Will PSD2 and SCA Ruin Your Customer Experience?

Blog: Enterprise Decision Management Blog

With less than 12 months to go until EU banks implement their strong customer authentication (SCA) solutions, project teams are facing tough decisions about the most important aspect of the business – customers making payments.

Alarmingly, from RFPs we’ve seen at FICO, many banks are creating systems that will either be non-compliant or will create an unacceptable customer experience. We’re hosting a webinar on October 2 to discuss how to do this the right way — here is the challenge we see.

A Brave New World for Payments

With PSD2, banks can no longer rely on their core offerings of making payments and providing balances. With the openness of PSD2, they’ll need to add value and convenience to the customer experience, or lose life-time customers to new challenger banks and Account Information Service Providers.

Merchants will no longer rely only on card payments and will access authorisation directly, releasing them from costs of the chargeback process while providing opportunity for payment discounts. For consumers, they will be in many cases unknowingly give up the chargeback scheme that offers consumer protection should purchases go wrong, especially the very much-unpublicised UK Credit Card – Section 75 claim.

With this new openness, increased competition, consumer demand for convenience and the chargeback claim process removed for direct payments, banks need to increase payment security to protect the business, whilst maintaining ease of payment. These significant minimum standards lead us to the biggest shift in the payments landscape we can remember and one of the most challenging balancing acts for retail banking leaders.

Who Will Win in the Frictionless Race?

With the relentless demand for digitalisation, millions of customers have already left brands that failed to provide hassle-free, frictionless services. RIP Blockbuster, HMV and even good old “Woollies”. Consumer acceptance is so rapid we now see Netflx, Spotify and Amazon as established go-to brands.

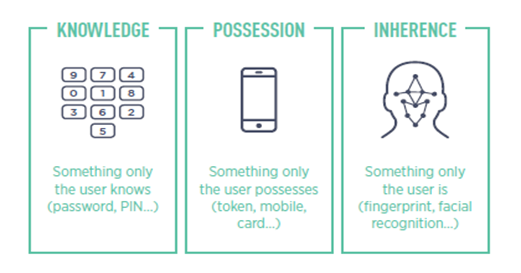

Here’s what this means for you: Dependent on your bank’s fraud levels and / or risk appetite, a consumer’s purchase may now require SCA. The customer will have to provide at least two of the following: knowledge, ownership and inherence. The two elements which are selected must be mutually independent of each other as to avoid a single point of compromise.

When banks invoke SCA in their customers’ purchases, they may be compliant, but they also have to provide a frictionless experience. Banks that get it right will build on customer loyalty, particularly against a backdrop of unprecedented data compromises, social engineering and scams. Banks that get it wrong will see their customers immediately flock to brands and payment types that offer services without the hassle.

We know when a customer gets upset about a transaction, it creates an irritation with the brand. Personally, if my bank gets SCA wrong and affects my payment journey, I’ll be quickly moving to a brand that makes it easier.

Find Out More

It is forecast that by 2024 instant payments will overtake card payments in e-commerce purchases. Are you ready to be the compliant bank of 2019 and future bank of 2024, or will you join the list of “remembered” brands that stopped their customers from making payments when they needed to?

I support banks throughout the EU with payments security around SCA and customer engagement, in the FICO Customer Communications Services business. Join me and Scott Taylor — a Fraud Business Strategy Manager for FICO’s communications services, who has worked in financial services for over 32 years — for our webinar to learn more.

5 Things You Need to Include in Your PSD2/SCA Vendor Selection RFP or Solution Design

Tuesday, October 2, 2018

11:00 am BST

Complimentary Webinar

60 minutes

The post Will PSD2 and SCA Ruin Your Customer Experience? appeared first on FICO.

Leave a Comment

You must be logged in to post a comment.