May Day, and a mayday for our world

Blog: Tom Graves / Tetradian

And yeah, this is where it gets seriously scary. Not just for me: for just about everyone.

I mentioned in the previous post that “I hate the money-economy”. It might be useful if I explained why?

—

Yes, this is May Day. Beltane, in the old pagan calendar. The day of the Lord of Misrule. The day of revolutions and all that.

Okay, I’ll admit there’s an element of that in what I’ll say here. My Quaker-style somewhat-anarchist approach does show through at times.

But much more, though, it’s about the other version of May Day. As mayday!, m’aidez!, and how we recognise and respond to such calls for help.

Because the real point here is that there’s a huge mayday! going on, with all kinds of warning-klaxons sounding all around us – and yet no-one seems to be noticing.

Which is kinda worrying.

Especially when it’s the ship we’re standing on that’s sounding the alarm. Oops…

Mayday!

—

What follows might kinda panic a few folks, so I’d best put up this sign to start with:

…because what follows isn’t about politics. It’s about raw facts. The politics comes later. But that politics ain’t goin’ nowhere – or nowhere useful / survivable – unless we stop pretending that a whole bunch of very real, painfully-unavoidable facts are other than indeed facts, and that we can’t continue to ignore them for much longer if we’ve to have any chance of getting out of this mess.

Arguing about who gets to sit in one deckchair on the Titanic ain’t exactly much help for navigating our way around a whole shoal of icebergs – but that’s about all that’s happening in global politics right now…

(And yes, that’s an actual deckchair from the actual Titanic. Fished up from the flotsam a few days later. We’ll be lucky if there’s even that much left of us if we carry on much longer, globally, with the way we are right now.)

—

Where this starts is a straightforward bit of whole-enterprise architecture. I’m working on a slidedeck for an upcoming IASA conference. What I want to focus on for there is a simple seven-point checklist for architecture-work:

- purpose and story – do we have clarity about what the aims are for this, and how we’re describing those aims? (use vision/values-mapping techniques and suchlike for this)

- scope – do we have clarity on scope and stakeholders? (typically use the holomap to explore at least three layers further outward from the nominal context)

- scale and scaling – do we have clarity on the applicable scale(s), and how we manage increasing and/or decreasing scale? (test at extremes of very-small and very-large – for example, Agile methods may be great for prototypes, but often poor for large-scale)

- full-cycle governance – do we have clarity about how we’re going to guide not just initial change, but the entire life-cycle? (include commissioning / decommissioning, development and maintenance of required skillsets, and more)

- constraints – do we have clarity on all constraints that may apply in the context? (this applies especially to non-negotiable constraints, such as those from physics or limits to scaling)

- structural flaws – do we have clarity on inherent structural-flaws in the context that need to be resolved for ongoing viability? (take care not to replicate existing structural-flaws in future designs)

- resistance to change – do we have clarity on any resistance to the required change, the factors that drive that resistance, and how to resolve them? (include vested-interests in maintaining dysfunctionalities in any current system)

The purpose of a checklist is to remind us of concerns and options within the context that we would otherwise tend to forget.

A point that turns out to be rather important – scarily important, in fact – when we start to look at concerns that go all the way out to a global scope and scale…

Mayday!

—

Time and again I see architecture-folks and others failing to take much, if any, notice of any of those items – or, in particular, any of these three themes:

- non-negotiable constraints

- existing structural-flaws

- vested-interests – even where such resistance presents major risks of large-scope/large-scale failure

Let’s take a simple physics-based example. Imagine that we’re building an internet-based high-speed trading-system for global banking. It’s really easy to forget that there’s a non-negotiable constraint in this context: the speed of light.

What? Why the heck would that matter?

A lot, is the short answer. Admiral Grace Hopper once did a beautiful demonstration of this on a TV show: she pulled out a piece of string about a foot long, and said “That’s a nanosecond”. That’s the maximum distance that light can travel in a nanosecond – about thirty centimetres. So if you’re going to send a signal halfway around the world, then by definition it’s going to take an absolute minimum of about 3 milliseconds to get there, by the fastest possible route, assuming no delays at all. With the internet, you have no control over routing, so it could go via geostationary satellites – and for that route, the absolute minimum is more like 50 milliseconds.

Throw in a few propagation-delays, bits of processing-time and so on. At best we’re looking at somewhere like a non-negotiable constraint of 10-100 milliseconds.

Each way.

Every time.

Establish the connection. That’ll be 10-100 milliseconds.

Establish the protocol. That’s 10-100 milliseconds too.

Establish identities. That’s another 10-100 milliseconds.

Do crosschecks on identities. Another 10-100 milliseconds.

A few more like that, at 10-100 milliseconds each, and you might just be ready to do the core transaction.

And then roll back the whole thing, closing off each of the connections – each of those costing another 10-100 milliseconds each as well.

Kinda adds up quick.

Which hurts if you’re trying to run something really fast.

Hurts even if you’re trying to run something that’s a whole lot simpler, too. If you’re reading a web-page in Australia in a server from the US, it isn’t just the bit-rate that slows you down. What really slows you down is all those cumulative delays from all those darn links to secure-protocols and web-trackers and advertisers’-crap and Ajax-calls for fragments-within-fragments of web-pages that are all fighting against the non-negotiable constraints of physics. But web-designers don’t seem to think much about that. If at all. And then wonder why everything seems so s-l-o-o-o-w. Oops…

Mayday!

—

But let’s crank this up a notch or two.

Use the same checklist to look not just at the design of a single web-app, but an entire global economy. Because yes, the exact same principles do apply, even there. Particularly around non-negotiable constraints, structural-flaws, and vested-interests.

Our global-economy is what would technically be known as a ‘possession-economy‘. All of it is built around concepts of personal and/or collective/corporate ‘right’ to exclusive-possession – or, to quote the 18th century English jurist William Blackstone:

There is nothing which so generally strikes the imagination, and engages the affections of mankind, as the right of property; or that sole and despotic dominion which one man claims and exercises over the external things of the world, in total exclusion of the right of any other individual in the universe. And yet there are very few, that will give themselves the trouble to consider the original and foundation of this right.

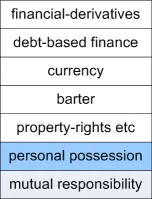

Everything else that we think of as ‘the economy’ then builds outward and upward from that ‘sole and despotic dominion’ of personal-possession.

The reality, though, is that that’s actually itself an overlay on top of a more ‘traditional’ and longer-lasting model known as a ‘responsibility-economy‘:

(That distinction gets kinda important, as we’ll see in a moment…)

Which is where we hit those constraints, flaws and vested-interests.

On non-negotiable constraints, here’s a doozie. A possession-economy naturally defaults to a pyramid-game (or, more accurately, a Ponzi-scheme of ‘winner-steals-all’, as we’ll see in a moment). The point here is that a pyramid-game can only be made to seem viable only as long as it continues to grow – but you can’t have infinite growth on a finite planet.

Yet once the ‘game’ stops growing, it cannibalises itself into oblivion, starting from the bottom. That’s why we have this whole obsession with ‘growth’ in the economy: it’s mandatory, because without it, the whole ‘game’ falls apart.

The reality, though, is that we started hitting up against absolute non-negotiable limits perhaps half a century ago. Resource-usage and a whole lot more. In the physical world, we’re now well into overshoot, worse and worse each year. Yep: ‘cannibalise into oblivion’ and all that. Oops…

In which case, how does the economy seem to keep on growing? Ah: there’s a neat little trick here, called ‘deregulation’. Back in the 1980s, the money-system was disconnected from anything physical – which means that yes, that now can keep on growing forever, to infinity.

(Just like Tulipmania and the like, all held together by belief and wishful-thinking. Oops…)

After all, money’s just a bunch of numbers – and there’s no limit to those, is there. BUT those imaginary numbers still supposedly assign ‘rights’ in the physical- world – because it’s money, right? So whoever controls the money can just keep on assigning themselves an ever larger and larger slice of what is, now, a steadily-shrinking pie (because of that little overshoot-problem). Ever wondered why inequality in ‘developed’ economies started growing steeply in the 1980s, and getting worse and worse ever since? Yep, that’s why. Oops…

What about structural-flaws? Well, at least two rather serious biggies: access to resources, and debt-based finance.

On access to resources, what I mean is that in a possession-economy, resources tend naturally to migrate to where they are least needed. Let’s illustrate this with the stereotype life-sequence:

- teenager at home: low income, low resource-needs

- first leaving home: low income, high resource-needs

- moving in with partner: higher income, low resource-needs

- children arrive: lower shared-income, higher resource-needs

- children at school: higher shared-income, (somewhat) lower resource-needs

- illness: lower shared-income, higher resource-needs

- children leave home: higher shared-income, lower resource-needs

- retirement: reducing shared-income, increasing resource-needs

In other words, what we think of as ‘normal’ is actually the worst system we could possibly devise: we’re most likely to have resources when we don’t need them, and least likely to have them when we most need them. The only way round this mess is to try to time-shift all those resources through a huge superstructure of banks, insurances, pensions, savings and the rest – which adds up to a huge overhead that arises only in a possession-economy. Oops…

(In a responsibility-based economy, by the way, we get rid of the entirety of that overhead with just one question: “What do you need?”)

Which brings us to debt-based finance, because in a money-based possession-economy, it’s one of the relatively-few permitted ways to do that time-shifting of resources. When you need resources, and you don’t have the income, you go to a bank or equivalent, and borrow the money. In other words, create a debt. Which you have to repay. At interest. On the bank’s terms. There’s a very good reason why the literal translation of ‘mortgage’ is ‘death-pledge’…

But wait a moment – where does the bank get the money from, to lend to you? Courtesy of deregulation, the short-answer is ‘nowhere’. The longer-answer is ‘from you‘. They lend you the money for your mortgage, and, over the period of the mortgage, you pay back typically three to five times what you borrowed. Which, as ‘indebtedness’, they can then use as collateral to lend to someone else – even though the money doesn’t ever actually ‘exist’. And they then use that invented-money to drag in the next sucker – and on, and on, and on. Do that to a few million suckers each year, as a bank, and you’ve just invented a vast pile of money and resources for yourself – from nothing at all, other than other people’s lives and work.

The catch for the lender in that kind of ‘game’, of course, is that it risks falling apart if people don’t or can’t pay the invented ‘money’. But that’s held at bay as long as the economy appears to be continuing to ‘grow’; and even if it does all fall apart, hey, you’ve got everyone’s money anyway, so you have all the ‘rights’ to a nice big slice of all those supposedly-shared resources. Debt is a ‘nice little earner’, yes? Nice for some, at any rate…

Which brings us to a third structural flaw that’s a little bit deeper, and that ultimately drives the whole mess:

- the physics definition of ‘power’ is ‘the ability to do work‘

- most social definitions of ‘power’ are ‘the ability to avoid work‘, or to entrap others into doing that work for us

Therein lie rather a lot of social problems – and the myth of ‘possession’ is one of them. Oops…

And here’s the real challenge: there is no way to make a possession-based economy sustainable. Courtesy of those non-negotiable constraints and structural-flaws, it cannot be done – and there is no way around that fact.

To be blunt about it, a possession-based economy is inherently incompatible with human survival. That particularly applies if we attempt to apply it over the longer term at a global scale – which, in essence, is what we’re still trying to do right now. Oops…

The alternative is a responsibility-based economy. It’s how all ‘traditional’ societies operate – those that have survived, anyway. We already know exactly how to do it at smaller scale, the scale of a village or a smaller town; we don’t yet how to make it work at larger-scale, the scale of a city or more. But we need to find out, and fast – because if we don’t manage to do it, and fast, at fully global scale, we’re dead. Oops…

But that, of course, is where we hit up against resistance to change. Lots of it. Particularly from the vested-interests of those who think they ‘win’ from the current mess. (In relative terms, yes, they might look like ‘winners’. But when ‘winning’ means living a little bit longer when nothing works any more and there’s no-one else left to entrap into tidying their mess, perhaps that kind of ‘winning’ is more like an even worse form of ‘losing’?)

So, in short, we have to find a way to defuse those vested-interests. Because if we don’t, then we’re all dead. Including the supposed ‘winners’. Oops…

Mayday!

—

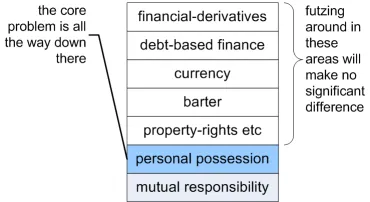

So how does this affect everyday enterprise-architects and the like? Well, the simplest way to illustrate it is with this little diagram:

Whatever we’re working on, it must somehow help to lead us towards dismantling this mess of a possession-based economy, as soon as we possibly can. Because if it doesn’t, we’re dead.

And the further away we get from tackling that deeper challenge, the worse it’s going to get.

So if you’re working right now on some fancy new form of fintech or whatever, the blunt fact is that in real terms it’s probable that all you’re doing is making things worse. For everyone. Including you.

If you’re helping a bank or whatever develop some shiny new way to leverage other people’s lives as debt, the blunt fact is that you’re probably making your own life less survivable. As well as everyone else’s.

If you’re futzing around with yet another form of so-called ‘alternative currency’, it’s not helping. If it doesn’t tackle the possession-problem, then by definition it will only make things worse.

Go back to barter? That doesn’t change anything – it just makes a bad system even more unworkable.

Playing with property-rights, ‘intellectual-property’, all those kinds of fancy games? It’s not gonna help – in fact it will only makes things worse.

Anything that supports the expansion of the possession-economy, in any way at all, is only driving us further and further, faster and faster, towards that non-survivable cliff.

Those are non-negotiable constraints: by definition, there is no way round them.

Those are the real facts here. Anything else is a delusion.

Mayday!

—

As architects of the human enterprise, we have one simple question, and one simple choice, everywhere, everywhen.

The question:

- Is what I’m doing right now helping towards dismantling the possession-economy, and replacing it with something real? – something grounded in interlocking mutual-responsibilities?

The choice, in every moment, every action:

- Push towards a responsibility-based economy, and help us all survive

or

- Push towards expansion of the existing possession-economy, and get us all killed

Kinda important choice, perhaps?

Your choice…