4 Steps Credit Unions Can take to be More Member-Centric

Blog: Enterprise Decision Management Blog

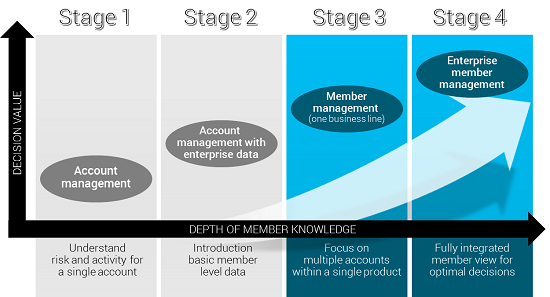

Credit Unions set the standard for knowing and understanding their customers. They know about the importance and uniqueness of the member relationship. However, building the member profile and using this information in order to drive customer-focused decisions can be challenging. Identifying the stages of member-centric management and leveraging the data available at each stage is the first step to being more member-centric.

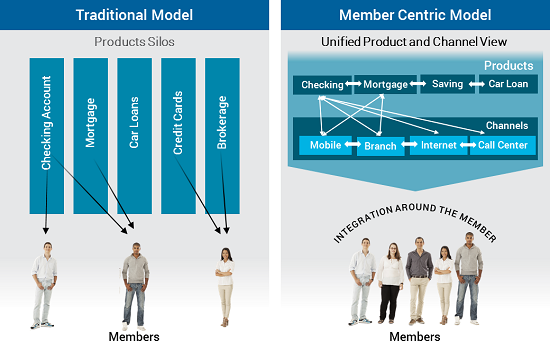

Traditional Model versus Member-Centric Model

Historically in the United States, member management was done at the account level using the Traditional Model. Products were managed by separate groups or silos, and information about the accountholder was not shared between these silos. In this Traditional Model, an accountholder could be in an overdraft status on their checking account and, because the information was not made available to other areas, a cash withdrawal against the credit card could be approved. The result would be inconsistent member treatment and uncontrolled risk.

Retail lenders across the globe have, in recent years, pursued an alternative approach which encapsulates the full customer relationship and can be referred to as the member-centric model. The Member Centric Model is designed to share information across product silos and communication channels. The result is a unified product and channel view of the member that can be used in the management of the individual member accounts. In our previous example, the over-drafted member was approved for a cash transaction on their credit card. In the Member Centric Model, information about the overdraft status of the account would be made available across all products and channels resulting in consistent treatment across all member contacts. The member-centric model can simultaneously improve risk management and improve the member experience.

For credit unions not already managing in a unified manner, going from an account level to a member level design can be intimidating. The good news is that benefits can be derived at any of the intermediate stages of member centricity. A thorough understanding of each of the stages and the associated benefits follows.

There are four basic steps of member management and each of the steps provides unique benefits to the credit union. I review each step based these questions:

- What are my goals for this account?

- What data do I need to make a decision?

- What kinds of decisions should I be making?

- What benefits should I anticipate?

Step 1 – Account Management

In an account management design, the decisions and treatments applied to an account is based primarily on data associated with the history of that singular account. For example, in a credit card account only information about the member’s credit card behavior is used to make decisions such as credit line adjustments, approve decline decisions or collection contact strategies, just to name a few.

Goal: Effectively manage risk and loss at the account level.

Data Needed: Account-only relationship, transactional, and payment data plus any account level score models

Decisions: Automated account-level decisions such as line management, authorizations, pricing and collections to name a few

Benefits: Decisions are automated and account history can be modeled to predict future performance and direct future actions

Step 2 – Account Management with Enterprise Data

At step 2, decisions are also managed at the account level. The difference is that member level data is introduced into the model and the logic that leads to the decision is made based on a wider scope of information. The decisions made are still at the account level only, and now account history is complemented with relevant data spanning the full member relationship. This is a very common stage of customer-centric management in the United States.

Goal: Make more informed decisions to build relationships and manage risk and loss

Data Needed: Relationship, transactional, payment, and performance data on all member accounts

Decisions: Automated account-level decisions based on performance across all lines of business

Benefits: Account level decisions become more consistent and are based on the full membership relationship

Step 3 – Member Management (one line of business)

At this level, the credit union is using data for a single business line (such as a revolving product line like credit card) and decisions are made at the line of business level rather than the account level. For example, for members with multiple credit card accounts, credit line management decisions are made at the member level and then the lines are distributed to each of the member’s credit cards.

Goal: Cohesive management of single line of business, including management of aggregate exposure, risk and loss metrics

Data Needed: Product-level data for an individual member; for example, if member has multiple auto loans with credit union, collecting and using the data for all of these loans when making decisions

Decisions: Applying treatments at the product level for each member. For example, if a member has multiple auto loans in collections, combining the collection efforts into a single treatment rather than separate contacts for each of the delinquent loans.

Benefits: A product level view of each member that ensures consistent treatment of similar member accounts

Step 4 – Enterprise Member Management

At this stage the credit union is using the complete member relationship profile to review and make decisions. This could be multiple occurrences of multiple products, for example 3 credit cards, 1 mortgage, 2 auto loans, a HELOC, a savings and a checking account. Having this depth of insight into the relationship as well as the history that the member has with the credit union enables the achievement of a holistic style of member management that would allow for consistent and appropriate treatment for a member in every aspect of the relationship.

Goal: Growth of the member relationship

Data Needed: Member account data across all relationships

Decisions: Member-level exposure across all product lines distributed at the account level, member-level line management, collections, and marketing

Benefits: Consistent and cohesive member treatment across all products and all contact channels, deepening of the member relationship

Putting it All Together

What stage of member management are you at today? Have you tapped into the value of the member-centric model?

Keep in mind that the benefits of member management are obtainable at each step of the way. Building a solid relationship with your members starts with an evaluation of your current policies, processes, and member touch-points. Moving through the stages of member engagement and member centricity redefines the relationship you have with your member base . . . so you can become a true financial partner to your members.

The post 4 Steps Credit Unions Can take to be More Member-Centric appeared first on FICO.

Leave a Comment

You must be logged in to post a comment.