Machine Learning Improves CNP Fraud Detection Rates by 30%*

Blog: Enterprise Decision Management Blog

* And makes the customer experience better, too.

While adoption of the EMV payment standard in the US (as embodied in chip cards and panic at the checkout) has been slow, fraudsters’ gravitation to card not present (CNP) fraud has been anything but. Two and a half years after the liability shift from issuers to merchants (i.e., merchants who decide not to, or are unable to accept EMV cards), most consumers have “embraced the chip.” Correspondingly, fraudsters have ramped up their CNP fraud schemes.

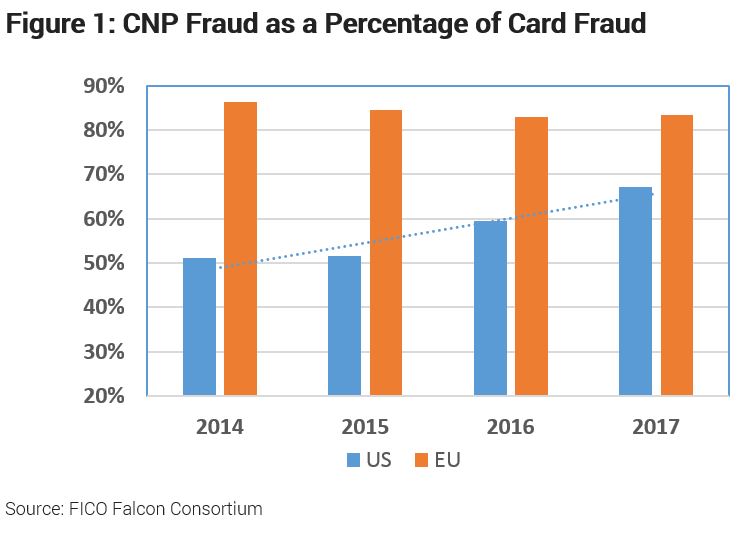

Figure 1 shows that CNP fraud comprised 67% of all fraudulent accounts in the US.

Figure 1 illustrates the growth in CNP fraud in both US and Europe. CNP fraud as a percentage of total card fraud increases significantly in 2016 and 2017 in the US after the EMV chip card migration (liability shift in late 2015). Europe, where the EMV cards were introduced about 10 years earlier than the US, has an even higher CNP fraud percentage – 80% of card fraud losses were CNP fraud. This suggests that the CNP fraud percentage may keep increasing in the US during the next few years.

The upshot: EMV effectively reduces card counterfeit fraud but does not address CNP fraud. Globally, CNP fraud includes transactions for which the cardholder does not physically present the card to the merchant. Instead, transactions are conducted digitally (mobile networks and internet), telephone and mail order. Most of these fraudulent transactions are facilitated by details obtained through skimming, hacking, email phishing campaigns, telephone solicitations or other methods.

Machine Learning Detects 30% More CNP Fraud

FICO continuously monitors all fraud trends globally. We’ve reacted to rising CNP fraud by constructing enhanced models in the FICO® Falcon® Fraud Management Platform. We use data from the Falcon® Fraud Consortium, which counts as members more than 9,000 financial institutions and card providers worldwide.

The changing landscape of CNP fraud has been observed in the Falcon Fraud Consortium data, and has helped us to build new machine learning- (ML) driven CNP models yielding a 30% lift in fraud value detection over previous approaches.

The major improvements afforded by the ML-enhanced approach fall into two categories:

- An increased emphasis on customer satisfaction

- Models that target the first significant CNP fraud transaction much more aggressively

Customer satisfaction is key

Although most EMV fraud liability has shifted from issuers to merchants, issuers want to ensure that all cardholders are protected from any fraudulent or abnormal card usage. Consumers expect their cards to be protected at all times, and issuers recognize that trust must be earned and maintained. As a result, many issuers are engaging consumers more quickly in dialogue triggered by suspect transactions, strengthening the bond between cardholder and issuer in the never-ending battle against fraudsters.

Identifying Fraudulent Transactions with Pinpoint Precision

Coupled with that bond, ML-driven models pinpoint specific transactions that card issuers want to validate with their customers. Past Falcon models determined whether the card was in a “state of fraud”; all transactions during the fraud episode were used to train the fraud models, allowing more certainty of fraud at the account level but often at the cost of several transactions that would occur before card activity was blocked.

FICO changed this methodology by training the machine learning models on the first significant CNP fraud transaction. This required much deeper behavioral pattern detection at the transaction level, to better differentiate legitimate and fraudulent consumer behaviors. The result is that FICO’s Falcon models detect fraud on accounts faster, significantly reducing the number of fraudulent transactions and associated dollar losses.

What’s Next for ML?

FICO’s new machine learning models are much more sensitive to abnormal single transactions, allowing CNP fraud to be detected quickly. Our new approach has the added benefit of uniting issuers and customers against fraudsters, as consumers confirm suspect transactions through text message exchanges, email and digital apps. The result is more fraud is stopped, customers are more satisfied, and fraudsters lose a major battle in an endless war.

Follow me on Twitter @ScottZoldi for the latest FICO news on machine learning, artificial intelligence and all manner of analytic innovation.

The post Machine Learning Improves CNP Fraud Detection Rates by 30%* appeared first on FICO.

Leave a Comment

You must be logged in to post a comment.