U.S. Credit Scoring Trends to Watch in 2019

Blog: Enterprise Decision Management Blog

After a 2018 that had its highs and lows, what might 2019 have in store from a credit risk management standpoint? Here are three key developments in credit scoring that we will be keeping an eye on in the new year:

Consumer-Contributed Data Takes Center Stage

Momentum is high in the consumer-contributed data space: consumers are getting more comfortable with sharing their data, provided they are presented with clear benefits for doing so. Mandates, such as the Revised Payment Services Directive (PSD2), are ushering in the era of Open Banking around the globe. Additionally, developments, such as the recent launch of the Financial Data Exchange (FDX), point to increasing collaboration between financial institutions and data aggregation vendors (such as Finicity, Plaid, Quovo, and Envestnet | Yodlee) to facilitate secure and efficient transfer of consumer-permissioned financial data.

In 2019, enhanced credit underwriting via digitally contributed-consumer data will hit the mainstream. With solutions such as the recently announced UltraFICO™ Score, lenders will be able to efficiently access and use verified data that reflects responsible financial activity to gain deeper insights into the credit risk profile of prospective customers. This will enable lenders to more effectively match the best credit offer to consumers.

The increasing availability of solutions that utilize consumer contributed data, such as UltraFICO™ Score, will help to further empower consumers to obtain the credit they seek under competitive terms, particularly for those with sparse or inactive traditional credit files. FICO research has found that 7 out of 10 consumers who exhibit responsible financial behavior in their checking and savings accounts could see a higher credit score with the UltraFICO™ Score.

Risk in Bankcard Originations on the Rise

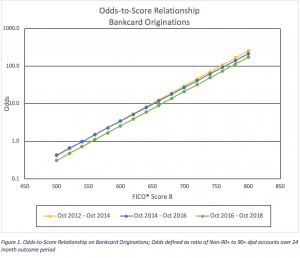

Since 2015-2016, we have observed a shift downwards in the relationship between repayment odds (defined as the number of on-time payers for every one defaulter) at a given FICO® Score in the U.S. This shift has been most notable for the bankcard originations population. Often, a downward shift in the odds-to-score relationship leads to tightening of underwriting, as lenders seek to ensure that new bookings are appropriately aligned with their risk tolerance. There is some evidence that this tightening is occurring, with the Federal Reserve Board (Fed) reporting higher reject rates based on its Oct. 2018 SCE Credit Access Survey.

Per figure 1 below, the shift in odds-to-score for bankcard originations has generally been a parallel one, indicating a systemic shift in risk across the board. Put another way, across all FICO Score ranges, the likelihood that a consumer with a newly issued bankcard will pay that card as agreed has decreased. The parallel shift implies that the ability of the FICO Score to rank-order repayment risk remains high: instead, there is a factor impacting new bankcard repayment beyond what is captured in the credit report. No clear explanation for this downward shift in repayment odds has emerged—our research has found that this shift is consistent regardless of factors such as geographic region, age, and card payment behavior (e.g., revolver vs. transactor).

We will be closely monitoring the odds-to-score relationship in 2019. It will be interesting to see if lender efforts to stem this trend via changes to their underwriting policies and the use of new data sources will offset further repayment pressures that are emerging, such as rising interest rates and increased volatility in the financial markets.

Average FICO Score — Has It Peaked?

Speaking of emerging pressures, will 2019 be the year that the streak of 8+ consecutive years of increases in the average national FICO® Score comes to an end? Since October 2009, the average year-over-year FICO Score has steadily and consistently increased, from a low of 686 in 2009 to the latest high of 704 as of 2018.

This has been driven by a number of factors, key among them the steady growth that the U.S. economy has experienced since the Great Recession, and increased consumer awareness around FICO Scores and credit education via programs such as the FICO® Score Open Access program. Additionally, the Fed recently highlighted that consumer credit scores in the lower score ranges may have benefitted over the past several years from NCAP-related efforts by the Consumer Reporting Agencies to refine practices related to the reporting of collections on consumer files.

For the past several years, these positive developments in consumer credit risk have been more than enough to offset the aforementioned (relatively modest) increase in defaults in originations. Will 2019 be the year that the nearly decade-long positive trend in average national FICO score finally levels off? We will be monitoring and sharing an update to last year’s findings.

Growth in Application Fraud Scoring Solutions

The broad rollout of EMV (aka “chip and PIN”) technology in the U.S. several years ago had the spillover effect of driving fraudsters to lower friction points in the credit lifecycle. For example: fraud at the point of origination has grown substantially over those same past few years. An October 2018 Aite Group research report shared that 42% of fraud executives state that application fraud is a top three cause of losses. By 2020, credit card application fraud losses are projected to exceed $767M.[1] Even in the mortgage application process, which is marked by careful verification procedures, CoreLogic recently quantified a 12% increase in application fraud between 2017 and 2018.[2]

As such, the importance of detecting potential bad actors and/or synthetic identities at the time of application is more critical than ever. We expect to see a spate of new scoring solutions that support omni-channel/omni-product enterprise-level decisioning, aimed at flagging potential fraudsters by leveraging state-of-the-art link analysis to identify emerging fraud rings, as well as by leveraging new data sources, such as consumer-contributed verified information, insights into address stability, and more.

2019 is going to be a strong test for the almost decades-long economic expansion that the U.S. has experienced. How the aforementioned factors will combine to affect credit defaults and the economy more generally in 2019 is difficult to predict. But there is one prediction I am certain of: the FICO team will continue to provide best-in-class credit risk tools to lenders and consumers alike, with the goal of ensuring that lenders are able to make competitive offers to their customers, and that millions of consumers are educated about their options and able to gain access to the credit that they deserve.

[1] Inscoe, Shirley “AIM Evaluation: Identity Document Capture and Verification” Aite Group Research, Oct 2018

[2] https://www.corelogic.com/downloadable-docs/mortgage-fraud-report-sept-2018-screen-091118.pdf

The post U.S. Credit Scoring Trends to Watch in 2019 appeared first on FICO.

Leave a Comment

You must be logged in to post a comment.