#InsurTech – 5 Trends that will Redefine the Industry in the Covid Era

Blog: NASSCOM Official Blog

Insurance has been a vital industry for the economic development of any country; however, it has seen a very low market penetration in India. The insurance penetration in India is 3.7% of the GDP while the world average is 6.31% (FY 2020)

However, Covid19 has brought a huge shift in this trend due to the awareness of the importance of insurance amidst the current pandemic.

According to a recent survey conducted by Swiss Re Group, a leading reinsurance provider, 39% and 63% Indians, respectively, now consider life and health insurance policies highly critical to have. This trend in India is only expected to rise shortly seeing the pandemic not going away too soon.

InsurTech is nothing but a smart combination of Insurance & Technology – paving the way for the deployment of technology innovations to offer innovative, optimized, swift, easy, and efficient insurance solutions to customers.

With the onset of the Covid19 pandemic in India, the significance of new-age InsurTech companies that can offer contactless, digital, innovative, insurance policies that provide security as well as threat coverage at flexible premium models to the Indian consumers, has gained huge impetus.

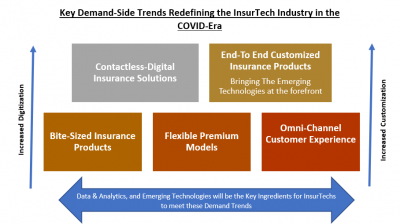

Let us look deeper into the key buy-side trends that will redefine the InsurTech Industry in the COVID-Era

Key Demand-Side Trends Redefining the InsurTech Industry in the COVID-Era:

- Contactless-Digital Insurance Solutions

Indian customers are increasingly looking for contactless, completely digitized, ‘zero-touch’ insurance solutions amidst the current pandemic. Digitization was already ticking the insurance industry even before the onset of this pandemic, but the demand for such solutions has risen manifolds in the last 3 months due to the virus’s fear.

From browsing, policies, policy distribution, customer onboarding, premium payments, to claims inspections, customers demand everything to be digitized and contactless.

Mobile-first InsurTech firms with multilingual chatbots that can eliminate the need for traditional policy agents and RMs can be a great success here.

- End-To-End Customized Insurance Products – Bringing Emerging Technologies at the forefront

Personalization will be the future of the Indian Insurance industry which hosts diverse consumers across regions, languages, religions, professions, ages, genders, etc.

InsurTech players that adopt a ‘segment of one’ model, where each customer is treated as an individual and his purchase intent is predicted using emerging technologies like AI, ML, Advanced data & analytics will be the leaders.

This analysis can be further used by the InsurTech players to offer end-to-end customized products to each individual, making a difference, and further building a relationship with the customer in these testing times which can be nourished for years to come.

Covid-19 has provided the opportunity to InsurTechs to showcase customized value-add benefits and bundled offers as the disease has driven greater levels of significance of policy coverage. InsurTech players should look to seize the opportunity.

- Demand for Bite-Sized Insurance Solutions

Bite-sized insurance solutions or ‘toffee insurance’ that can cater to varied types of health and non-health insurance needs of the Indian population of all age-groups (especially the millennials and the Gen-Z) is the need of the hour.

Mobile screen damage insurance, house roof insurance, malaria insurance, covid19 insurance, pet insurance, dengue insurance, and many more bite-sized insurance products that are not only pocket friendly but also cover the specific threat that the consumer wants to insure – are seeing huge demand, especially during the current pandemic.

InsurTech players that can deploy data and analytics proficiently to craft customer-friendly bite-sized solutions based on their preferences will be the clear winners.

- Demand for Flexible Premium Models

Insurance pricing and premium models can no more be a cost-plus model, especially in the current pandemic situation where customers and prospects are over vigilant about every penny they pay.

Innovative, and flexible premium models with increased value transparency is the need of the hour.

InsurTech Players are not only increasingly using emerging technology like big data, advanced analytics, to design customer-need based, usage-based premium models but also to estimate customer willingness to pay accurately and predict fraudulent customers and take necessary actions in time.

- Omni-Channel Customer Experience

While new-age are focusing on multiple channels and platforms to engage customers and prospects, it becomes important to ensure that the quality across channels and platforms is maintained at the optimum level.

Disjointed customer experience across channels can cause a drift in the customer’s mind and make him look for other players.

InsurTech players that deploy emerging technology to provide ease and connected experience to customers and prospects across channels and insurance processes will be the leaders in the COVID era and beyond.

Looking Ahead:

With the abrupt swing to remote-only interactions, traditional insurers can no longer afford to be slow in the speed of their digital transformations. Further, new-age InsurTechs in India like Acko, Mantra Labs, PolicyBazaar, and many more have already stepped up their businesses and are revolutionizing the insurance landscape in India.

However, innovation & understanding of the dynamic trends in the demand-side InsurTech industry is the key parameters for making the right moves to clinch a share in the insurance industry in India amidst the current pandemic situation.

Insurtech players should look to understand the same and accordingly craft their business & tech strategies.

Stay tuned to read more on InsurTech disruptions. You can also comment in the box below or can reach me here.

About the Author: Shivani is leading FinTech research initiatives at NASSCOM, having close to 12 years of experience in research and consulting in the areas of banking & financial services, FinTech, and related technologies. In her current role at NASSCOM, she is closely working with the industry leaders and other stakeholders in delivering strategic insights on digital transformation and articulating a roadmap in disruptive technologies for the Indian IT and the FinTech industry.

References:

https://www.investopedia.com/terms/i/insurtech.asp

https://insuranceblog.accenture.com/

BCG Research

McKinsey Research

PWC Research

Yourstory.com

NASSCOM Insights

The post #InsurTech – 5 Trends that will Redefine the Industry in the Covid Era appeared first on NASSCOM Community |The Official Community of Indian IT Industry.

Leave a Comment

You must be logged in to post a comment.