Millennials and Credit: Are We Missing the Real Story?

Blog: Enterprise Decision Management Blog

Our fascination with millennials and their like or dislike of credit continues to occupy its fair share of column inches – so much so that a while back I decided to take a look for myself. I shared results of that study in a prior blog post, where I revealed that millennial credit habits don’t look too different, at least directionally, from the rest of the population.

Here’s what I found: Compared with 10 years ago, today’s 18-24 year olds have lower credit and store card balances, and while they have more auto loans, the value of these loans did not grow as much as inflation would suggest. By contrast, growth in student loan debts outpaced inflation, being both greater in number as well as balances; this undoubtedly creates a drag on capacity for other forms of consumer credit.

Subsequently, I also looked at the 25-34 year age band, and the picture is much the same. The real value of balances between 2005 and 2016 are both down by about 19% when compared to the overall movement in the retail price index.

What was most telling, however, was that the credit picture for those over 35 years old looks remarkably similar, with minor expected differences (e.g., balances generally increase).

Taken overall, it isn’t an encouraging picture. While the economy has recovered from the great recession, lending still lags the “heyday” of 2005.

This got me thinking about what else might be going on. Is the millennial fascination just a cover story for a more pressing issue facing US credit grantors? And, indeed, that seems to be the case, based on our latest research.

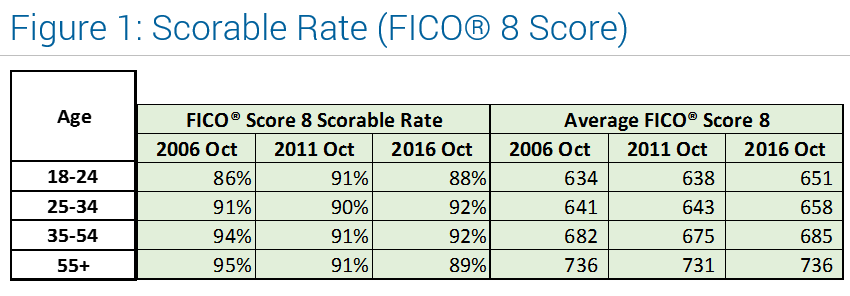

First, I looked at FICO® Score 8 scorable rates and average score by age group to see if either would explain today’s lending lag. As it turns out, the problem can’t be blamed on fewer consumers getting scored or on falling scores making acceptance harder. While scorable rates vary a bit over time, they haven’t changed in any fundamental way. With average score, we see an expected pattern where there’s been a drift upward in the younger age groups and relative stability elsewhere.

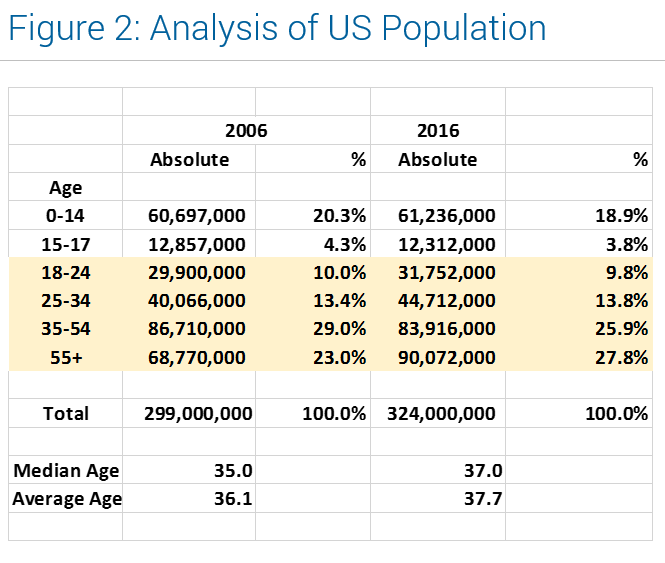

Since these stats only pertain to consumers with credit bureau files, I investigated further. The population stats in Figure 2 show that there’s actually a lower percent of US consumers in the 18-24 age band than there were 10 years ago. What’s most notable is the 3.8% jump in people over 55. This begs the question: “Who is actually applying for credit?”

Source: http://www.populationpyramid.net/

As I’ve mentioned before, a credit bureau report doesn’t clearly tell you who applies for credit and gets accepted in an easy-to-understand way. Given that FICO® Scores have stayed stable or increased, we can assume US consumers are generally as credit-qualified as before, and instead concentrate only on credit inquiries, which represents credit-seeking behavior.

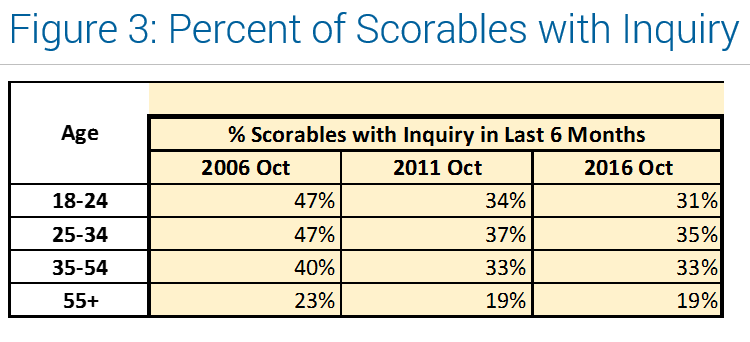

In Figure 3, what’s most notable is there’s been a general reduction in credit appetite (as measured by percent of inquiries) across all age bands over the last decade. As expected, across all time periods, we see a decrease in credit-seeking behavior as consumers age and have less need for new credit.

In my last blog post, I showed that balances for most types of credit are not growing in line with inflation. Therefore, the industry is being squeezed from both sides – that is, lower appetite for new credit and lower balances.

Simply multiplying out population stats and inquiry percentages reveals a 15% reduction in the number of inquiries in the six months prior to October 2016 relative to October 2006. While these numbers come from a single credit bureau, it’s likely the situation looks similar at the other bureaus.

Ultimately, millennials and their habits might make interesting reading, but for financial services, it misses the point. US credit appetite is down – a trend that may only get worse over time, as credit grantors face a ticking time bomb of an aging population. Absent a broader attitudinal change toward credit, there’s no easy solution on the horizon.

The post Millennials and Credit: Are We Missing the Real Story? appeared first on FICO.

Leave a Comment

You must be logged in to post a comment.