Process mining in banks and financial services – what, why and how in 2024

Blog: Blog | ProcessMaker

Process mining is a popular method for businesses to gain insight into their processes by analyzing data on tasks, processes, and key workflows. It uses data from different IT systems and business applications, such as financial transactions, to create a visual representation of how key processes work and how they can be improved. Process mining focuses on transforming event logs into meaningful representations of processes, bridging data science and process science.

In this article, we show how process mining can be used in financial operations, and provide an example of how it can be used in banking to improve loan approvals processes.

What is process mining and process discovery?

Process mining is a data-driven approach for discovering and analyzing business processes. It looks for event logs in IT systems and uses this data much like a digital fingerprint to create a visual representation of each process and workflow. This allows businesses to gain insight into their operations and identify areas where they can improve efficiency.

Process mining techniques, such as process discovery, enable organizations to monitor and analyze their processes in real time, facilitating process optimization and enhancing customer satisfaction.

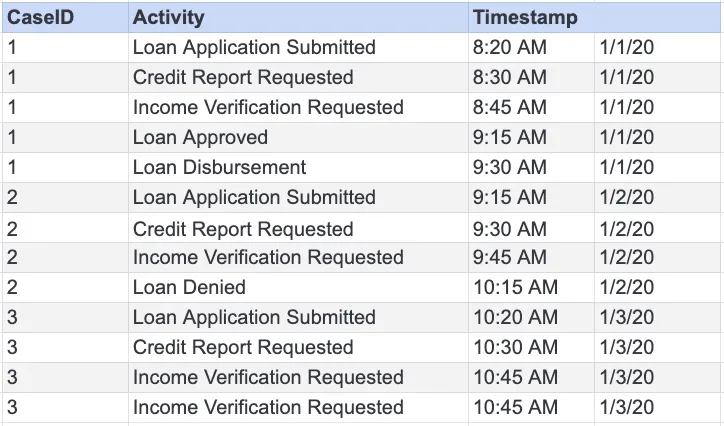

Simplified example of event logs in a mortgage loan data set

Process mining is not a new technology. It originates in the field of data science and can be simply thought of as the application of data mining techniques to business process management. Thanks to significant investments and technological advancements such as artificial intelligence (AI) we have seen a rapid expansion of different kinds of processes mining software companies.

How Process Mining Works

Process mining is a sophisticated technology that extracts digital traces from event log data to provide a comprehensive understanding of business processes. By transforming data from both human activities and software robots interacting with enterprise systems into an event log, process mining creates a detailed visual representation of end-to-end processes. This visualization, coupled with insightful analyses, offers the factual basis needed to understand, improve, and monitor how tasks are executed.

Utilizing AI-driven dashboards and advanced visualization techniques, process mining saves significant time on analysis. It connects directly to source systems, offering a continuous and real-time view of how business processes are carried out. This continuous monitoring helps identify bottlenecks, deviations, and inefficiencies that need to be addressed or automated. By providing a clear picture of the current state of processes, process mining enables organizations to make data-driven decisions to enhance efficiency and effectiveness.

How can process mining help banks and financial services companies?

Banking, financial services, and insurance (BFSI) are known for being highly complex business sectors where competitive advantage can come from achieving operational excellence in relatively repetitive but service-intensive processes. This makes them ideal candidates for process mining.

Process mining can be used to analyze any financial processes and identify areas for improvement and automation in a data-driven way. For example, an insurance firm can use process mining to improve the claims process, a mortgage lender can use process mining across the loan approvals process, or an institutional lender can use process mining to help with reporting and audit processes.

Key benefits of process mining in financial services

Process mining can help most financial services to improve efficiency and reduce costs to better serve the needs of their customers. Some key benefits for banks and financial institutions include:

- Discover and remove costly process bottlenecks.

- Automatically detect fraudulent transactions.

- Manage regulatory and compliance risk.

- Identify automation or standardization opportunities.

- Improve customer satisfaction and customer experience.

Process Mining Tools and Software

Process mining software is essential for organizations aiming to analyze and visualize their business processes based on data extracted from various sources, such as transaction logs or event data. This software identifies patterns, bottlenecks, and inefficiencies within a process, enabling organizations to enhance their operational efficiency, reduce costs, and improve customer experience.

Several process mining tools and software are available in the market, each offering unique features and capabilities. These tools offer comprehensive functionalities, from process discovery and conformance checking to performance analysis and predictive analytics, making them invaluable for any organization looking to optimize its business processes.

Case: improving mortgage loan approvals with process mining

Let’s look at an example of how process mining can be used to improve home loan approvals in consumer banking. By analyzing data from existing loan applications, a financial institution can identify areas where the process is slow or inefficient and make changes to streamline it.

Examples of mortgage loan processes that can be mined using event log data

- Loan origination – steps taken by a new borrower to apply for a loan and for processing the loan application.

- Loan processing – tasks preparing the loan application for underwriting.

- Loan underwriting – credit review, risk assessment, and verification of eligibility for loan.

- Loan closing – executing the mortgage loan application and contract.

- Loan servicing – managing the scheduling, notifications, and payments of loans.

For example, they may find that mortgage loan applications are taking too long to process, or that certain documents are being requested unnecessarily, leading to long average cycle times. For mortgage lenders, slowness in processing new loan applications can lead to higher fallout rates as customers may go for faster alternatives.

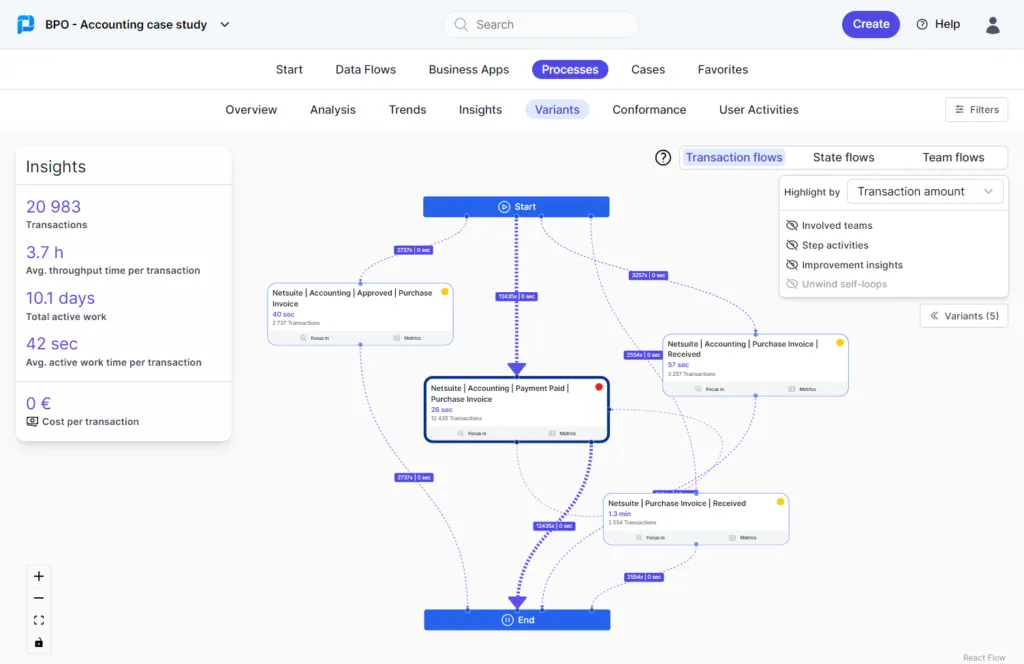

Example: purchases invoices process variants within Netsuite

By making changes such as automating certain parts of the workflow or removing unnecessary steps, the organization can speed up loan approvals, maximize pull-through rates, and improve customer service.

Automation and Process Mining

Process mining plays a crucial role in helping organizations automate their business processes by pinpointing areas where automation can significantly improve efficiency. By reducing manual errors and increasing productivity, automation becomes a powerful tool for business process improvement. Process mining provides strategic recommendations to eliminate inefficiencies and enhance overall business process performance.

Advanced process mining solutions enable organizations to build and prioritize automation pipelines or process optimization efforts. These solutions offer immediate insights into the potential impacts of proposed process changes or automation, allowing for informed decision-making. Furthermore, process mining continuously monitors and measures the results of automation efforts, ensuring that the desired improvements are achieved and sustained over time.

Compliance and Process Mining

Ensuring compliance with regulatory requirements is a critical concern for organizations, and process mining can be instrumental in this regard. By identifying deviations from regulatory standards, process mining provides conformance checks and root cause analysis, allowing organizations to compare their processes against established rules and regulations.

Process mining also helps organizations monitor and log process improvements over time, ensuring that their processes remain audit-ready. Compliance checking is an essential aspect of process mining, as it helps organizations mitigate the risk of non-compliance and avoid potential penalties. By leveraging process mining, organizations can ensure that their processes are not only efficient but also compliant with all relevant regulatory requirements.

Limitations of process mining in financial services for process improvement

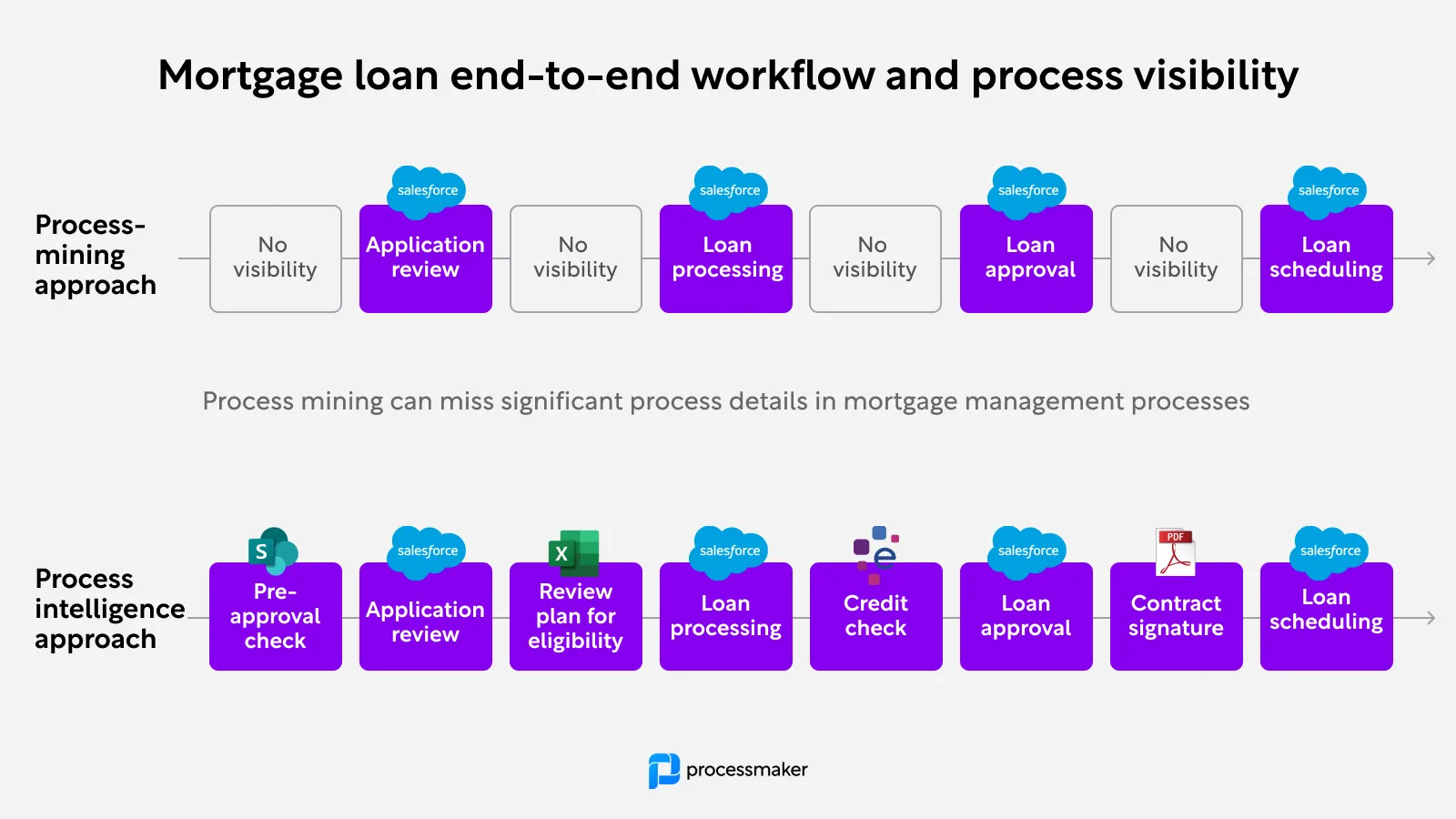

While conventional process mining has proven benefits to BFSI companies it has one major limitation. Many financial processes and workflows extend beyond the core ERP or CRM solutions. Think, for example, of the various business applications that are used to support case handling, such as Microsoft Excel for reporting, Adobe PDF for contracts, and various cloud-based credit risk databases. In most cases, process mining is limited to the availability of event logs and each business application needs to be integrated separately.

The key alternative to process mining is hybrid process intelligence software such as ProcessMaker. Hybrid process intelligence utilizes artificial intelligence to create generative event logs for all of your tasks and processes – providing you with a truly 360-degree view of financial processes. The key benefit of hybrid process intelligence is that you get to track all the tasks, workflows, and activities across all your business applications, and not just your ERP or CRM system event logs.

Conclusion

Process mining is a powerful data science technique that can help organizations in the finance industry gain insight into their processes and identify areas for improvement. It can be used to identify bottlenecks in processes such as loan approvals, uncover discrepancies between internal processes and external regulations, and detect fraudulent activities.

One alternative to process mining solutions is process intelligence software, which gives you a more detailed end-to-end view of your workflows and IT systems. By using process mining or process intelligence, organizations can streamline their processes and improve efficiency, ultimately leading to better customer service and higher profits.

The post Process mining in banks and financial services – what, why and how in 2024 appeared first on ProcessMaker.