AI Meets AML: How Analytics Improve Compliance and Cut Costs

Blog: Enterprise Decision Management Blog

In yesterday’s post, my colleague TJ Horan introduced the topic of artificial intelligence being applied to anti-money laundering (AML). I’m going to explore the impact advanced analytics can have on the current state of regulatory compliance.

Today most of the financial institutions use rules-based transaction monitoring and KYC systems to fight money laundering. There are two main disadvantages of these systems:

They tend to produce a high percentage of false positives. We have seen some improvement in the false positive rate through the use of the risk-based approach (RBA), which banks have been implementing to comply with international regulations (such as the 4th EU ML directive, BSA 4 pillars, and FATF 2012). RBA follows a multi-step approach: After initially assessing any risks (money laundering, tax fraud, etc.), customers are automatically categorized into a risk bucket. Based on the categorization, the right level of due diligence is being applied, with riskier customers getting more due diligence.

Focusing more on high-risk customers lowered the false-positive rate. But it’s still too high.

They only detect what you are looking for. Detection scenarios today only produce alerts following on known and existing scenarios. There’s no ability to detect new scenarios – similar to the “zero-day” attacks in cybersecurity. In the fast-changing world of financial crime, this isn’t good enough.

Adding AI

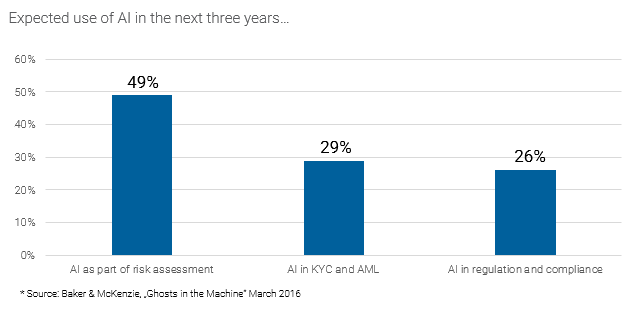

As TJ noted, AI-based systems can detect abnormal patterns that are being seen for the first time, and which may form a risk. At our FICO TONBELLER User Group, we shared Baker & McKenzie’s view on the use of AI for financial crime compliance:

At FICO TONBELLER, we have a head start. Working with FICO’s analytics group, we have combined the risk-based approach and traditional detection scenarios with two new pieces of AI, patented by FICO:

- The Soft Clustering Misalignment Score clusters customers based on their behavior, based on multiple dimensions. A customer who doesn’t fit standard alignments will be noted and might lead to an updated risk classification.

- The AML Threat Score uses historic alerts and user decisions. Patterns which in the past have been classified as “ok” will be released. Others which seem to be “unusual” will receive a high “threat score” and might lead to an alert.

Continuous training of the system means the analytics grow smarter by studying the accuracy of their past predictions based on the outcomes. That’s what a compliance officer is looking for.

AI will increase the efficiency and effectiveness of a risk mitigation strategy in multiple ways, and will directly address the two challenges for risk-based systems.

AI can detect patterns you’re not looking for. Detection of (so far) unknown behavioral patterns will lead to identification of more complex money-laundering patterns. Improving effectiveness lower the risk of fines and help banks remain competitive for legitimate customers’ business.

Also, AI allows us to use unstructured data in addition to the well-structured customer and account transaction data. Unstructured data might be the text of a letter of credit or an email. This can also reveal patterns we’re not seeing today.

AI promises to reduce the number of false positives. This will lower compliance costs and improve the quality of the alerts, while speeding up the handling of alerts and allowing compliance officers and investigators to focus on the most relevant, high-risk cases. The remaining rules will be easier and be maintained with a lower effort. Data collection and analysis can be automated to a higher degree by the combination of AI with traditional detection scenarios.

Cost pressure will accelerate the adoption of AI in the compliance sector. Compliance departments should develop strategies on how to leverage these new technologies to contribute to their success

Tomorrow, in the last post in this series, Dr. Scott Zoldi will go deeper into the analytic technologies being used in AML.

To find out more about how FICO is putting AI to work in AML, register for our February 23 webinar, co-presented with CEB TowerGroup, “Hiding in Plain Sight: Is Your KYC Process a Spotlight or a Blindfold? Operational Benefits of New Analytic Technologies.”

The post AI Meets AML: How Analytics Improve Compliance and Cut Costs appeared first on FICO.

Leave a Comment

You must be logged in to post a comment.