A Practical Guide to Digital for Banks

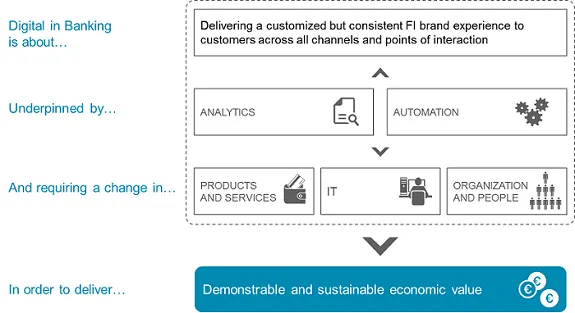

“Digital” is critical in financial services, but defining the term is difficult. At Celent, we believe that digital requires a structural change in the financial institution. Our framework illustrated below makes it easier.

Digital in banking begins with the customer. Banks should be clear what their brand stands for (e.g., superior service, price promise) and seek to deliver a consistent brand experience in all customer interactions.

Not all channels need exactly the same functionality, but the customer’s impression should be of the bank brand, rather than channel.

Celent’s Framework for Digital in Banking:

Analytics play a crucial role in optimizing the delivery of a bank brand experience in real time for each customer based on a wide variety of data from different sources. Banks have always had a wealth ofinternal data, but have historically not been very good at using it. Now, customers are also creating a huge digital footprint of external data via their connected devices on search engines, social platforms, and merchant sites. Using this data appropriately can be extremely valuable.

Today’s workflow and business process management tools not only orchestrate processes internally within the bank, but also trigger interactions with customers. Similarly, banks go beyond electronic statements when trying to get rid of paper and digitize documents. They invite customers to complete application forms electronically and utilize imaging and document uploading technologies to capture and store digital documents instead of paper.

Digital requires a fundamental change in the banks’ operating model to deliver new products and services to customers more efficiently and effectively and change how banking products are developed—from engaging customers in idea generation to rapidly testing new product ideas to allowing customers to self-design products. Banks are starting to realize that they need to embrace partnershipsand invest in startups to compete effectively.

Banks stuck with old and siloed legacy platforms struggle to maintain agility, while regulatory and other mandatory changes keep pressure on IT budgets. IT mirrors the shape of the business and for IT to become more effective, the business organization needs to break down its silos. To do so, digital transformation needs to become a CEO-level issue.

Digital banking is not about novel ways to satisfy every client demand. Digital transformation must result in a demonstrable and sustainable economic value for the bank. Too often financial institutions embark on digital transformation programs without a clear view how their efforts will translate into economic value. Digital efforts need to address revenue uplift, risk cost mitigation, and / or operational cost reduction.

For financial institutions embarking on a digital transformation journey, Celent recommends the following:

- Focus on the customer experience of your brand: go where your customers are; understand what drives customer value; and organize around the customer.

- Build flexibility into your operating model, both business and technology; prioritize investments which enable flexibility and provide options for future changes.

- Keep an eye on the market: learn lessons from other successful players (not just banks); watch for opportunities to acquire new products, skills, and capabilities; and be open to partnership opportunities.

- Be clear how economic value will be derived.

- Establish a portfolio of plays and create a roadmap: “must haves”—typically defensive or high positive value impact under most scenarios; “watch points”—lower value with the option to delay action or change course; and “big bets”—uncertain direction and high investment/impact.

This blog is adapted from “Defining a Digital Financial Institution: What Digital Means in Banking,” by Dan Latimore and Zil Bareisis.

The post A Practical Guide to Digital for Banks appeared first on Customer Experience Management Blog.