Insurance Digitization: What is it? How does Robotic Process Automation Play a Role?

Blog: UIPath.com

Insurance digitization has been getting a lot of attention lately. The 2014 Accenture Digital Innovation Survey led that firm to conclude,

-

“The survey data shows that the overwhelming majority of insurers believe that digital technologies are changing the fundamentals of the industry.”

Harry Goddard, Head of Technology at Deloitte, said at the European Insurance Forum,

-

“Digital technology is shaping the insurance sector in two ways. First, it will disrupt the traditional supply chain between the consumers and service providers. Second, the insurance industry is going to have to become “far more relevant to consumers so that consumers will seek insurance at a much earlier stage.”

A KMPG Insurance Industry report in September stated,

-

“The potent combination of data and digital is also driving increased innovation in the industry, leaving it ripe to undergo significant structural change in the coming decade.”

These dramatic pronouncements beg the questions: what exactly is digitization; how does it apply to the insurance industry; and how does robotic process automation (RPA) fit into this landscape?

What is Digitization?

Surprisingly – given the level of attention to this topic – answers to those questions aren’t easily found. In fact, in some instances terminology gets tortured to the point where it appears on the brink of a circular definition. For instance, a prominent third party advisory firm says this about the subject, “Digital technologies empower customers like never before…..To compete in the face of digital disruption…. you must enhance your digital customer experience while also driving agility and efficiency through digital operational excellence.”

For the purpose of this article, digitization is defined as:

-

A highly automated flow of structured data between online, enterprise and cloud applications;

-

Enabling transparent transactions and interactions between customers, third parties and employees; and,

-

Supporting real time reporting, analytics, and decision-making.

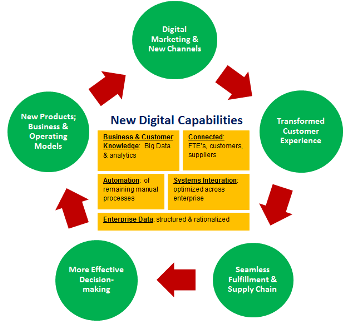

Many digitization articles focus on social networking, smart phone apps, online sales and customer experience. Perhaps this is because most readers can immediately relate personal experiences to these technologies. However, a great deal of digitization scope is within the enterprise and invisible to customers, suppliers and other third parties. This scope involves operational and business model changes which will result in cost savings and performance improvements which can deliver significant profitability and productivity benefits.

A limited approach to digitization will likely lead to two negative outcomes:

Benefits Shortfall: by only addressing distribution, inbound marketing and sales, a company will necessarily miss the full range of benefits from digital changes.

Lost Opportunities: while a company might choose a limited approach to digital change, competitors may not. Newcomers to the market, likely unencumbered by legacy environments and technology, may aggressively pursue a much wider digital strategy, seizing the initiative and making it difficult for the company to regain opportunities once well within its grasp.

A full digital strategy includes:

Connectivity: customers, employees, suppliers and all other significant third parties should be able to easily and transparently communicate as necessary. Objectives can be as obvious as employees accessing enterprise applications remotely or customers using mobile apps to order goods and services; or they can be less apparent – for example, an automated web services integration with a third party web portal – but equally valuable.

Automation: per the saying, “the speed of the fleet is that of the slowest ship”, any manual activity – compared to automation – brings three negatives to a process; lower performance, less accuracy and a hindrance during normal volumes and a chokepoint at peak demand. Further, non-automated activities are likely to contribute to black holes of unstructured data.

System Integration: just as some processes remain unautomated despite a company’s ERP and BPM systems, so too every company has inefficient or manual integration points with legacy applications and third party systems or web portals. Once these deficiencies are corrected, the company has the potential to meet customer, supplier or business user expectations.

Enterprise Data: the unfortunate reality is that mature companies typically have isolated silos of structured data and black holes of unstructured data. Keep in mind the original definition of digital was a data characteristic: isolated and excluded information means the company is running operations with some fraction of all the data it needs – the very antithesis of digital.

Business and Customer Knowledge: mining Big Data to gain highly specific business and customer knowledge is a foundational underpinning of any digital strategy. Bear in mind Big Data is an aggregate of enterprise data and monetized third party data. Assuming enterprise data is not compromised by silos and black holes, this aggregation will provide the company with a strong, unique, competitive edge over new competitors. Likewise with customer knowledge – aggregating that information with third party Big Data will provide the company with a powerful marketing and sales edge, making it easier to retain existing customers and run an efficient sales funnel.

Next Up

In the next blog we’ll look at how the specific characteristics and segments of the insurance industry lend themselves to digital technology and transformations.

Then we’ll examine how robotic process automation fits into the insurance digitization picture, how it’s currently being used in the industry and where it’s likely to be in 2016.

Leave a Comment

You must be logged in to post a comment.