All about GST e-Invoicing Generation System

Blog: NASSCOM Official Blog

The GST council has approved recently the concept of E-Invoice in the GST eco-system from January 1, 2020. This is a great step taken towards the ease of doing business, which will help in reducing compliance burden and increase business efficiency. However, globally E-Invoice is not a new concept, it is already implemented successfully and working in more than 100 countries. Actually, e-invoice is not required to generate from the Govt. portal directly rather than it will be generated in the same manner as currently generated. However, there would be a little change where the invoices will be reported to the centralized portal so that such invoices can be validated and reverted back with invoice reference number along with QR code to the taxpayer.

Changes in the invoicing system after GST E-Invoice implementation

The government is going to standardize the invoicing system. The existing invoicing system would be changed by adding a few new steps after the implementation of GST e-invoicing which aims to reduce compliance burden, errors in manual processing of invoices, paper use, fake invoices, etc.

Most of the Invoices generated by different software look more or less the same, and can’t be understood by another computer system even though business users don’t understand them fully. If we see, we find that there are hundreds of accounting/billing software, which generate invoices to store information electronically and it is difficult to understand the data on such invoices by the GST System while they are reported in their respective formats. Further, the format of reporting in GSTR-1 as well as for the e-way bills are different from the original invoice which will be done separately.

Now to cope up with these issues the invoicing system has been standardized which will no way impact the way the user would see the physical (printed) invoice or electronic (ex pdf version) invoice. There will be changes in the current operating accounting systems to make them available for the E-invoicing facility. However, this can be a huge disadvantage for Desktop and other accounting systems that are not integrated with the GSTN Portal. Whereas now all the software providers would adopt the new e-Invoice standard wherein they can re-align their data access and retrieval in the standard format.

The other aspect of this concept is that users of the software would not find any change, the taxpayer would continue to use his accounting system/ERP or excel based tools or any such tool for creating the electronic invoice as they do currently. But the required update would be from the side of software/ERP providers into their software/ERP.

How E-Invoicing will be beneficial for everyone?

Get better taxpayer services

- Now there would be one-time reporting on B2B invoice data and would reduce reporting in different formats (one for GSTR-1 and the other for the e-way bill).

- Now users can generate sales and purchase register (ANX-1 and ANX-2) from the same data to keep the Return (RET-1 etc.) ready to file under the new return system. Even the e-Way bill would be also generated using e-Invoice data.

- It would be included as a part of the business process of the taxpayer.

- Substantial reduction in input credit verification issues as the same data will get reported to the tax department as well to the buyer in his inward supply (purchase) register.

- On receipt of info through GST System as the buyer can do reconciliation with his Purchase Order and accept/reject in time under the New Return.

Reduction of tax evasion

- Get complete trail of B2B invoices

- Be aware of system-level matching of input credit and output tax

Improve efficiency in tax administration

- Elimination of fake invoices

E-invoice generation responsibility

The responsibility to generate e-invoice has been assigned to the taxpayers, E-invoicing would be implemented in a phased manner and it is currently applicable to B2B (Invoice/Debit Note/Credit Note), wherefrom January 1, 2020, to March 31, 2020, it is optional for the taxpayers in the first phase. In the second phase from April 1, 2020, it would be mandatory to generate for all the registered person, whose aggregate turnover in a financial year exceeds one hundred crore rupees.

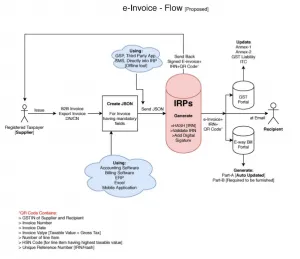

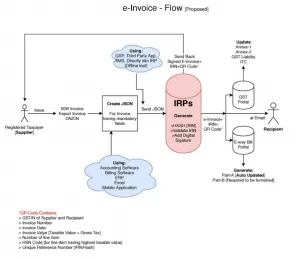

How E-invoice would be generated?

Step 1: E-invoice would be created by Taxpayers on their every sale on accounting/billing/ERP System

Step 2: As the e-invoice would be prepared, will be directly reported on Invoice Reference Portals (IRP)

Step 3: A unique Invoice Reference Number (IRN) would be generated by IRP which will be attached to the e-invoice and the system will digitally sign the same and return to the taxpayer (supplier) as well as the recipient.

Step 4: The IRP would also generate a QR code while containing the unique IRN along with some important parameters of the invoice such as GSTIN of supplier and buyer, invoice number, date,

Invoice value, total tax amount and HSN code of the major item. Afterword the same would be returned to the supplier.

Step 5: later, GST System will generate a return as well as an e-way bill from this data.

Step 6: QR code will enable offline verification using the Mobile App.

Refer to the technical flow of e-Invoice generation below:

The decision for the implementation of GST e-invoicing was made in the 37th GST Council meeting chaired by Union finance minister Nirmala Sitharaman. The standard of new e-invoice mechanism was discussed as well as approved and the same including the schemes published on the GST portal.

Find out how you can make e-invoicing easy!

The post All about GST e-Invoicing Generation System appeared first on NASSCOM Community |The Official Community of Indian IT Industry.