Is the Modern CFO Headed for Extinction?

Blog: Kofax - Smart Process automation

Live from 2017 SAP SAPPHIRE NOW & ASUG Annual Conference: Exploring the Impact of Digital Transformation on Finance

Could today’s CFO be headed the way of the dinosaurs? It probably won’t be that dramatic. But, the role of the CFO, and the role of finance organizations as a whole, are changing thanks to automation, innovation and emerging disruptive technologies that are altering the way we do business.

This has been a hot topic at the 2017 SAP SAPPHIRE NOW & ASUG Annual Conference. In the opening keynote on Tuesday, May 16, we heard Michael Dell, Chairman and CEO of Dell Technologies, explain to SAP CEO Bill McDermott how the emergence of intelligent technologies across all sectors and industries, combined with the abundance of data coming from hundreds of sources, are giving organizations a ton of opportunity to reimagine themselves. Where is the opportunistic explosion of data coming from? A lot of it comes from finance, opening doors to transform the back office into a true strategic business partner.

More Analytical, Less Transactional

During a presentation titled “Finance in a Digital World and the Impact on CFOs,” Jon Steele, Principal at Deloitte Consulting LLP, helped shine a light on the transformation of finance and what it means for today’s CFO. He discussed the speed at which new innovations are being introduced and the disruption this is causing in finance. The increasing importance of automation is leading to a concept Jon called “lights out finance.” Taken from the common supply chain and logistics term, as more and more financial processes happen without human intervention, finance professionals must be prepared to use their talents to do other things, moving away from transactional activities and taking on more analytical roles for the organization.

Additional industry trends Deloitte has seen include the increasing uncertainty of the macro-economic environment. And, something we have all known for some time: that back office functions (such as finance and HR) have been tasked with doing more with less, which has led to more outsourcing and the creation of shared service centers. All the while, the same demands to stay compliant with ever-changing regulations remain.

Finance also has access to more information than ever before. With new technology and more connected systems, data that was previously unavailable is coming to the surface. CFOs need to find ways to transform growing data volumes into strategic insight and in turn help their organizations enhance the customer experience and find new competitive advantages.

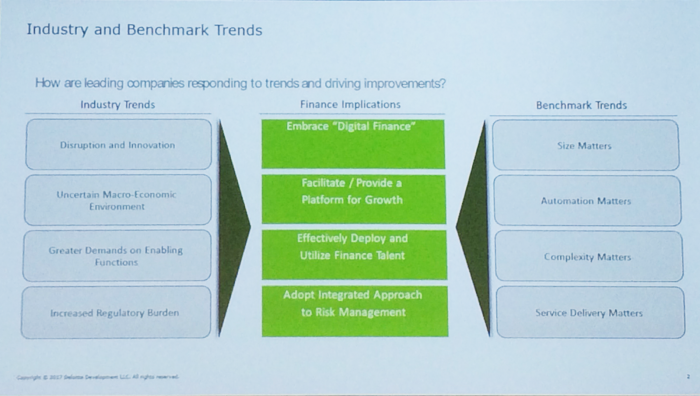

These trends mean CFOs are forced to embrace the idea of “digital finance” while providing a platform to grow their organization, finding new ways to utilize finance talent and also managing risk with a more integrated approach.

A slide from Jon Steele’s “Finance in a Digital World and the Impact on CFOs” presentation illustrating how industry trends are impacting finance and the CFO.

What are the technologies disrupting finance right now? According to Steele, they include the cloud, robotic process automation, visualization, advanced analytics, cognitive computing, in-memory computing and blockchain. While many organizations aren’t ready for the more aspirational cognitive, advanced analytics or blockchain technologies, the aforementioned solutions, such robotic process automation and the cloud, are currently being investigated or implemented.

Evolve or Become Extinct

A common theme resonating across conference sessions this week is the very real possibility that 5 years from now the CFO role will look completely different. Now is a pivotal moment where the CFO can help finance leverage automation and use the flood of information coming in from previously unconnected systems to become a strategic player that helps move their organization forward.

This isn’t a new concept. For example, Forbes featured an article last year on the role of the CFO taking on more IT responsibilities and the impact of newly available data for the organization. For CFOs who use SAP and are interested in learning more about technologies to automate financial processes, such as procure-to-pay, there are resources available like this technology guide. We’re not quite ready to put the CFO on the endangered species list yet. With the right information at their fingertips, CFOs can be prepared for what comes next.

Visit Kofax at SAP SAPPHIRE NOW & ASUG Annual Conference (booth 1026) to learn how SAP organizations are already leveraging disruptive technologies in their financial ecosystem.

Leave a Comment

You must be logged in to post a comment.