Key Takeaways from #TwitterChat on Fintech Opportunities in India during COVID-19

Blog: NASSCOM Official Blog

FinTech is one the most thriving sectors in India in terms of both business growth and employment generation. Indian Fintech market is one of the largest fintech markets globally and has a huge potential in near future. Unveiling the impact of Covid19, the opportunities and the untapped potential of this market is extremely crucial, especially in the current times.

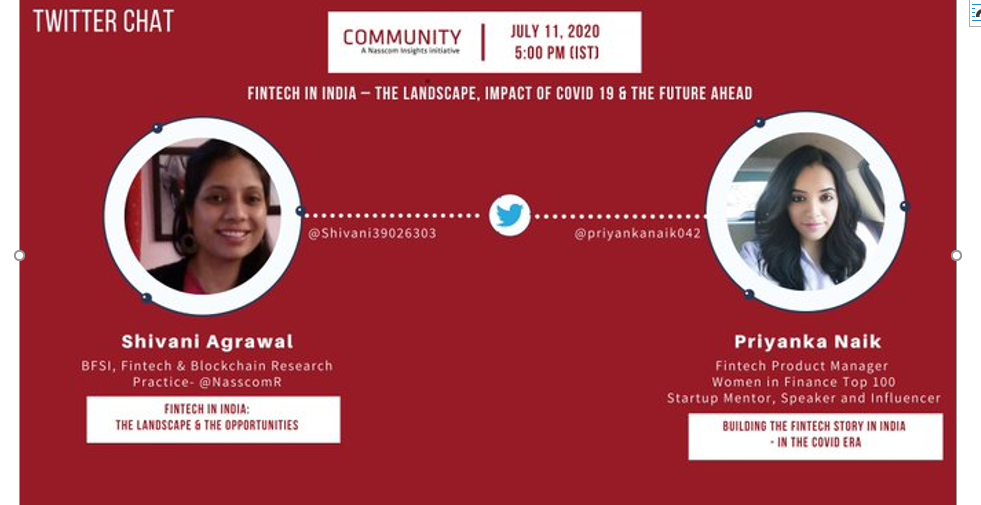

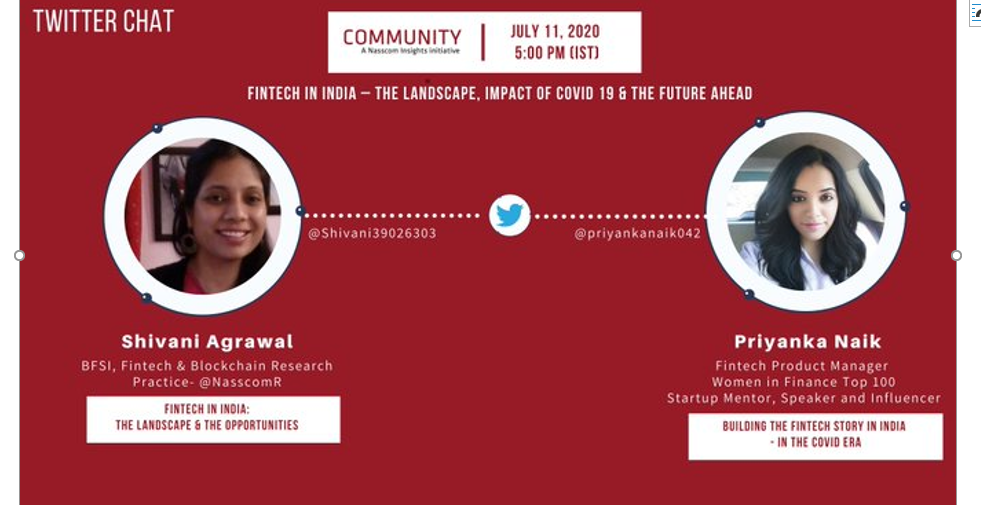

NASSCOM Insights in association with Ms. Priyanka Naik, Fintech Startup Mentor, Speaker, and Influencer, Women in Finance Top 100, hosted a Twitter Chat on 11th July 2020 on Fintech. The key topic of the Twitter Chat was Fintech In India – The Landscape, Impact of Covid 19 & The Future Ahead and the panelist onboard for this chat along with Ms. Priyanka Naik was Ms. Shivani Aggarwal, BFSI, Fintech & Blockchain Research Practice Lead at NASSCOM Insights.

7 Key takeaways from the Twitter Chat on Fintech In India – The Landscape, Impact of Covid 19 & The Future Ahead:

- Overall Impact of Covid-19 on Fintech in India

Covid19 has impacted discretionary spending of Indian consumers adversely and funding has become difficult for some fintechs in India, as investors are focused on established fintechs with clear business models. But there is a pinch of positivity for the Indian Fintechs amidst this crisis for all mist all fintech verticals:

- PayTech has seen a boom in India. Digital payments have seen a huge uptick with a ~42% rise in India post lockdown due to the fear of risk in cash transactions.

- Health Insurtech too has seen a huge rise of about 30% post lockdown in India.

- Similarly, demand for Wealthtech using robots, Lendtech & BankTech using emerging technologies and latest digital models has seen a huge surge during the current pandemic in India.

- Top Disruptive Technologies that can help FinTechs disrupt the Indian ecosystem in current times

Top disruptive technologies enabling fintechs crisis management solutions amidst the COVID19 pandemic in India are Artificial Intelligence, Blockchain, Cryptocurrency, Internet of Things, Augmented Reality, & Machine Learning

Fintech startups riding high on the use of these disruptive technologies will be the clear winners in the covid era. Some illustrative Fintechs in India in AI include – Active.Ai, Spixxi, in Blockchain -Ripple, BitPay, We. Trade, in VR – 4Experience

- Key Do’s and don’ts for Fintechs in India in the current pandemic

Do’s:

- Digitize your business

- Enable contactless payments

- Experiment with remote work

- Utilize talent from top colleges (many of them have their offers rescinded)

- Educate the lower income group and businesses to adopt fintech solutions

Don’ts:

- Exchange cash (can be a potential covid19 carrier)

- Burn money on frills (manage cash flows tightly)

- Compromise on company’s information security

- Be rigid (but adapt with changing times)

- Key characteristics of successful Fintechs post COVID era

The most successful Fintech startups of the Covid Era will –

- Re-pivot their businesses to stay relevant

- Diversify to add “need-of-the-hour” services like home delivery of groceries, essential items, etc.

- Localize their apps for more penetration in #tier2 and #tier3 cities

- Establish strategic partnerships

- Automate more of their services using AI / ML / DL / NLP

- Top 3 Tips & Strategies for Fintechs to Ride higher on the Landscape

- Create secure systems to protect businesses from risk

- Step up your game – go over & above customer expectations to gain loyalty

- Lastly – be agile, use technologies to your advantage, listen to your customers and remain competitive

- The Untapped Opportunity Areas for Indian Fintechs in the current times

The Key Untapped Opportunity areas for Indian Fintechs in the current pandemic hit times are:

- Digital payments, Regtech, Insurtech, Lendtech, BankTech – as Indians chose to digitize everything, they do due to the covid fear, more and more business opportunities will emerge for fintechs in India in these arenas

- Incumbents will design mobile-first banking solutions

- Digital Financial Services (DFS) will gain prominence

- IoT enabled payments will allow consumers to pay without handling cash

Payment Fintechs already dominate the Indian Market & were the most lucrative funding choices even till 2019. Payment FinTech startups raised 58% of total fintech funding in 2019, followed by InsurTech (13.7%) & Lendtech (10.8%).

This trend is expected to continue to see a surge even in the covid era in 2020 and beyond with top untapped opportunity areas still waiting to be explored by Paytech, Insurtech, & Lendtech fintechs in India, moreover crucial in the current crisis.

- Future projections of Growth of The Indian Fintech Market

The Indian Fintech market is expected to reach INR 6,207.41 billion by 2025, expanding at a CAGR of ~22.7% from 2020-2025. As discussed above too, rise of digital commerce, digital payments, digital financial innovations using AI, blockchain, IoT, etc. will be the key growth levers in India’s Fintech Market’s Growth Story in the near future

Login more to read through the full Twitter Chat with Shivani Aggarwal & Priyanka Naik at https://twitter.com/NasscomR/status/1281217830243807235

References:

NASSCOM Insights

The post Key Takeaways from #TwitterChat on Fintech Opportunities in India during COVID-19 appeared first on NASSCOM Community |The Official Community of Indian IT Industry.

Leave a Comment

You must be logged in to post a comment.