Instant payments and regulatory push to spur infrastructure rationalization

Blog: Capgemini CTO Blog

According to the World Payments Report 2017, global payments will grow at an average of 10.9%, with emerging economies at 19.6%. This is estimated to amount to US$725.8 billion in revenue by 2020. There are multiple implications of this growth spurt, most notably the convergence in SEPA-driven Europe in terms of electronic and messaging payments instruments (ISO 20022).[1]

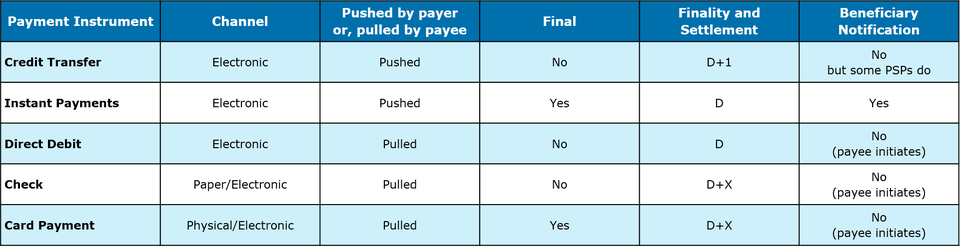

This converged payments landscape includes multiple instruments responding to different payment situations. They include a variety of traditional and modern with a mix of digital and paper as well as push and pull payment situations. Payments instruments are traditionally managed end-to-end from channels to clearing, which can create silos and challenge banks and payment service providers (PSPs) in their attempts to enable a channel-consistent customer experience.

The emergence of instant payments offers the opportunity for market infrastructure rationalization, which will help to simplify back-end processing and allow payment processors to focus resources on front-end activities that can enhance value offerings to clients.[2]

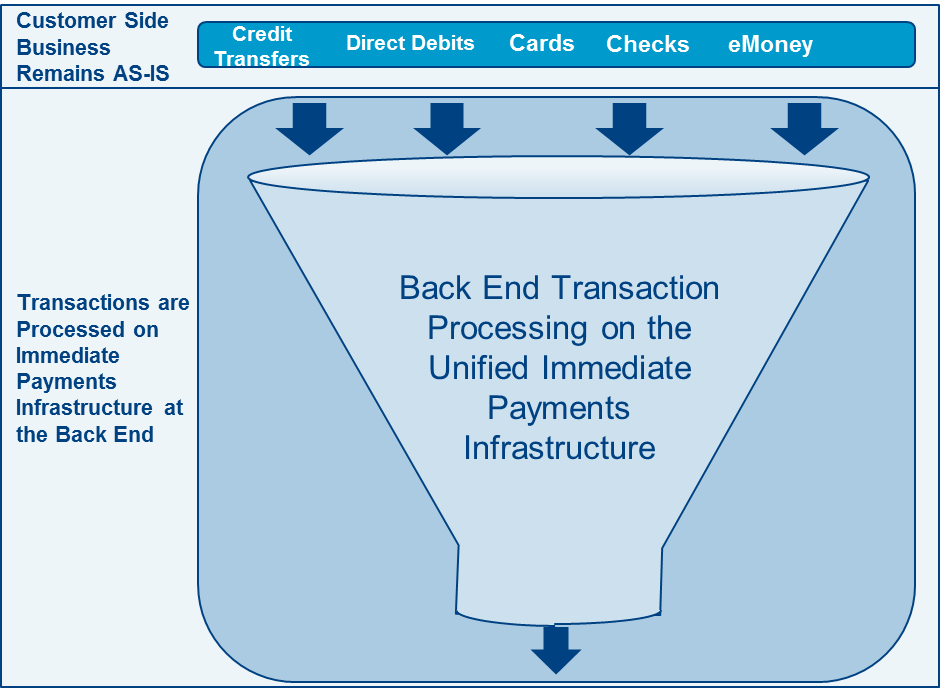

Convergence of payment mix and instruments can support existing instruments including credit transfers, direct debits, cards, and checks as IP-based offerings. Back-end infrastructure can be rationalized on internet protocol (IP) rails to process transactions, which offers a two-fold advantage for financial institutions and PSPs.

First, they can offer customers a seamless instrument or method transaction experience. And, second, resources can now be redirected to the back-end based on IP rails, so that cost savings are used to boost customer experience.

Convergence and Rationalization of Payments Instruments

Source: Capgemini Financial Services Analysis, 2018

There are multiple overlaps and redundancies of key functionalities across instruments. A check is a paper payment instruction forwarded by payees to payers’ bank. A card is a direct debit that is physically initiated, and so on.

Central authorities of many leading countries are taking up payments infrastructure rationalization initiatives.

For instance, Canada has introduced a roadmap of its modernization initiative and the development of a Canadian Payments Ecosystem. Targets include setting up Lynx, a core clearing and settlement mechanism (CSM) for large-value payments and settlement optimization engine (SOE) for retail batch transactions. The Canadian plan aims to implement real-time rails (RTR) to institute rail-agnostic domestic payments that offer simplified payments and a richer set of viable payment options.

Similarly, the UK’s New Payment System Operator (NPSO) is inviting billers to participate in its Request to Pay initiative, which will give firms and their customers more control, flexibility, and transparency in bill payments. Slated to launch in 2019, Request to Pay is expected to be a secure messaging service for payments – almost akin to email – overlaid on top of existing infrastructure.

Moreover, the United States’ Federal Reserve has formed a Faster Payments task force to oversee payments infrastructure modernization which is expected to go live in 2020. The new U.S. system will include an interoperable framework to enable all payments solutions to communicate with one another.

Payments infrastructure rationalization is becoming the need of the hour as it will help payment firms to scale up their operations, develop customer-centric solutions, offer customized payments solutions, and provide flexibility.

Ideally, rationalization initiatives in every country would be custom-designed based on local practices, payment and system preferences, and other local conditions. Local conditions include developments such as consolidation of the European member state, which dictate measures to be undertaken by specific regulators, such as checks decommissioning, convergence in processing, and decommissioning of instruments locally and centrally.

With an eye on the future, the banking industry should strategically assess the value and use of existing instruments and begin to take steps toward rationalization. Further, the banking community could act as a catalyst, along with regulators, to support infrastructure rationalization to reduce overall system costs that could shift to more overall economic benefits.

Before moving to infrastructure rationalization, consideration of instrument rationalization is critical. Steps might include:

- The decommissioning of checks in countries where they are still in use through adherence to a strict migration plan that offers a replacement proposition for users and a timeline for market education.

- Consideration of SEPA Credit Transfer (SCT) and SEPA Instant Credit Transfer (SCT Inst) coexistence. Identify any specific use cases for SCT that SCT Inst cannot address.

- Discussion around the convergence of cards processing with instant payments, over time. If not at the customer level, is it possible to achieve convergence at the acquiring stage, so that processing silos are reduced?

Finally, at an overall industry level, due diligence is necessary to identify the basic payment instruments that would sustain in the long run, in the push and pull segments covering all use cases.

As instant payments adoption proliferates and reaches critical mass, regulators, banks, and other market participants would be wise to proactively examine and assess ways to mitigate the unnecessary complexity of existing payments instruments and to reduce the number of instruments.

To learn more about how you can rationalize your payments infrastructure, connect with me through my profile or on social media.

# # #

[1] SEPA: Single Euro Payment Area is an EU-created payments system that harmonizes the way cashless payments transact between euro countries. The single euro payment area is approved and regulated by European Commission.

[2] Rationalization is the review and reduction, virtualization, or redistribution of technology, software, or infrastructure to ensure maximum operational capability and flexibility at lowest cost.

Leave a Comment

You must be logged in to post a comment.