The Financial Case for an Enterprise Platform for Manufacturing Operations Management

Blog: Apriso Blog

The strategy to implement a Manufacturing Operations Management (MOM) solution is usually presented and justified as a route to operational excellence across an enterprise (and beyond to supply chain partners). As an enterprise solution, a MOM solution will typically have an IT architecture that comprises a common platform across the enterprise. This structure lets processes, definitions and data be readily shared, to enable greater operational agility, higher performance and better reporting and analysis. Combined, these benefits then lead to improved operational excellence and continuous process improvement. Better intelligence is gained, understood and distributed faster, to more decision-makers.

The strategy to implement a Manufacturing Operations Management (MOM) solution is usually presented and justified as a route to operational excellence across an enterprise (and beyond to supply chain partners). As an enterprise solution, a MOM solution will typically have an IT architecture that comprises a common platform across the enterprise. This structure lets processes, definitions and data be readily shared, to enable greater operational agility, higher performance and better reporting and analysis. Combined, these benefits then lead to improved operational excellence and continuous process improvement. Better intelligence is gained, understood and distributed faster, to more decision-makers.

There is nothing wrong in this thinking. These are strong, valid arguments from a production executive’s perspective. But what about the Chief Financial Officer (CFO) who will have to ultimately approve the expenditure and sign for it? Is there a clear financial case for deploying an enterprise Manufacturing Execution System, based on such issues as Return on Investment (ROI), operating margins, and capacity utilization?

The ROI Case

An enterprise MOM is generally easy to justify from an ROI perspective. It has a direct impact on global operational efficiency, such as to:

- Validate processes virtually to help ensure the right product is built

- Improve quality by building each product right-first-time

- Enforce paperless execution, to reduce waste and recalls

- Synchronize material flows, to reduce idle inventory

- Lower IT support and implementation costs, through a unified execution environment

- Reduce training costs with greater systems consistency across the enterprise

Based on what I have observed while working with manufacturing clients over the past couple of decades, a large manufacturer can reasonable see an improvement in operating margins of between 2% to 6%, and an investment payback in 6 to 24 months. Naturally, exact ROI numbers depend on many variables unique to each manufacturer, such as number of plants, complexity of production, and market forces. But results such as these are common: A major auto maker reduced inventory by 45%, saving $95 million. A medical supply company reduced inventory by 25-35% across 16 plants. A large aerospace manufacturer reduced Work in Process (WIP) and Days in Inventory (DII) planned by 24%.

Most importantly, these results can be achieved with relatively low risk. A MOM platform is by definition very scalable, so manufacturers can run pilot plants to shake out bugs, verify ROI, and build a deployment roadmap with confidence.

The Capacity Case

Another way to look at justifying an enterprise MOM solution is in terms of the capital investments made in production capacity, probably the largest fixed manufacturing cost. Improve plant capacity utilization, and you improve margins.

Capacity has two key dimensions: Volume and velocity. In other words, how much can you make, and how fast can you make it, within quality and compliance requirements?

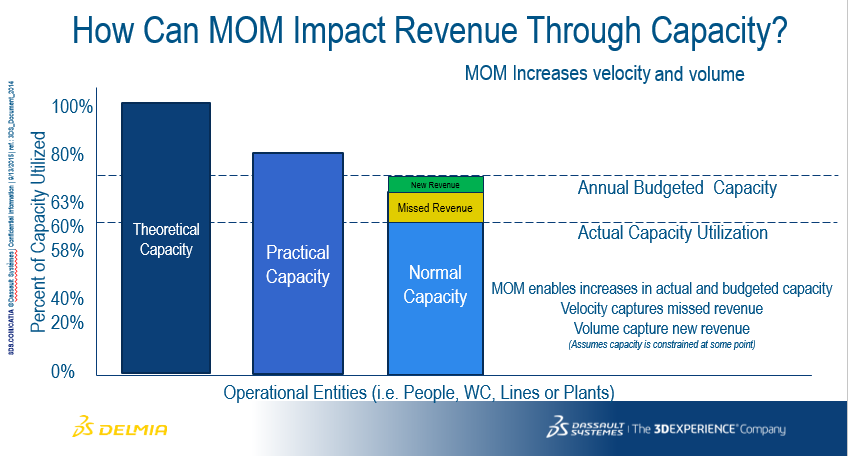

The chart above illustrates a simple representation of the capacity issue. Manufacturers have a theoretical capacity, which can never be achieved because no plant can be 100 percent efficient. Then there is the practical capacity—what can a plant reasonably do? The practical capacity of most plants is around 80 percent, although this can vary. This means manufacturers write off 20% of capacity as a planned loss. But, quite often 80 percent capacity is not actually achieved. A “Normal” capacity is what ultimately winds up in the budget. The gap between Normal and Practical capacity is recoverable with a MOM solution.

There are two ways to address this gap. Increase Velocity by making more product within existing capacity, shown as “Missed Revenue” above. Increase Volume by creating more capacity than previously existed, shown as “New Revenue” above. Combined, these performance improvements can help shrink the gap between Practical and Normal Capacity. Now we’re getting into scary numbers for a CFO. Effectively wasting 40 percent of any asset is a big cost, and a huge amount to ignore.

An enterprise MOM solution can move normal capacity much closer to the practical limit, both directly and indirectly. Direct impacts include improved scheduling for less idle time and increased velocity in faster ramp-ups and fewer production re-runs. Less direct impacts are also significant and include the ability to continuously improve and share best practices.

What to Do with New Extra Capacity?

Those, including the CFO who helps secure all this capacity, that implement a new MOM solution will experience a new problem: “What will I do with all the extra capacity I now have?” Some possibilities are:

- Expand sales efforts to drive new orders

- Accelerate delivery times to customers

- Allocate an extra ½ hour per shift for Continuous Improvement (CI) testing

- Schedule more training and other CI tasks

- Reduce undesirable overtime

- Insource and increase “verticalization” of processes

- Run preventive maintenance checks

Other Financial Benefits

There are many other financial arguments I haven’t even touched on. One is the ability to use improved capacity utilization to defer capital expenditures. You may be able to avoid opening a new plant or line just by better utilizing the ones you have. Clearly, this will have huge positive financial implications, such as improving RONA, ROI as well as asset utilization metrics.

Quality is another important financial issue. Build a product right, the first time, and your efficiency, customer satisfaction and employee morale will improve. This type of performance improvement is completely viable when implanting an enterprise MOM solution, as it will ensure the current production processes are current and executed appropriately, leading to fewer recalls and re-runs. Better tracking, faster velocity, and greater agility all contribute to exceeding customer expectations.

The bottom line is that the implementation of an enterprise, platform-based MOM solution offers manufacturers one of the best investment options to improve overall operational effectiveness and generate significant Return on Investment. In fact, the returns can be so big, quite often other IT implementations attempt to attribute these performance improvements to their deployment, rather than appropriately allocate the returns to the manufacturing operations solution. With such a rapid ROI with such (relatively) low risk, what’s not for a CFO to love?

If you liked this article, here are others you might also find interesting:

- Is Bigger Better? How to Get More ROI on Manufacturing Machinery

- Top 10 ROI Metrics to Justify an EAM/CMMS

- 5 Maintenance Tips to Extend Equipment Life and ROI

Leave a Comment

You must be logged in to post a comment.