Why Account Management Scores Matter – in Russia and Beyond

Blog: Enterprise Decision Management Blog

Many lenders in markets outside the US use FICO® Scores to assess the risk of consumers applying for loan, but don’t continue to monitor those consumers’ risk using the FICO Score. In this post, I will share analysis that shows why using account management scores is equally important. I will share recent analysis done in Russia, where more than half of the top Russian banks use FICO Scores delivered by NBKI, but most are only using the scores for Account Origination.

The FICO Score in Russia

The FICO® Score has been available in the Russian market through the National Bureau of Credit Histories (NBKI) since 2008. Winner of the Best Scoring Solution 2016 from Russia’s Banking Review magazine, FICO Score 3 was developed through analysis of more than 10 million Russian borrowers and 200 million credit lines.

The FICO Score provides two separate scores, tailored for their uses:

- The Account Origination score rates the risk of a credit applicant at account origination.

- The Account Management score rates the risk of an existing customer, and supports portfolio management strategies throughout the customer management lifecycle, including credit line management.

FICO analysts regularly monitor these scores to ensure that the models are providing the high degree of accuracy in risk assessment that is expected of FICO products. This regular monitoring also enables FICO analysts to identify any developing credit risk trends occurring in the Russian market.

Account Origination Analysis Shows Shift in Risk

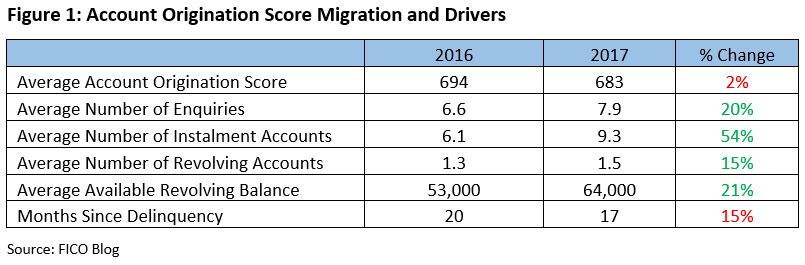

The distribution of the FICO® Score for Account Origination on newly booked accounts is largely driven by the risk appetite and acceptance criteria of individual lenders. Figure 1 shows an analysis of a group of consumers who applied for credit in 2016 and were scored with the Account Origination score. We then scored the same consumers 12 months later, again with the Account Origination score, to see how their risk had changed.

In 12 months, the average score for this group of consumers has dropped by 11 points. Looking at some key characteristics that factor into the score calculation, we can start to understand why:

- The average number of enquiries has increased by 20%, indicating that these consumers continue to shop for additional credit after already taking on new credit.

- The consumers also have more instalment debt on file 12 months later, and larger available revolving balances to spend. Whilst we would expect the number of accounts to have increased as these consumers were applying for credit in 2016, a 54% increase in instalment accounts is significant.

- The same consumers are also showing more recent delinquency compared to 12 months previous.

This shift towards a more risky profile among those recently granted credit highlights the importance of careful risk monitoring of this population. Regular review of monitoring reports helps lenders identify if a particular tranche of business is shifting risk and merits proactive risk management.

Risk shifts such as this show why it’s even more important for lenders to leverage robust account management scores to ensure they maintain a healthy portfolio. Most lenders use behaviour scores to manage their booked accounts; these scores forecast a consumer’s risk based on masterfile data that shows how the consumer has managed their credit commitments with that lender alone. The FICO Score for Account Management gives an added dimension: Its analysis is based on how a consumer is managing all of their credit commitments across all lenders.

Lenders who have both internal behaviour scores and credit bureau account management scores can significantly enhance their customer management strategies using both scores in a dual-score matrix.

Account Management Score Shows Updated Risk

A recent blog post highlighted the improvement seen in the Russian economy since the 2014 financial crisis through FICO’s Credit Health Index. We see the same trend by looking at the FICO® Score for Account Management for entire credit-active population. The average FICO® Score increased by 6 points between 2016 and 2017.

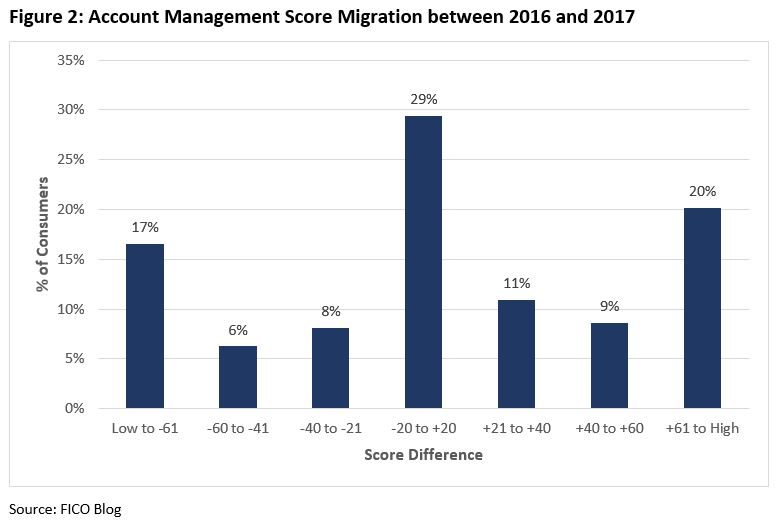

Over the 12-month period in question, the majority (71%) of consumers experienced a significant change in their Account Management scores of 20 or more points (Figure 2). 40% of consumers experienced a material score increase, while 31% of consumers experienced a score decrease. Without the use of a refreshed Account Management score, these important shifts in the credit risk posed by a particular customer — whether up or down — would be less likely to be picked up on by the lender.

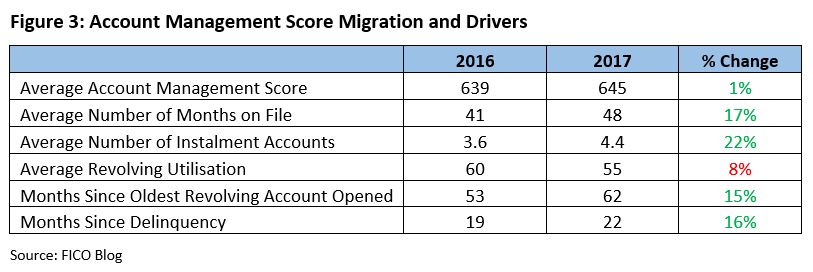

Examining how key credit characteristics shifted between 2016 and 2017 highlights some of the drivers in the 6-point increase in the average Account Management score (Figure 3). The increase in the age of recent delinquency and the decrease in revolving utilisation helped increase the average Account Management score.

The improvement in the overall portfolio quality means more consumers can qualify for positive actions, such as credit limit increases. For example, if a lender has a strategy of only approving consumers with a FICO Score for Account Management of over 610 for a line increase, 3% more consumers would have qualified for that line increase in 2017 compared to 2016.

Strong Risk Segmentation

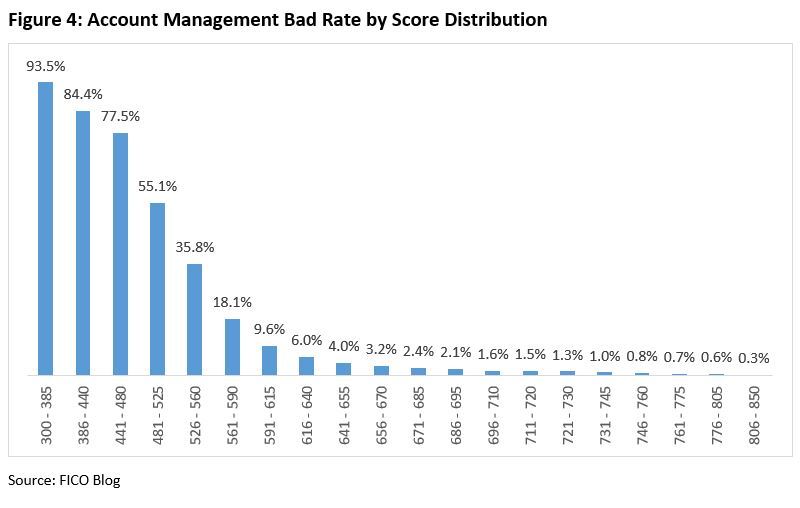

When evaluating risk, the FICO Score for Account Management offers excellent segmentation. For example, the overall 90+ bad rate in 2017 for consumers scored in 2016 is 20.1%, whilst the lowest-scoring 5% of consumers have a bad rate of 93.5% and the highest-scoring 5% of consumers have a bad rate of 0.3%. This near 300-fold difference in default likelihood between the top and bottom 5% of consumers based on their FICO Account Management score again demonstrates the high degree of rank-ordering offered by FICO Score (Figure 4). Lenders can leverage this predictive strength to significantly improve profitability, by utilising the FICO Score in conjunction with behaviour scores to enhance their account management strategies at both the lower and upper score ranges.

Final Thoughts for Russian Lenders

Analysis of Account Management FICO Score distribution as well as the Credit Health Index shows a Russian economy that is improving since bottoming out in 2014. To make the most of this upswing in conditions, it is important for lenders to use all of the tools available to make the most robust and profitable lending decisions, especially when recent profiling indicates that consumers taking on new debt skew towards higher risk when re-examined 12 months later. Using FICO Score 3 at NBKI in conjunction with an internal score will enable lenders to significantly improve profitability based on a more complete view of the creditworthiness of both new and existing customers.

The post Why Account Management Scores Matter – in Russia and Beyond appeared first on FICO.

Leave a Comment

You must be logged in to post a comment.