AI AML Models Help Find the Bad Eggs

Blog: Enterprise Decision Management Blog

Hope you had a relaxing Easter weekend with family and friends! In between coloring eggs, if you picked up a paper or scrolled through a news site, you probably would have seen the news that $130 million cash was found at the house of the ousted president of Sudan and how the US government foiled a money laundering operation by drug traffickers using bitcoins. Money never sleeps, as they say. Not even for Easter and such events are on the rise and a cause of constant worry for compliance officers all around the world.

AI AML Models: Solving a Big Problem

So, here’s the key problem. Regulatory bodies around the world have pegged global money laundering at $2 trillion. What’s worse, they estimate that less than 1% is ever caught. So to try and combat this regulators have raised the penalties for institutions found to have facilitated money laundering whether it was unknowingly or not. This has seen total fines on global financial institutions skyrocket to $27 billion in the last 10 years with Asia Pacific accounting for $600 million of that. To cope, financial institutions have hired armies of compliance officers and the median salaries in this segment have increased by 30% YOY. Lexis Nexis reports that the average cost of compliance for financial institutions in APAC is as high as $1.5 billion.

At the same time, the alert volumes from existing compliance systems have increased, but still, less than 1 in 100 alerts get converted to Suspicious Activity Reports. Citing a report from ACAMS, one of the top global banks embroiled in investigations for money laundering related to drug traffickers was struggling with approximately 3,800 alerts per FTE per day. As a result, banks have large teams of talented individuals who must work through piles of false alerts to effectively find a needle in the haystack!

AI AML Models: Reducing 90% of False Positives

Our Chief Analytic Officer at FICO, Dr. Scott Zoldi started to examine this problem a few years ago and saw an opportunity. Leveraging the strong analytics experience in fighting fraud over 25 years, FICO announced the availability of advanced analytics to combat this problem (Using AI and Machine Learning to Improve AML). With patented techniques from fraud analytics like collaborative profiling and outlier analysis, early results indicated a reduction in false positives of up to 90% while catching 50% more suspicious transactions previously undetected. Like FICO Falcon analytics, we found a significant separation between frauds and false positives at higher score bands. In a Proof of Concept undertaken with a top 10 European bank, 42% of the highest scoring transactions consisted of only 10 false positives for every 1000 alerts generated above the score cutoff at the customer level.

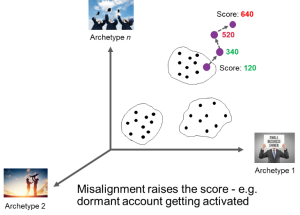

These models leverage two exciting new technologies. First, these unsupervised models use soft clustering to check misalignment within clusters based on behavior patterns. This ensures that the model stays current and adapts with changing behavior patterns.

Second, it uses Explainable AI – top reasons associated with the score are attached which not only satisfies the regulators but also makes the cases easy to investigate. A detailed description of the concepts can be found at Deep Dive: How to Make “Black Box” Neural Networks Explainable.

AI AML Models: Adding Scores To What You Have

These models can be deployed as a standalone component to supplement existing rules based anti-money laundering systems to enrich the data with scores that could be used for both enhanced detection and for alert prioritization. This capability leveraging the FICO Decision Management Platform can be invoked as a microservices call and is being made available for both on premise and cloud.

So for all those banks in APAC whose compliance teams have come back from the Easter break to a mountain of alerts, I am sure sorting through these false positives is causing more indigestion than the chocolate they had. But there is an effective solution. Analytics is set to help detect more suspicious transactions a lot more precisely. These two models can free up compliance officers so they can better investigative analysis leading to faster action, reducing reputational risk from regulatory fines and lower the cost of compliance.

The post AI AML Models Help Find the Bad Eggs appeared first on FICO.

Leave a Comment

You must be logged in to post a comment.