformational win-win partnerships with regional banks and credit unions.

With an eye on the future, firms will boost customer/member engagement by collecting transaction data that tracks behaviors, patterns, and financial history to produce deep customer insights. Artificial intelligence can synthesize this data to recognize when a specific service is particularly relevant to a customer so banks can leverage AI solutions to trigger timely offers for personal credit, savings, bonds, insurance, or a home mortgage.

AI can bring significant value to regional banks and credit unions to increase revenues, reduce costs and risks. Rather than incur fixed costs of maintaining expensive AI teams, AI as a service seems to be the way forward for the industry given the demand-supply gap for AI talent. The time is now.

I encourage you to contact me via social media to learn more.

# # #

[1] MonJa, “Small Banks and Why They Need To Adapt To The Latest In Artificial Intelligence and Machine Learning,” Yulia Gnatyuk, June 6, 2018, https://www.monjaco.com/blog/small-banks-ai-machine-learning.

[2] Hüify, “Acquisition vs Retention: The Importance of Customer Lifetime Value,” Will Tidey, February 17, 2018, https://www.huify.com/blog/acquisition-vs-retention-customer-lifetime-value.

[3] The Financial Brand, “Meet 11 of the Most Interesting Chatbots in Banking,” Jim Marous, March 14, 2018, https://thefinancialbrand.com/71251/chatbots-banking-trends-ai-cx/.

[4] Capgemini, AI Revolution in India Banking, 2019, https://www.capgemini.com/wp-content/uploads/2019/02/IBABankTech2019AIRevolutioninBankingFinal.pdf.

[5] Tech Republic, “How automation in financial services could boost revenue by $512B?,” Macy Bayern, July 12, 2018, https://www.techrepublic.com/article/how-automation-in-financial-services-could-boost-revenue-by-512b/.

[6] Capgemini Research Institute, “Where are banks and insurers on their digital mastery journey?,” 2019, https://www.capgemini.com/in-en/wp-content/uploads/sites/6/2019/03/30-min-%E2%80%93-Report.pdf.

[7] Business Insider, “The $450B opportunity for the applications of artificial intelligence in the banking sector & examples of how banks are using AI,” Eleni Digalaki, June 24, 2019, https://www.businessinsider.com/the-ai-in-banking-report-2019-6.

[8] Economic Times, “SBI, other banks using AI big time to improve efficiency, cut costs,” July 01, 2018, https://economictimes.indiatimes.com/industry/banking/finance/banking/sbi-other-banks-using-ai-big-time-to-improve-efficiency-cut-costs/articleshow/64814370.cms?from=mdr.

[9] Ibid.

[10] Emerj, “AI in Banking,” Kumba Sennaar, November 22, 2019, https://emerj.com/ai-sector-overviews/ai-in-banking-analysis/.

[11] PYMNTS.com, “NatWest, Vocalink Analytics Go After Invoice Fraud,” April 4, 2018, https://www.pymnts.com/news/b2b-payments/2018/natwest-vocalink-invoice-fraud.

[12] Seeking Alpha, “BB&T And SunTrust Merger: It’s All About Technology, Stupid!!!” John M. Mason, February 8, 2019, https://seekingalpha.com/article/4239556-bb-and-t-and-suntrust-merger-all-technology-stupid.

[13] American Banker, “Small and midsize banks can’t shy away from AI,” Marc Butterfield, May 22, 2019, https://www.americanbanker.com/opinion/small-and-mid-sized-banks-cant-shy-away-from-ai.

[14] World Economic Forum, “4 ways AI will impact the financial job market,” David He and Venessa Guo, September 14, 2018, https://www.weforum.org/agenda/2018/09/4-ways-ai-artificial-intelligence-impact-financial-job-market.

[15] Tearsheet, “Inside First National Bank of Omaha’s launch of a digital consumer loan,” Zack Miller, December 9, 2019, https://tearsheet.co/podcasts/inside-first-national-bank-of-omahas-launch-of-a-digital-consumer-loan.