Perfecting the Customer Experience in Financial Services

Blog: Bizagi Blog

Did you know that 61% of financial services firms feel that they neglect the implications of systems change when trying to build engaging customer experiences?

This statistic (taken from Bizagi’s research) is concerning, especially when considering the competitive pressures in customer experience that financial services firms face.

Today’s consumers compare their banking experiences not only to those delivered by rival banks, but also to other services offered by the world’s most disruptive companies, including consumer tech giants like google and global online retailers like Amazon.

If banks want to retain and attract customers, they have to find a way to keep pace with increasing customer expectations.

You Have to Focus on the Customer to Provide the Best Experience

Research from the Digital Banking Report, Improving the Customer Experience, found that only 37% of organizations have a formal CX plans in place. Yet good customer service is the most highly valued attribute at banks according to a survey by Forrester Research of more than 110,000 consumers.

Customer experience objectives at most financial services organizations focus on internal benefits, according to the Improving the Customer Experience report.

This includes selling and cost-cutting, rather than customer benefits like simplicity, ease, and responsiveness. This proves that they are not grasping the essence of customer experience: the way in which banks engage and interact with their customers. Or according to Forrester: “How customers perceive their interactions with your company.”

Banks need to enhance the customer journey so that every touchpoint with the customer delivers a valuable interaction. This means connecting information from back-end legacy systems and collaborating with front-end systems in a cohesive manner.

For more information on how to optimize your loan origination service, read our blog on how to enable faster, personalized, compliant and connected loan approvals.

According to Accenture research, nearly 70% of banks believe that their back office has not tapped all of the potential that lies within their current legacy systems.

However, Accenture comments in its 2018 report, Back Office, It’s Time to Meet the Customers, that releasing and optimizing this value will be dependent on organizations’ ability to use digital technologies and to create better front-line interfaces for improved customer journeys.

Adopting an agile approach to digital operations will allow banks to digitize and automate operations, which will in turn help to improve the customer journey. Australia-based bank ANZ is currently rolling out a scaled agile approach to its business.

“We need to break with some of the traditional 20th-century approaches to organizing and working, to ensure we are more responsive to 21st-century customer expectations,” said CEO Shayne Elliott.

“Moving to implement the agile approach at scale in our business is an important evolution in how we run ANZ which will allow us to respond much more quickly to customer needs, create higher staff engagement and make further improvements in efficiency.”

How to Bridge the Gaps with Digital Process Automation

The biggest challenge financial services face in customer experience efforts are with data analytics, technology and getting a complete customer view, according to The Financial Brand.

This is unsurprising when you consider the complex IT infrastructure of most banking and financial businesses. Their inflexible legacy systems are often a major hurdle when it comes to creating an automated and engaging customer experience (not to mention a nightmare for compliance and fraud prevention).

Indeed, Accenture found that complexity to the current state of their legacy environment was the greatest barrier to banks’ ability to drive digital transformation.

A digital business platform that enables digital process automation (DPA) can be transformational to an IT infrastructure, connecting rigid but reliable legacy systems to modern digital services. In the financial services industry, DPA solutions enable:

- Banks to accelerate transformation by leveraging platform technologies to rapidly add a layer of agility to legacy systems. Legacy systems can be wrapped with an agile, process-centric application layer that empowers employees and enhances customer experience.

- Banks to model and automate the processes needed to meet the requirements of regulation, in areas such as data privacy and reporting, underpinning compliance with regulation while also facilitating innovation.

- IT and business teams to effectively collaborate using the common language of process. Using digital business platforms enables banks’ IT and business teams to co-document, curate, and share processes – and to automate these processes.

DPA in action: Increasing long-term customer value

A FTSE 100 company with more than 16 million customers, Old Mutual is an international investment, savings, insurance and banking group, and the largest insurer in South Africa.

A FTSE 100 company with more than 16 million customers, Old Mutual is an international investment, savings, insurance and banking group, and the largest insurer in South Africa.

Its decision to invest in DPA was part of an organization-wide business transformation program to accelerate a step change towards a customer-centric operation.

Old Mutual wanted to achieve a 360-degree view of all customer interactions across all channels – a single view of the truth. Tight integration with back-office systems provides advisors with all the relevant information to make quality decisions, enabling customers to be served instantly.

Initially, the firm wanted to reduce customer waiting times across branches and enable sales advisers to provide consistent service and advice on the spot. Automated and streamlined customer engagement processes now manage customer authentication and present customers. Wide-ranging services include funds withdrawals, loan applications through to reporting identity theft or initiating claims.

Using DPA, Old Mutual has been able to leverage customer insight and data analytics, providing more relevant products and services to customers, and improving retention and revenues from cross-sales and leads.

Technology was simplified and processes incorporated into a common service layer. Integration with digital technologies enabled any communication to be delivered through the customers’ choice of media, such as email or SMS.

The result for Old Mutual was a reduced number of escalations to the back-office related to incorrect customer data. Experienced front-desk advisors were redeployed elsewhere as integrated digital process automation systems support intelligent decision-making. Consistent and improved customer experience was delivered across all channels.

Transform your operations with DPA

87% of financial services firms view digital transformation as a significant strategic challenge for their business. DPA not only help to address the complex process applications that IT are looking to drive forward as part of this transformation but also enables departments to communicate using the common language of process.

To find out more about how banks can leverage digital business platforms to achieve rapid product innovation, download our free whitepaper, ‘Harnessing Digital Process Automation to Drive Transformation: How Banks Can Leverage Digital Business Platforms to achieve rapid product innovation in a highly regulated market’.

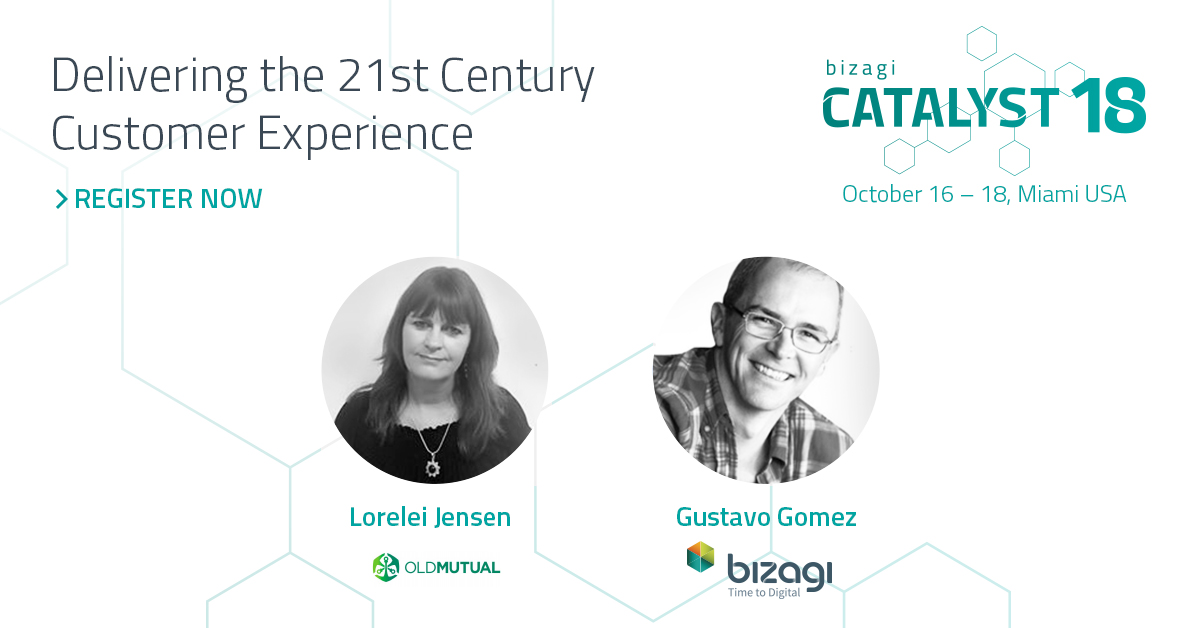

If you’d like to find out more about how Bizagi is helping businesses to accelerate their digital transformation initiatives, why not register for our global community conference on October 16-18, Bizagi Catalyst 18.

This event will bring together a range of inspirational speakers, leading industry analysts, successful business leaders and Bizagi experts. We’re especially excited to have the multi-talented Guy Kawasaki joining us. Click here to find out more about the exciting agenda and beautiful Miami venue.

The post Perfecting the Customer Experience in Financial Services appeared first on Bizagi Blog – Ideas for Delivering Digital Transformation.

Leave a Comment

You must be logged in to post a comment.