The future of payments processes: banks can take a cue from successful BigTech formula

Blog: Capgemini CTO Blog

Payments players across the globe are rationalizing infrastructure to meet increasing customer demands for faster, more secure, and convenient payments.[1] Rationalization enables technology to be predictive, value-based, and efficient as the growth of instant payments spurs the need for agility.

Advancements in technologies – cloud, API, Big Data and artificial intelligence – will be critical to the development of a payments infrastructure that can seamlessly adapt within the emerging collaborative payments ecosystem.

Although somewhat new to the payments party, BigTechs have a history of developing profitable platform and network businesses that leverage and build upon new technologies. Now, they are applying their infrastructure expertise to payments.[2]

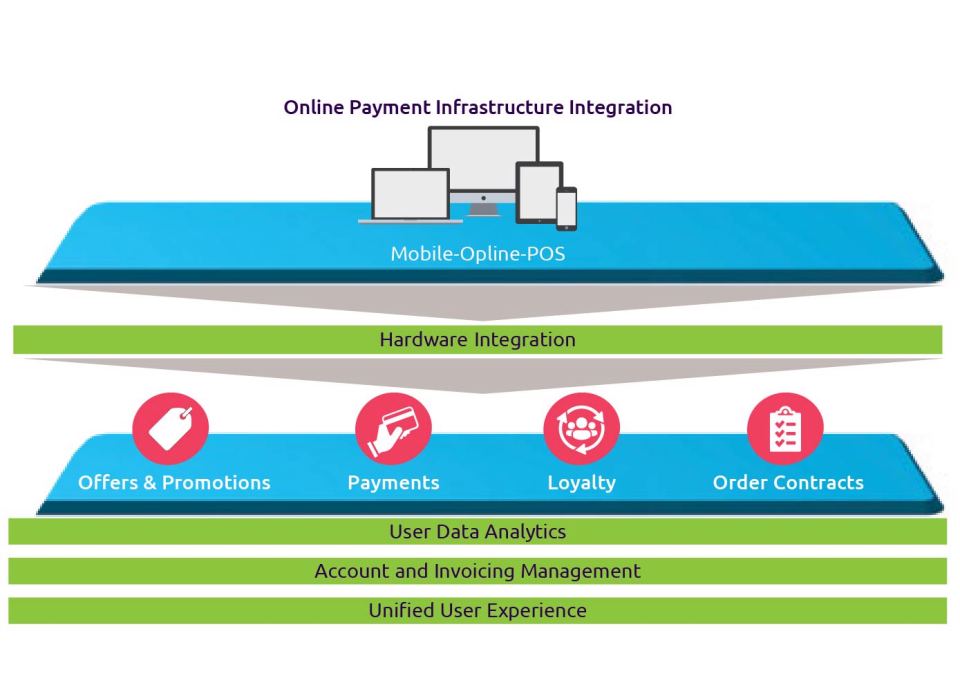

Online payments infrastructure integration

Source: Capgemini Financial Services Analysis 2018.

BigTechs offer enhanced user experience through an integrated platform that encompasses a broad array of services – a successful recipe that aligns with the future-proofing goals of payments leaders.

- An intuitive, digital design that makes service access easy for clients

- An invisible, cloud-based infrastructure enables scalability and global 24/7 real-time services

- Massive use of customer data to analyze client behavior, predict customer expectations, and prevent fraud

- Agile processes that leverage robots and artificial intelligence

- API connectors to support ecosystems that are relevant to client data and can deliver collaborative value.

As payments incumbents, banks retain the lead when it comes to market share of transactions, client trust, and the number and variety of solutions. However, as reported in the World Payments Report 2017 from Capgemini and BNP Paribas, BigTechs successfully entered the market through skillful adoption of digital wallets and payment solutions for tomorrow’s use.

As banks move to platform economies within a regulator-supported open ecosystem, they can learn from BigTech best practices and then embrace those that best fit their business model.

For example, they might consider separating payments – and cards – from core banking, and moving them to an autonomous data-centric, event-based system managed in the cloud.

By 2021, 75% of enterprise point-of-sale vendors are expected to begin to significantly

re-architect their solutions to meet rising omnichannel and customer experience expectations.[3] Preparation should begin now to effectively redesign client services and interfaces to meet these impending changes.

Surely the place to begin is through collaboration with other banks and FinTech firms by sharing standards and implementing API connectivity.

As the role of traditional payment-processing intermediaries shrinks within the new payments ecosystem, consolidation, convergence, and collaboration will bolster future relevance and new business models. The ability and willingness to agilely change will be critical.

For more insights on how the payments industry is evolving, and what this means for you, please download a complimentary copy of the World Payments Report 2017 developed by Capgemini and BNP Paribas, at www.worldpaymentsreport.com

# # #

[1] Rationalization: The review and reduction, virtualization, or redistribution of technology, software, or infrastructure to ensure maximum operational capability and flexibility at lowest cost.

[2] The term BigTech refers to global tech giants such as Alibaba, Amazon, Apple, Facebook, Google, Rakuten, and Tencent

[3] Visa web site, “Innovations for a Cashless World,” December 2017, https://usa.visa.com/dam/VCOM/global/visa-everywhere/documents/visa-innovations-for-a-cashless-world-2017-report.pdf

Leave a Comment

You must be logged in to post a comment.