Why Diversity Abounds in New Branch Designs

Branch channel transformation is a complex and expensive undertaking. For all its complexity, however, there are at least two certainties. Namely that 1) it’s no longer optional, and 2) there is no single blueprint.

It’s the rich diversity in approaches taken to the important task of improving branch channel efficiency and effectiveness that makes this topic so fascinating.

Retail financial institutions need to possess a number of core competencies to remain successful. Among them is omnichannel delivery. For this reason, Celent launched two research panels in 2015, one devoted to digital banking and another focused on branch transformation.

No Longer Optional

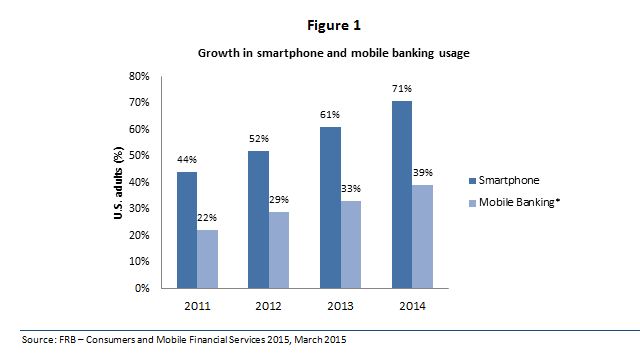

In its first Branch Transformation Panel survey, 81 percent of financial institutions regarded branch transformation as an imperative. After roughly a decade of talk but little action, we are encouraged by banks’ embracing the need to get going. They’re not alone. Retailers of all shapes and sizes are wrestling with how to deliver a compelling and differentiated omnichannel experience, what that means in their stores and how to manage a rapidly changing cost-to-serve. The rapid pace of change increases both the uncertainty and sense of urgency. One only needs to consider the meteoric rise of mobile engagement (Figure 1). Things are not what they were just three years ago. Channel systems designed ten years ago aren’t the answer to tomorrow’s challenges.

No Single Blueprint

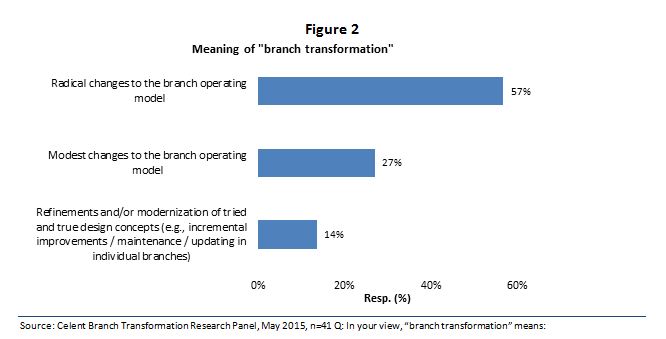

While financial institutions may be aligned on the importance of tackling branch channel transformation, there is a wide range of responses around what this actually means. Most banks appear to associate branch channel transformation with “radical changes” in the branch operating model. Arguably, for many banks, radical changes are needed. But not everyone sees it this way (Figure 2).

This diversity of opinion is to be expected. It stems from a number of factors: each financial institution’s culture and business strategy, desired customer experience, target market, legacy system capability and a host of other factors. The most distinguishing factor may be the willingness (or not) of each institution to intentionally disrupt its business model before someone else does. If you liked banking because it was slow-moving and predictable, the next few years will be stressful for you.

This blog post was adapted from “These Early Days of Branch Channel Transformation: Celent Branch Transformation Panel Series Part 1,” by Jean-Marie Ubigau and Bob Meara

The post Why Diversity Abounds in New Branch Designs appeared first on Customer Experience Management Blog.

Leave a Comment

You must be logged in to post a comment.