Technology Empowers Financial Services

Blog: AuraQuantic Blog

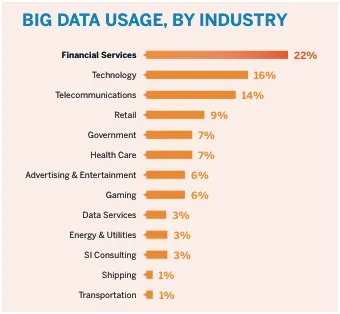

In today’s increasingly digital world, firms in the financial services sector look to Internet of Things, Big Data and Intelligent Analytics to seek, store, manage and analyze data for a greater insight to enable well founded decision-making, gain competitive advantage and improve customer satisfaction. In light of recent issues, such as the economic crisis, customer mistrust following the Payment Protection Insurance mis-selling and increasing regulation it’s not surprising that the financial services industry is the biggest user of Big Data.

2014 witnessed unprecedented growth across all things digital, and digitalization continues to soar. With 3.010 Billion active internet users, 2.077 billion active social accounts and 3.649 billion unique mobile users reported in Jan 2015, it’s easy to see why organizations are so interested in tapping into this source of information to seek a better understanding of their customers. Social media algorithms make it possible to understand user sentiment in real-time which is essential for an organizations’ continuous improvement.

In the primary sector, for example, Internet of Things allows agricultural businesses to accurately track their performance. Real-time data will allow banks to continuously assess the health of the farm’s crops and animals in order to accurately predict yields, property and business value in order to create personalized and accurate risk profiles and offer farmers tailor-made products.

Motor insurance customers can implement an IoT device in their cars to measure exactly how, when and where each insured vehicle is driven. This information determines the driver’s behavior and generates a risk profile which insurance companies can use to reward careful drivers and offer personalized insurance plans.

In Personal banking, the Internet of Things will capture data from all kinds of smart devices to provide customers with a real-time holistic view of their finances. Banks can use the information gathered on their customers’ day-to-day lives to anticipate their needs and offer advice, products and solutions to assist them to make financially sound decisions.

The Turkish Bank Garanti has launched its new ‘socially integrated’ banking service connected with social networks such as Facebook and Twitter which helps customers monitor their account activity and transfer funds more easily within their social circle. Indicators display customer’s spending patterns and alert on overspending.

Internet of Things and Big Data facilitate enterprise risk management to improve business banking. In-depth customer insight will enable banks to provide financial analysis, products and services to give business customers a competitive edge in today’s hyper-competitive market.

In addition to assisting the banks to provide innovative new services, the Internet of things and Intelligent Analytics also optimize processes within the banks and financial service companies. For example, a connected counterfeit note detection machine automates all tasks following the detection of counterfeits. Big Data can also detect fraud by analyzing data and alerting on deviations from standard patterns.

New Millennia Group PLC, which provides funding, credit insurance, payroll and administrative facilities to recruitment agencies in the UK, is an example of a financial services company that benefits from IoT. New Millennia uses connected facial recognition machines and identity scanners combined with AuraPortal Intelligent Business Process Management Suites (iBPMS) to optimize their processes and ensure regulatory compliance.

For optimal effectiveness Big Data analytics must be supported by the correct software suite. IBPMS turn the vast amount of data gathered from IoT devices and all other sources into “actionable information”, i.e an iBPMS makes sense of the data and helps the organization to use this data to create new customer engagement initiatives, provide meaningful business insight ,enable workers to make well-informed decisions, optimize and automate processes, etc. The Intelligent Analysis App in AuraPortal iBPMS, for example, helps decision-makers to visualize all reports in realtime.

To succeed in today’s customer-empowered economy, it is increasingly evident that banks and financial services organizations must leverage an iBPMS which incorporates Internet of Things, Big Data and Intelligent Analytics to help them deliver finely-tailored products, services and advice to suit the new generation of highly connected customers who demand real-time answers. Connected devices will deliver an unprecedented level of data and customer insight and analytics will enable the banks to innovate and transform to better anticipate and meet each customer’s needs and lifestyles.