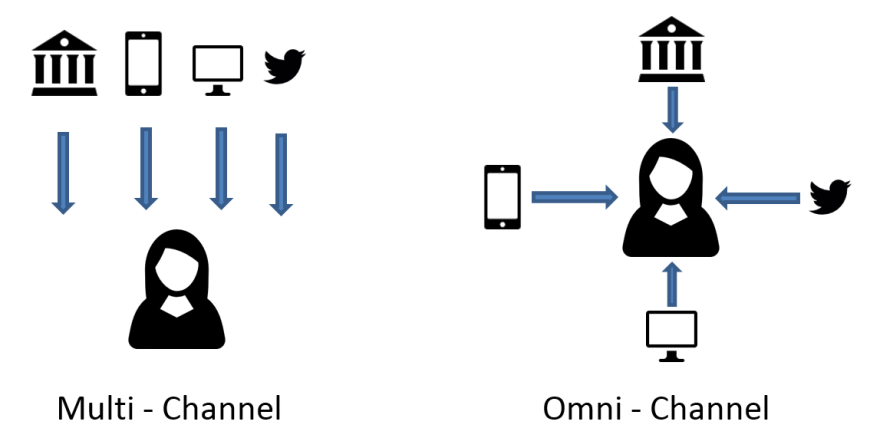

All banks are multi–channel. Even those “online only” offerings still have phone numbers for us to call in times of need. The trouble with most though, especially the longstanding incumbents with their legacy IT platforms and back office processes, is that channels often don’t work in the same way, have the same processes or communicate in any way with one another. You can’t finish something you started online in branch or start something online and have someone on the phone know what you’ve just been doing before you called, but you often can sort all your issues in 140 characters via Twitter. By definition, multi means more than two and omni means every. Therefore, whilst a business may provide numerous channels, they are not omni-channel unless there is interconnection between all touch points from the perspective of the customer.

The Financial Services Club Blog in 2014 suggested 73% of people would consider a financial services offering from Google, Apple, Amazon or Paypal over their own bank. Arguably, over and above their offerings being a bit prettier or more exciting, their ability to use omni-channel in all the right places and processes must contribute significantly to this. The question now is how do banks begin to challenge this — to go from being multi-channel, which was all the rage five years ago, towards omni-channel, creating a seamless experience for us demanding customers across whichever channel we desire at any one time?

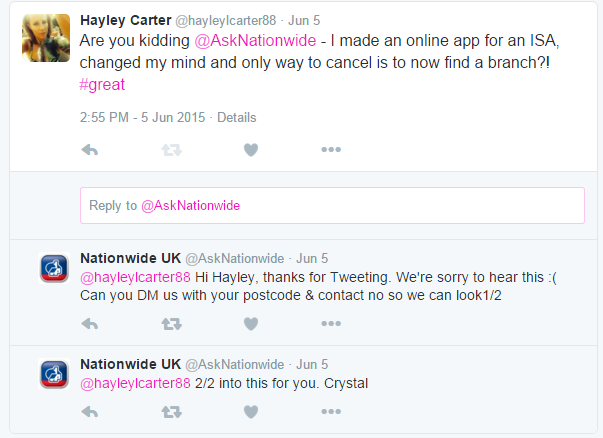

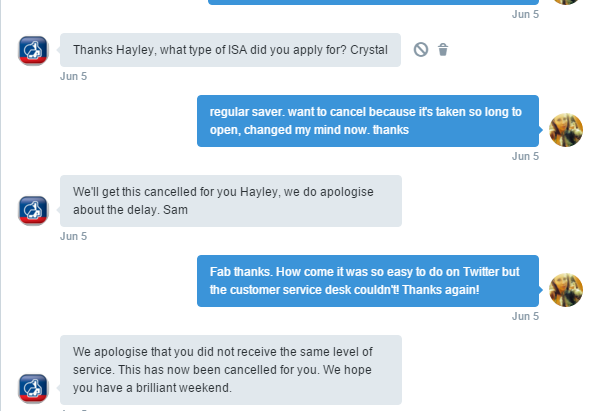

Recently, I decided to open a regular saver ISA, online, with a bank of which I had not previously been a customer. The online application process was short and straight forward and I was ultimately pleased with my decision to choose them. Three and a half weeks later however, with no open account and a bit of free time to look into some other alternatives, I changed my mind. With an application lost in the ether somewhere having sent it online, phone seemed like the obvious solution. As it transpired, sufficient security checks can’t be completed over the phone if no accounts exist for you as a customer and the telephony channel couldn’t even view an application that had been submitted online. The only way I could stop the application for a product I didn’t even have and no longer required was to go to the branch, apparently. Not being 100 percent convinced this was the case, I took to social media.

Problem resolved in less than 5 minutes. Whilst in this instance it would have been useful for the bank to have a perfect omni-channel set up, in reality, for processes such as closing accounts or cancelling requests, it isn’t strictly necessary. Omni-channel may be the phrase of the moment, but the necessity is more to understand which customer journeys are likely to cross multiple touch points and which journeys can be completed in a single channel, or in multiple different channels but rarely requiring cross over between them.

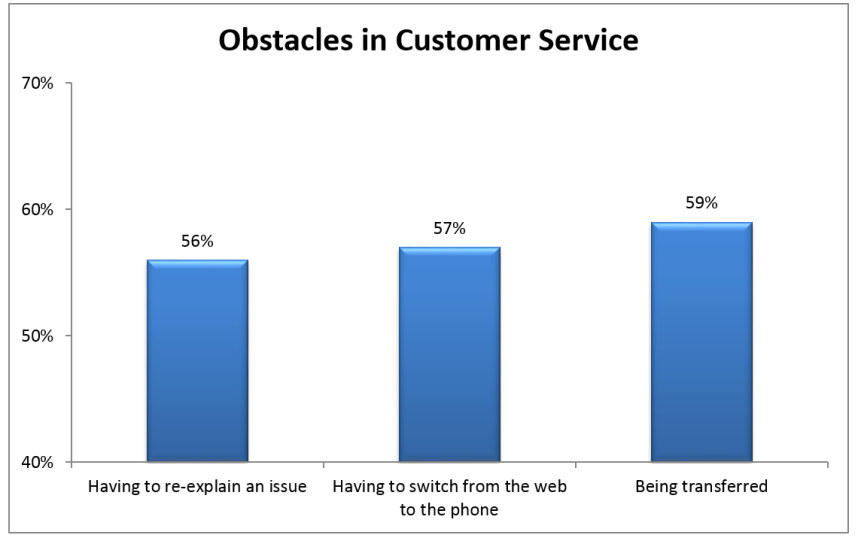

Product opening is a great example of a process that does demand much more necessity for an omni-channel experience; take my first mortgage application journey as an example. I started by browsing on my tablet at home, playing with the online tools and calculators to understand roughly what might be achievable. Next, I gave the bank a call to try and either gleam some advice from them over the phone, or book an appointment to speak to someone in the branch. Next stop was the branch itself, where I spoke to the advisor and basically got everything sorted. At each touch point however, it was like starting from scratch, giving all my personal details, how much I needed to borrow, which kind of property I was looking at etc.; this was one of the biggest issues reported by 56% of customers in a Harvard Business Review study five years ago, yet still appears to be a prevalent issue even now. Have we really made that little progress in half a decade?

Data from various divisions across the bank would’ve picked up everything I had done in each channel but the disconnect between them prevents that seamless customer experience. Research by the Aberdeen Group concluded that firms with a well-defined omni-channel customer experience management (CEM) program achieve a 91% higher year-over-year increase in customer retention rate on average, compared to organisations without omni-channel programs. It is this definition that it appears some financial services organisations still lack, with projects still siloed in each of the channels not really considering the “bigger picture” of the multiple touchpoint customer journey.

Analytics allow those working in online sales within banks to understand on which pages or at which parts of processes customers are dropping out, but this is not being used effectively to not only aid customers to have a more seamless experience, but also help colleagues picking these customers up in other channels. Surely it would be better for everyone if the branch staff could see what I was trying to do online before I turned up, therefore removing the emphasis on me as a customer to repeat my issue numerous times.

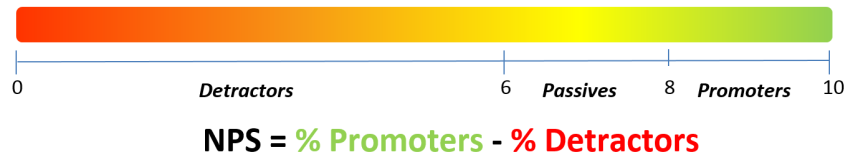

All banks capture and track customer satisfaction, NPS or something similar as a way to assess how happy customers are with a channel, generally using surveys to ask for a rating out of 10:

Equating customer satisfaction purely to a number out of 100 however, doesn’t provide the necessary depth of understanding to properly strategise for the future. Banks still need to understand things like Customer Effort across a whole process, look at all the customer touch points in a journey, understand how this can impact loyalty and ultimately value to the organisation to really begin to implement a roadmap towards the right omni-channel strategy.