AI Meets AML: How the Analytics Work

Blog: Enterprise Decision Management Blog

The focus on financial crime, and the money laundering that funds terrorist attacks and other criminal activities, has forced the industry to look for smarter approaches. In the previous posts in this mini-series, TJ Horan noted that AI is the newest hope for compliance, and Frank Holzenthal explored the benefits that AI can bring to compliance officers.

Now it’s my turn, and I’m going to explore the AI and machine learning technologies my team has integrated into the FICO TONBELLER Anti-Financial Crime Solutions. We have built on top of the FICO TONBELLER solutions using FICO’s battle-proven and patented artificial intelligence and machine-learning algorithms, which are used in FICO Falcon Fraud Manager to protect about two-thirds of the world’s payment card transactions.

Industry experts have begun to realize the significance of analytics in combatting anti-money laundering. For instance, Aite Group LLC in its 2015 report Global AML Vendor Evaluation noted that “increasingly, regulators recognize that rules alone are not an effective manner of detection and are pressuring banks to include more sophisticated analytics.” Our new machine-learning techniques are directed specifically towards real-time, transaction-based KYC anomaly detection and highly refined self-learning models focused on anti-money laundering SAR (suspicious activity report) detection.

As Frank noted in his post, we have integrated two main AI components into our AML products.

Soft-Clustering Behavioral Misalignment Score: Powerful customer segmentation using Bayesian learning

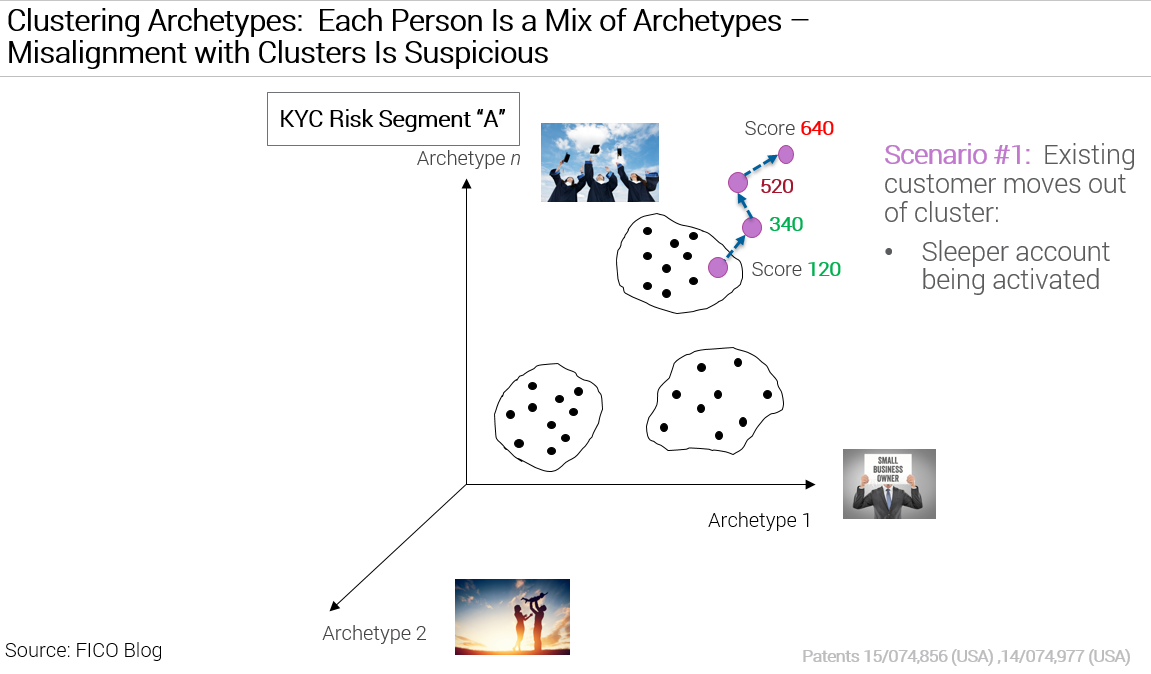

Traditional AML solutions resort to hard segmentation of customers based on the KYC data or sequence of behavior patterns. FICO’s approach recognizes that customers are too complex to be assigned to hard segments and need to be monitored continuously for anomalous behavior.

Using a generative model based on an unsupervised Bayesian learning technique, we take customers’ banking transactions in aggregate and generate “archetypes” of customer behavior. Each customer is a mixture of these archetypes and in real time these archetypes are adjusted with financial and non-financial activity of customers. We find that using clustering techniques based on the customer’s archetypes allows customer clusters to be formed within their KYC hard segmentation.

Different clusters have different risk, and customers that are not within any cluster are suspicious. As transaction monitoring is applied differently based on KYC, understanding which customers are misaligned within this segment based on their transaction behavior is very important, and transaction rules may not be sufficient. Further, as customers deviate from known clusters of typical behaviors based on transaction archetypes, the Soft Clustering Misalignment score alone can be used to drive investigations and possible SAR filings.

AML Threat Score: Using machine learning to detect and rank-order suspected AML cases

AML Threat Score: Using machine learning to detect and rank-order suspected AML cases

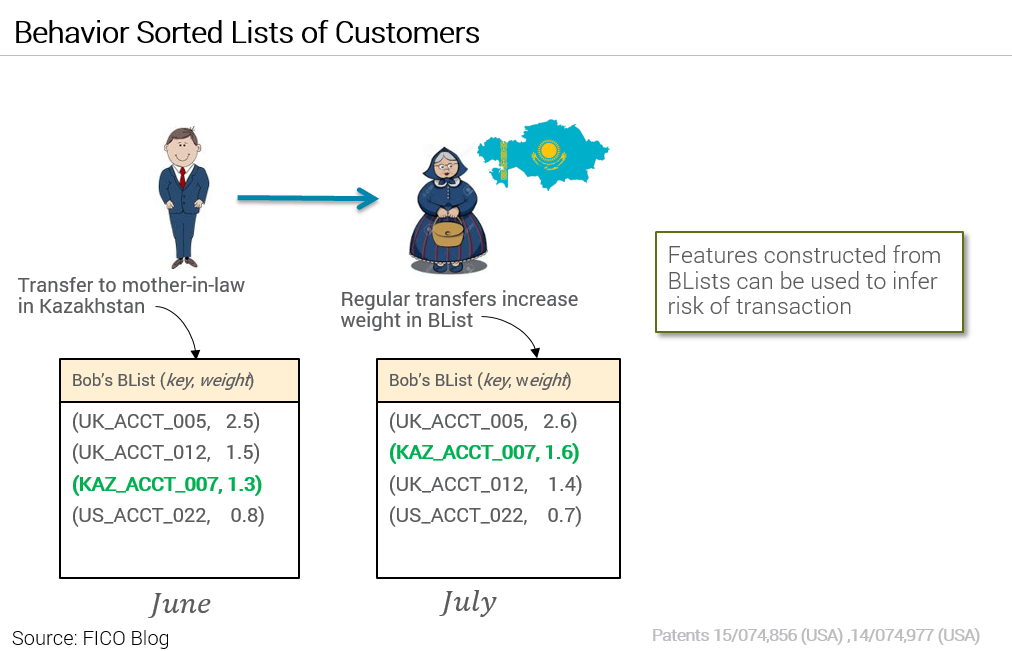

Our AML Threat Score prioritizes investigation queues for SARs, leveraging behavioral analytics capabilities from Falcon Fraud Manager. It uses transaction profiling technology, customer behavior sorted lists (BList), and self-calibrating models that adapt to changing dynamics in the banking environment. Here’s how these work together:

- Profiles efficiently summarize each customer’s banking transaction history into behavioral analytic features using recursive analytic algorithms, making ultra-low latency, real-time analytics possible.

- BList maintains a weighted list of the most frequent accounts for a customer, based on regularity and frequency of money transfers to those accounts. Features constructed from BLists act as “fingerprints” of the customer’s account. Changes in BList can indicate suspicious behavior to be investigated. In a data consortium of multiple banks, BList can be used to create global “fingerprints” of good and bad accounts, allowing for quickly identifying fast-changing patterns of malicious activities that couldn’t otherwise be detected.

- The streaming self-calibrating models are capable of automatically tracking the outlier points for each feature in real time. Then a Multi-Layered Self-Calibrating (MLSC) Score is created by combining multiple outlier models from all the features. MLSC models are structured like a neural network model, where the features in the hidden nodes are selected to minimize correlation. The weights of the model are either expert-driven or based on limited SAR data.

These capabilities enable the AML Threat Score to analyze transactions in real time, pinpoint even previously unseen money-laundering patterns and stop them before the transactions are executed. The score can also be used to layer on top of current rules-based transaction monitoring to help with prioritization of investigation, to improve the detection and lower false positives.

Multiple ways for adopting analytics using Siron®

FICO’s real-time and dynamic KYC risk assessment and SARs-filing capabilities are unmatched in the market today. Our Siron® product also provides rules-based transaction monitoring capabilities that are relied on by both financial institutions and by regulators.

Siron allows for a gradual integration of analytics into current transaction monitoring. In a “rules first” approach, these novel techniques can be used to reprioritize the rules-based alerts for more effective workload management. A “scores first, rules second” approach can detect new types of AML patterns in real time while potentially reducing the rules set. The ultimate in this value proposition is the adaptive model framework, where FICO’s self-calibrating models are fully leveraged to learn from recent SARs while the rules respond to the regulatory typologies.

FICO has had a history of firsts, from being the first to use analytics for credit application processing systems in the 1950s to being the first to use machine learning for fraud detection in 1991. With our AML analytic capabilities, we continue to be the trailblazers!

Follow me on Twitter @ScottZoldi

To find out more about how FICO is putting AI to work in AML, register for our February 23 webinar, co-presented with CEB TowerGroup, “Hiding in Plain Sight: Is Your KYC Process a Spotlight or a Blindfold? Operational Benefits of New Analytic Technologies.”

The post AI Meets AML: How the Analytics Work appeared first on FICO.

Leave a Comment

You must be logged in to post a comment.