Alternate data can streamline the underwriting evaluation process

Blog: Capgemini CTO Blog

As a financial services consultant, I often talk with life insurers facing similar challenges. They say they want to reduce underwriting costs and shorten approval cycle times. And they want to improve accuracy without adding new processes that some policyholders consider tedious and invasive.

Alternate data changes the scene

Underwriting accuracy is directly proportional to the data underwriters use. Until recently, insurers relied almost exclusively on information they collected through customer applications and medical exams. Underwriters evaluated an applicant’s age, gender, height, weight, driving record, and family medical history to calculate a premium rate. Blood/urine tests, drug screening, and hypertension/cholesterol readings were often required.

Now, insurers can access multiple alternate sources for a range of customer information, including:

- Data retrieved through digital channels such as biometric wearables, social media, telemetric devices, or genomics websites

- Electronic health record (EHR) information via partnerships with ecosystem specialists, historical clinical lab test data, or data from governments or open API platforms.

These days, many life insurers leverage claim reports and AI-based systems to generate insights from EHRs and prescription databases to accelerate underwriting decisions.

The role of advanced data management technologies

Alternate data has significant advantages, although managing high volume and velocity – as well as the veracity – of information can be daunting. However, technology advancements enable firms to get the best from alternate data. For instance, cloud infrastructure enables convenient data storage, on-demand computing power to process vast data volume, and advanced machine learning algorithms to gain insights from unstructured data.

Quicker underwriting

As more ecosystem players collaborate, life insurers gain a supply of consistent high-volume data to speed and scale up the underwriting process, with an enhanced critical view of the risks to be insured.

Haven Life, a digital life insurance agency, subsidiary of MassMutual, uses artificial intelligence algorithms to assess applicants’ historical lab results and medical claims data to generate instant coverage quotes and dispense without in-person medical exams.

More accurate underwriting

From a risk management perspective, life insurers can leverage alternate data better to identify new risk parameters and price risk.

India-based Max Life Insurance leverages predictive analytics during the underwriting stage to spot the likelihood of an early claim or potential fraud and routes questionable applications for additional verification.

Life insurers are turning to alternate data sources for continuous underwriting. In Poland, AXA launched a life insurance policy for senior citizens. The policy comes with an intelligent medical wristband to continuously monitor policyholders’ vital health parameters.

The data-driven risk management will help insurance firms enhance their underwriting processes, reducing loss, and providing a better customer experience.

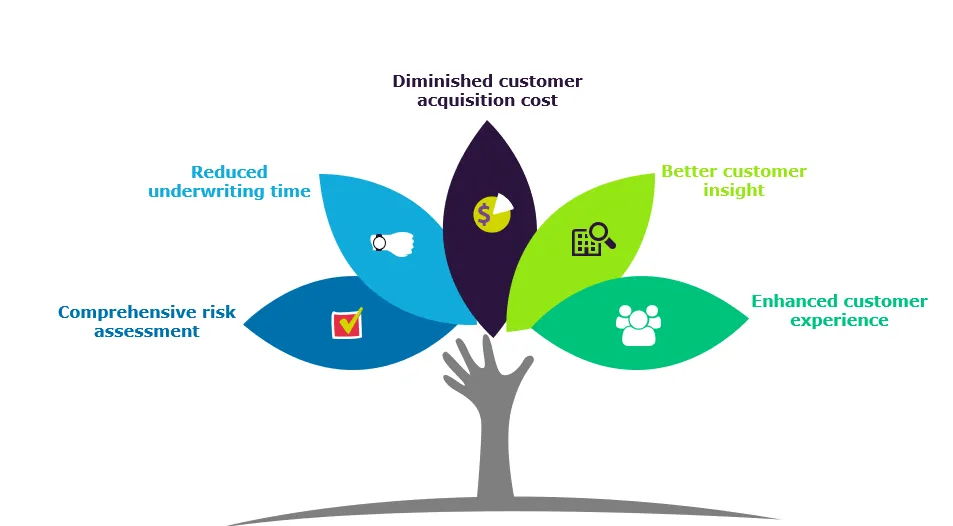

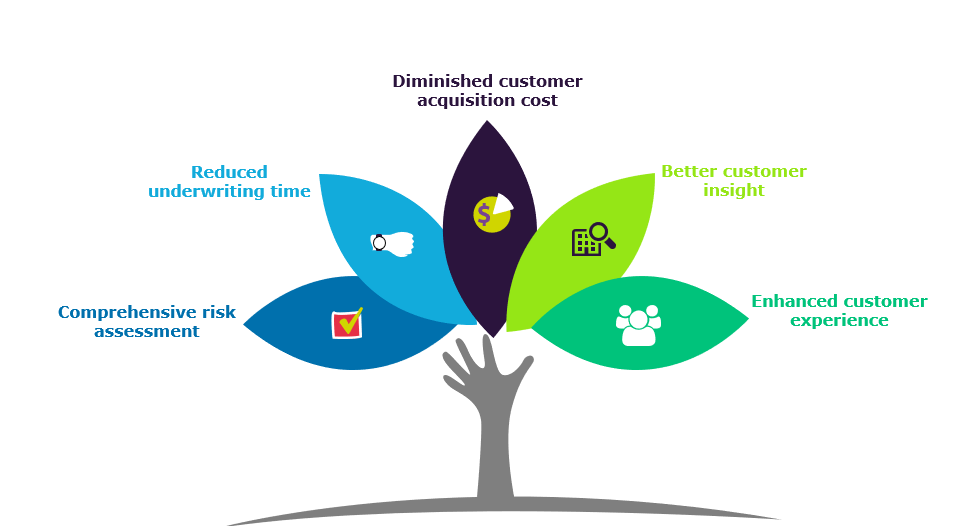

Benefits of using alternate data for underwriting

Create new value-added services

With alternate data, insurers can identify emerging risks and create personalized services because they thoroughly understand each customer’s risk profile.

In the United States, John Hancock developed Aspire, a wellness program, to help people with diabetes manage and improve their health. The firm uses data from wearables to provide coaching, clinical support, education, and rewards for healthy behavior.

In South Korea, Kyobo Life Insurance developed a fraud prediction system based on internal and external data sources to identify potential fraud before it happens.

When used together, alternate data and advanced data processing can help life insurers:

- Significantly reduce application processing time

- Free prospective policyholders from invasive medical test procedures

- Make policy approval decisions via virtual meetings and examinations

- Enable continuous underwriting and accurate risk assessment.

Download a free copy of Capgemini’s Top Trends in Life Insurance: 2021 to learn more about how life insurers can use alternate data.

To discuss an alternate data strategy for your firm and to exchange ideas about this topic, feel free to connect with me.