Survey: How Fraud and Security Attitudes Differ by Age

Blog: Enterprise Decision Management Blog

We are all used to articles that make sweeping generalizations about age – millennials and avocados springs to mind! But it can be difficult to really understand how, or if you should be customizing online experience to different age group, and how you do that when you must also manage fraud and security.

Our survey of 2,000 US consumers uncovers how the age of customers affects what they think about fraud and security measures. We look at how much friction in the customer journey they will tolerate — and what they will do if fraud and security measures get in the way.

Here are a few things we’ve found:

When People Turn 18 They Quickly Open Online Accounts

When we look at online accounts for financial services, in general the older a customer the fewer accounts they have. People over 55 have an average of 2.4 each, while people age 25-34 have an average of 4.11. Interestingly, 18-24-year olds also say they have an average of 4 online financial accounts; given that they newly qualify for many such accounts at 18, it seems there is a pretty fast pick up of new financial products during very young adulthood, which then levels off.

Young People Don’t Tolerate Account Opening Disruption

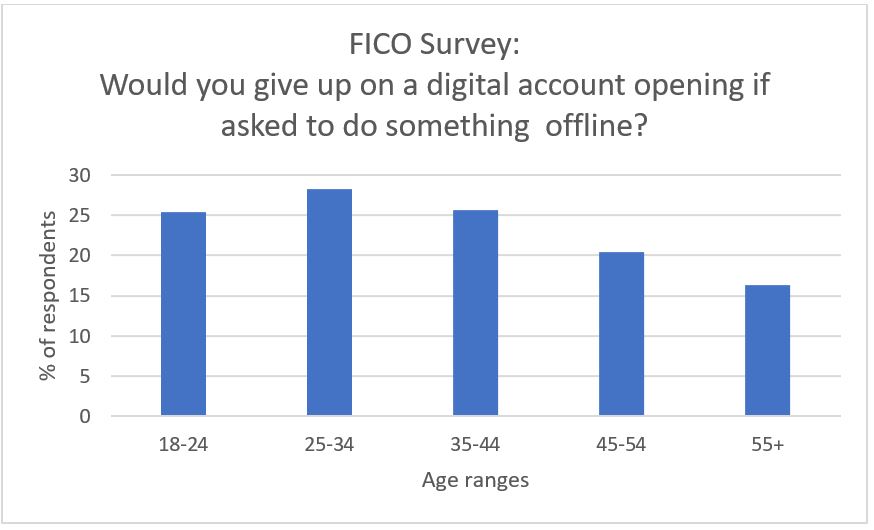

We wanted to find out how tolerant people are of having a digital account opening interrupted because of fraud and security issues. We asked what they would do if they were opening an account online and were asked to do something offline, for example post some documents, take a phone call or visit a branch.

The least tolerant age group were the 25 -34-year olds — over 28% would abandon an account opening. After 35, tolerance gradually increases; only 16% of the over 55s would give up.

If the target customer for your products is between 25-34, you could be losing significant business. And as these are young adults of an age where it is likely they are establishing careers and homes, this is an important age group when you are looking to build a loyal and profitable customer base.

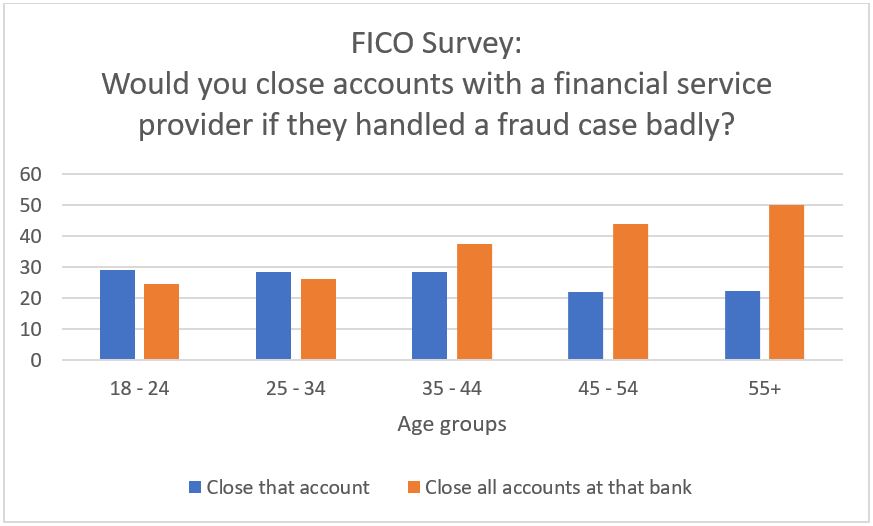

Older People Are More Likely to Close Accounts After Poor Fraud Case Management

When fraud happens, all age groups have high expectations of their banks. The older your customers are, the more likely it is that they will close accounts with you if they feel an incidence of fraud was dealt with poorly.

Of the 18-24 year olds, 54% will close accounts, but for those over 55 it is 72%. It’s also significant that as people get older they are more likely to close not only the account where fraud has happened but also any other account they hold with that provider.

These are just some of the results of our consumer survey. We asked many more questions and also surveyed 2,000 people in the UK. Join our Tweet Chat to learn more.

Tweet Chat

October 30

4pm GMT, 9am PDT, 12pm EDT

#fraudtrends

The post Survey: How Fraud and Security Attitudes Differ by Age appeared first on FICO.

Leave a Comment

You must be logged in to post a comment.