What Is Collection Treatment Optimization?

Blog: Enterprise Decision Management Blog

While analytic optimization can be used across the debt management cycle, collection treatment optimization is one of the best ways to get started. Through analytics, you can determine the ideal action to take on every account, as well as when to take it. Collection treatment optimization can also answer that vexing question, “Do we have too many collectors or not enough?”

Collection treatment optimization is a powerful tool that you can use to get your workforce to do the right things and make efficient use of the capacity you have.

Whom Do I Treat?

The main challenge in early collections is operational. It’s a volume business — a large bank may have 10,000 or 100,000 accounts rolling into collections every month. That’s too many for most staffs to work, so how do you triage it?

Bear in mind that the majority of these accounts are not rolling into collections because a borrower is under financial strain or can’t manage finances. In most cases, they didn’t have time to make payment, or they had an unexpected expenditure that means don’t have the funds in their accounts. Nine out of ten will cure within a month, so you can spend a lot of money talking to people you don’t have to talk to.

Some of these will pay anyway, whatever you do, even if you don’t remind them. Others you need to call or remind, and the longer you leave it the less room you have to manoeuver. If you wait until they’re two or three payments late, it may be more difficult for them to make up payments. Also, if a person is under financial strain, you might be competing with other organizations for available funds.

The art is to have the right balance between nudging and extensive care. That is why you want to segment. For some customers, more expensive treatments might have very little uplift. A customer might pay after a text message with 75% probability, calling them might only increase it to 78% probability, so the extra cost might only be justified for large balances. In some populations, where the probability gap becomes bigger, the extra cost for the more effective treatment might be justified for smaller balances.

How Do I Treat Them?

Your toolkit is typically nudging people with a letter or text message, or calling the customer through a call center or automated voice channel. These channels have dramatically different costs. A text costs virtually nothing, but phone calls may cost a dollar or a euro or 50p per minute.

Say you talk to someone who paid yesterday, or is on their way to the bank to make a payment. With all the greeting and verification, your short call can take 90 seconds to two minutes. That’s 2 euros gone — not much, but if you do it 10,000 times a month, that’s a lot of money for information you don’t need. If you only send a text message, that’s fine — but if the wording resonates with the customer, they might call you to tell you they’ve already paid, and there’s 2 euros gone.

There is a hierarchy in effectiveness of methods. Talking to a borrower is more socially binding than a text message. With collection letters, the people you really need to reach might stop opening their mail at some point. So what is the right combination of call, voice, text message and letter or indeed any combination of the leading seven channels?

It’s easy to come up with a valid collections treatment path (such as text, text, letter, call), but there can be a massive difference between valid and best. You might do champion / challenger testing to gradually improve your strategy, but it’s an inefficient approach; you can only change one variable per test, and you need one-to-three months to figure out if the new strategy is better. This is a blind man’s walk – you take one step at a time, and you step back if you walked in the wrong direction. Optimization draws you a map that shows where the top of the hill is, and allows you to jump straight to it.

How Do I Balance the Workload?

Even if you have a decent strategy for segmenting customers and assigning actions, this will be complicated by workload issues.

Accounts enter in waves, so you won’t have the same inflow every day, and you need to spread work over the month. Credit cards are less of a problem — there are between 15 and 22 cycles spread over the month. But many loans or mortgage products only have payments once or twice a month, so all accounts become delinquent at once. You can’t call them all on the 15th.

Furthermore, you have to deal with the higher volume after vacations and holidays, where you will face higher delinquency rates. If you’re a mobile provider, you may sign a bunch of new contracts when a new iPhone is released, which can cause a wave of delinquencies with the next invoice. You also need to schedule around vacation time for collectors.

This is where collection treatment optimization really delivers benefits, because it works these capacity crunch constraints out for you. In a traditional environment, you can do ad hoc capacity management by manually overwriting your strategy, saying this week we won’t dial this campaign because we don’t have enough people to cover it. But this can negate the impact of a good strategy. With optimization, at the press of a button you can adapt your strategy to fit new constraints and capacity.

What Else Can Collection Treatment Optimization Do?

Optimization is agile and gives you the best possible balance between capacity and effectiveness at any given time.

- Say you’re halfway through the month and you haven’t hit your targets — you can use optimization to refocus.

- You can use optimization to answer questions like, “If I had 10% more capacity, what would the financial impact be?”

- If your CFO or COO says you have to reduce workforce by 5% or 10%, optimization can tell you how this will affect results, and at the same time deliver an adjusted strategy that maximizes your collection goal under these new constraints

- Optimization can help you deal with regulation. If you can’t contact a customer more often than X times a day or week or month, that will affect your financial results. Optimization can simulate that.

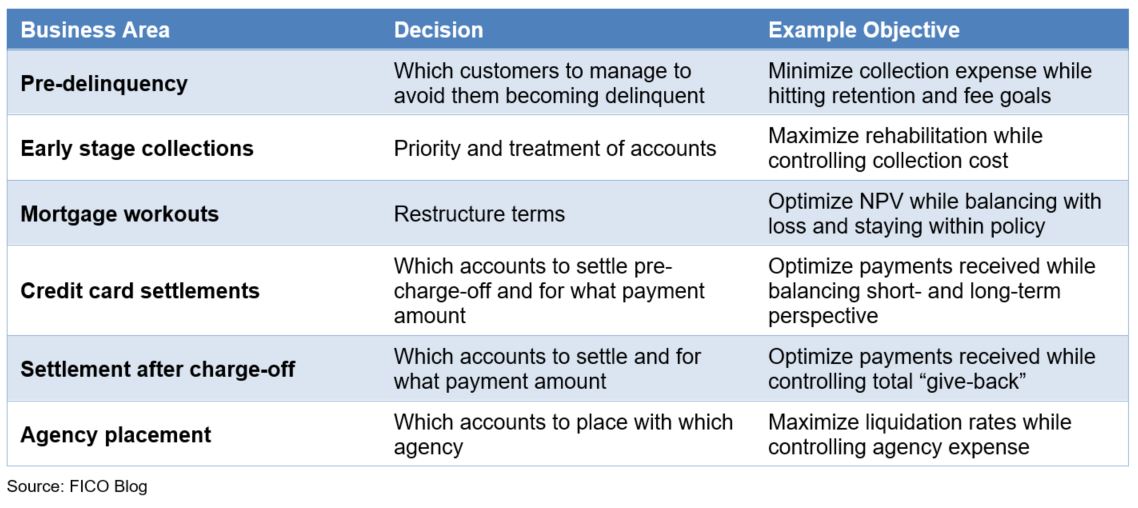

Optimization has benefits across the debt management lifecycle.

Optimization is more commonly used today in areas like manufacturing and logistics, where it would be nearly impossible to develop a valid strategy with pen and paper or even a spreadsheet. In collections, anyone can write down a strategy and start executing it — but that doesn’t make it the right strategy, or solve the executional problems that optimization can address.

The introduction of IFRS 9 increases the need for efficient treatments in early collections. Now is the right time to get started with optimization.

To learn more, watch this short video from my colleague, Dave Lightfoot:

The post What Is Collection Treatment Optimization? appeared first on FICO.

Leave a Comment

You must be logged in to post a comment.