Algorithmic Insurance and Customer Value Scoring Disasters

Blog: The Tibco Blog

One of the more baffling aspects of the US Insurance market is the seemingly total inability of the typical insurance carrier to differentiate between a customer with a high or low Lifetime Value (LTV) especially when it comes to renewals. Insurance companies are losing millions of dollars in easily won business a year by not putting effort into assessing the LTV of their customers. And, in today’s tech-obsessed world, there’s no reason for this to still be happening. There are easy and quick solutions out there to help with this problem.

Let me tell you a story to illustrate this.

A colleague recently had his car insurance come up for renewal. His current carrier shall remain nameless to protect the guilty but we can tell you it’s a Top 10 USA P&C carrier.

- He has been with the same company for 5 years

- He has no endorsements, moving violations, or claims in that 5-year period

- He’s married, in his mid-30’s with a white collar profession so he’s low risk from an underwriting perspective

- He drives a mid-range, safe, reliable car

- He pays his premium in full at the beginning of the policy year (no installments)

Sounds like a customer any sensible carrier would like to hang onto right?

Here’s what happened:

- My colleague got a renewal notice from this company showing they had upped his premium by $200 to a total premium of about $1400. A rise of about 17%.

- Predictably enough, he was aggrieved at this perceived gouging that he immediately started shopping around for another carrier.

- He was aggrieved enough that even if the other quotes matched his new higher premium he will give one of the others his business just to punish his existing carrier.

- Whatever happens, the existing carrier has lost a lucrative customer with an existing high LTV value.

Let’s do a little math on this:

- The existing carrier works on a Combined Ratio of .90 which means they make about $120 year on his policy. Over 5 years that’s about $600.

- He would normally renew his policy every year without too much scrutiny on price so lets say another 5 years at $600.

- This would have made his LTV to the carrier about $1200 assuming no claims in that time period.

- The carrier has now lost his business and goodwill. The cost of acquisition of a new Auto customer is about $480.

- This means the carrier will need to replace my colleague’s business with a new customer. Assuming the same profile, premium, and Combined Ratio, it will take them about 4 years to break even on the new customer — assuming the new customer stays all 4 years.

So essentially, the original carrier has lost the potential profit of $600 as well as taking on acquisition costs of $480 for a new customer.

What a fiasco and avoidable too!

What could the original carriers options have been?

1. Discount – Due to our colleague’s high LTV they could have frozen his premium or reduced it slightly with no claims discount (NCD)

2. Modest Increase – They could have applied a modest increase tied to inflation perhaps and stayed under our colleague’s “shop around radar”

3. Bundling – They could have worked a bigger raise in but take the sting out by offering to bundle with another product

In a nutshell, the carrier had several options available to them to retain my colleague’s lucrative business. So why didn’t they follow any of the above paths to keep his business? It comes down to two probable reasons:

1. Policy: It’s the carriers policy to jack the price up and take a calculated risk that the policyholder won’t notice or move their business away.

2. They are unable to score the customer with an accurate LTV: Their current analysis and pricing tools don’t allow them to take a holistic view of the customers LTV and react accordingly to keep valuable customers when renewal comes around.

If the reason is #1 then the carrier deserves everything that’s coming to them with respect to customer attrition.

If it’s #2 then keep reading….

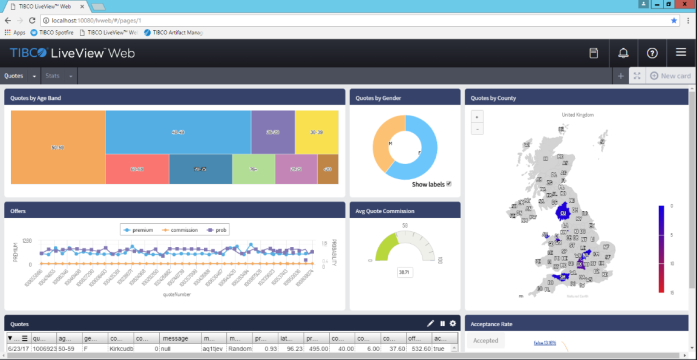

TIBCO’s Insurance Pricing Accelerator can host pricing models that generate quotes based on incoming quote requests with a round-trip response time of less than 1 second on average. That compares to the industry average of 5-7 seconds. Why is this important?

Having an extremely low request-response quote generation time has two key benefits:

1. It can reduce the dropout rates where customers request a quote but get impatient when the quote response takes too long and click away from the site, resulting in lost business.

2. The fast response time gives the insurance carrier an extra 6 seconds to add more advanced calculations to the mix such as customer value scoring of the type that the carrier in this case failed to do.

Summary

Property & Casualty in particular is a commodity business with US carriers alone spending in excess of $6B a year on TV and press advertising alone just to lose and claw back small amounts of market share from each other.

There has to be more intelligence in assessment of the value of new customer’s business and more importantly, renewal customer business because renewals have much lower acquisition costs and overall higher LTV.

The carrier’s loss of our colleague’s business was completely avoidable with a little thought put into customer value scoring. But, it’s probable that their current pricing and underwriting systems do not allow them to accommodate scenarios like this.

Read more about the Algorithmic Insurer and its potential to change how insurance companies think about pricing both new and existing companies.

Leave a Comment

You must be logged in to post a comment.