Loan Origination: How to Make it Fast, Personalized, Compliant and Connected

Blog: Bizagi Blog

Over 75% of customers only engage with banks online and branch footfall is declining 15% year-over-year, according to Lloyds Banking Group, proving that mobile and online banking is more imperative than ever. Speed and convenience are at the heart of this change, so in the case of facilitating loan approvals, time really is money. Customers expect an intuitive loan application process with real-time decisions for mortgages, personal loans and credit card origination. A smooth and efficient end-to-end loans process is a genuine competitive advantage.

But while the majority of lenders are now “talking digital”, not all are “acting digital” – and those who are actively digitizing their services struggle to integrate legacy systems to form a cohesive digital strategy. Whether provisioning consumer or business loans, the multiple touch points between the front and back office in the loan origination system make it particularly convoluted – all the more reason to automate the process.

Faster, Slicker Loan Approvals

Digitized customer experiences that have permeated all parts of our lives have resulted in consumers and businesses alike expecting a faster, slicker and easier digital interface when it comes to managing their finances.

As highlighted by Ceto and Associates, these heightened customer expectations have been driven by processes such as purchasing cars. When buying a vehicle from a dealership, consumers can receive a loan approval directly from the dealership within a very short window. Yet, if that consumer went to an independent financial services provider it would take 24 – 48 hours before they receive an answer. This is due to indirect lenders applying automation to their underwriting systems to ensure that they remain competitive and secure a deal with their customer.

The key question every loans business needs to answer is how they can approve loans faster, whilst ensuring against fraud and keeping errors to a minimum? There are moving parts to consider too, such as credit checking services, loans review managers, analysts and fraud detection teams. By automating the loan origination process, not only do the customers receive a better service, but the loan providers can approve more loans and generate more revenue. A win-win situation.

One FTSE 100 bank who approached Bizagi had 11 disconnected systems, preventing staff from obtaining a singular customer view which was slowing their loan approval process, not to mention the wet signatures that were needed for 95% of processes. But by automating processes and providing contextualization of customer information, staff could spend less time manually cross-checking information and were provided with an intuitive view of customer profiles containing all the relevant data they required.

Personalized and Contextualized Customer Experiences

In addition to speed, customers now also expect highly personalized experiences. This means providing contextual multi-touch services on both mobile and desktop that aren’t tied to paper-intensive onboarding processes.

An automated onboarding process that offers transparency will not only delight and impress customers, but it can also turn them into brand advocates who can recommend their swift, pain-free loan application experience to their friends and family.

Once the vital customer information is captured in the onboarding processes, financial service providers need to take responsibility to continually monitor customer feedback. This valuable insight can be used to enhance both the loan origination process and complement other offerings in their portfolio.

The FTSE 100 bank who used Bizagi to automate their loan origination system saw customer point of contact resolution improved by 30% thanks to the holistic overview they gained of their customers. These contributed to the bank being able to improve its net promoter score by an impressive 15% – demonstrating the power of a borrower-centric approach.

Meet Loan Regulation Obligations Head On

Whilst being borrower-centric is all well and good, the imperative of adhering to financial regulations cannot be ignored. Since the financial crisis, the loans market has seen tighter governance, so whether you are looking to meet Basel III or the latest Payment Services Directive, requirements to self-regulate the day-to-day operation have increased significantly.

Transparency is now the name of the game. “[Transparency] has become foundational to how the loan operation relates to regulators, borrows and other departments within the financial institution,” states Fiserv in its Loan Origination Automation report. “Transparency is not only being able to provide insight into origination processes and practices, but it also means being able to pass along transactional data to those who request it – when and how they request it.”

Automation allows you to achieve this transparency by establishing a single approach to loans regulation whilst permitting flexibility to adhere to local laws enabling you to derive cost and speed efficiencies. Flexibility is particularly important as legislation around financial services is always evolving and developing new directives to meet as it will save money in the long-run. What’s the point in building your loan origination system so rigidly that you cannot adapt to the changes that will inevitably come?

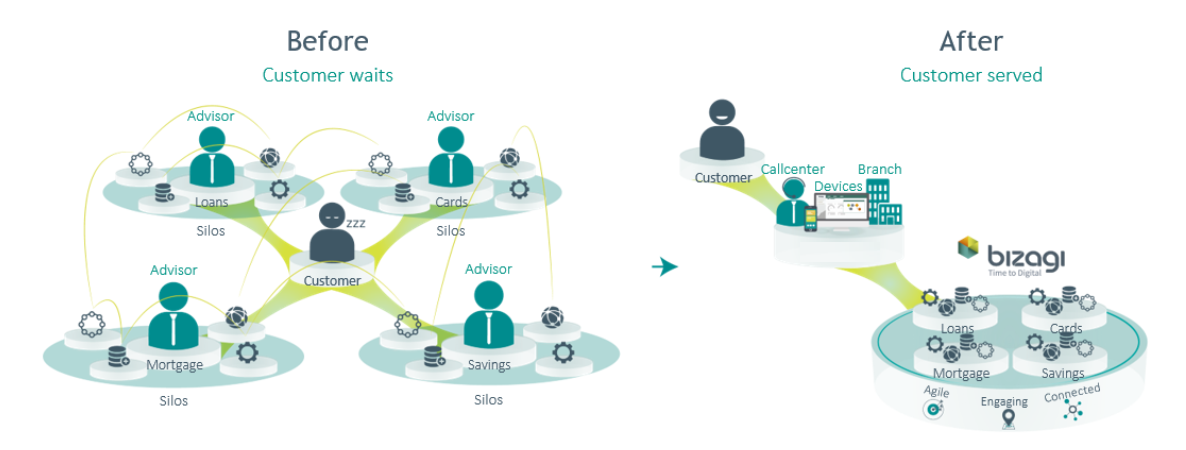

Untangling your Spaghetti System

The loan origination process has multiple touchpoints and with so many different business parts to approve, it can be difficult to streamline the approach. Financial services providers will often find that their products such as cards, mortgages, and loans are all siloed and run on different operating systems. This can lead to a “spaghetti effect” as the applications and databases communicate with the business processes and the front-end user interface because the digital process information is typically defined as ‘data-in’ and ‘data-out’ for each process, form or rule.

This can prevent scaling the platform and leads to poor transparency, both for the loan provider and the customer. By introducing an enterprise service layer or wraparound, financial services can gain a more holistic view of their operations and processes. The FTSE 100 bank who we worked with had 11 disconnected systems with no single view of the customer, which was leading to an unnecessarily long onboarding process as they were relying on individually coded variables to approve the customer data. But by using Bizagi to introduce Digital Process Automation through a simplified data model, they reduced their customer onboarding time ten-fold.

Many businesses struggle today with the complexity of their existing and legacy systems not integrating. Not to mention the organizational boundaries that prevent looking at the loans business end-to-end.

If you would like to see Bizagi improving the loan origination process in action for yourself, watch our Bizagi Mortgage Loan Demo on Brighttalk. Simply sign up for an account if you don’t already have one and watch it on the player below.

The post Loan Origination: How to Make it Fast, Personalized, Compliant and Connected appeared first on Bizagi Blog – Ideas for Delivering Digital Transformation.

Leave a Comment

You must be logged in to post a comment.