Identifying Tax Fraud through Social Network Analysis

Blog: Enterprise Decision Management Blog

Social Network Analysis (SNA) tools hold the potential to help tax and revenue agencies identify non-compliance and tax fraud. These tools have been proven to be effective in fraud detection¹, but to date haven’t been utilized to any large degree at tax agencies. This blog describes what an SNA tool is, and how it can be utilized at a tax agency.

Social Networking Analysis Explained

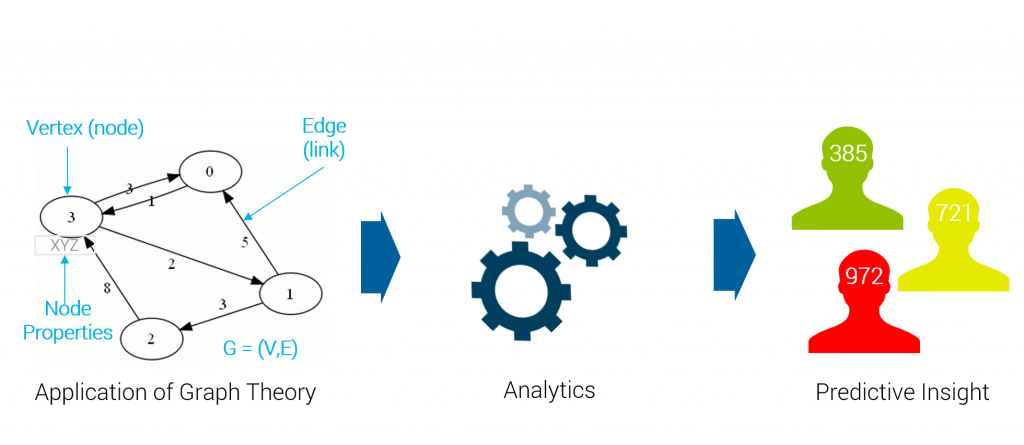

SNA is an analytic approach of correlating people, entities and relationships to determine how tightly an individual or business is related to others who have known compliance issues. These relationships can be from shared phone numbers, physical addresses, bank accounts, credit cards, or any other connection that is available through data capture. The results of the SNA can show the risk that a specific individual or business presents, based on their relationship with others who have known issues within the network. As can be seen below, using graph theory and analytics, we gain can valuable insights into specific members of the network.

Opportunities for Tax Agencies

There are many opportunities for tax and revenue agencies to take advantage of SNA tools, across registration, audit and collections business areas.

- Improper registrations. Tax agencies have always faced the problem where they close a business and the business re-opens (typically now owned by a relative of the original owner) at the same or a nearby location. In this case, a business may have been closed by the state or municipal government for non-payment of taxes. The owner tries to stay in business by opening a similar (or identical) business with a different legal name and a different legal owner (e.g., a spouse, parent or another relative). Because of the manual efforts that would be needed to detect the issue, the relationships will almost always go undetected. The challenge for the tax agency is the owner will have changed, and won’t be an exact match to the previous business.

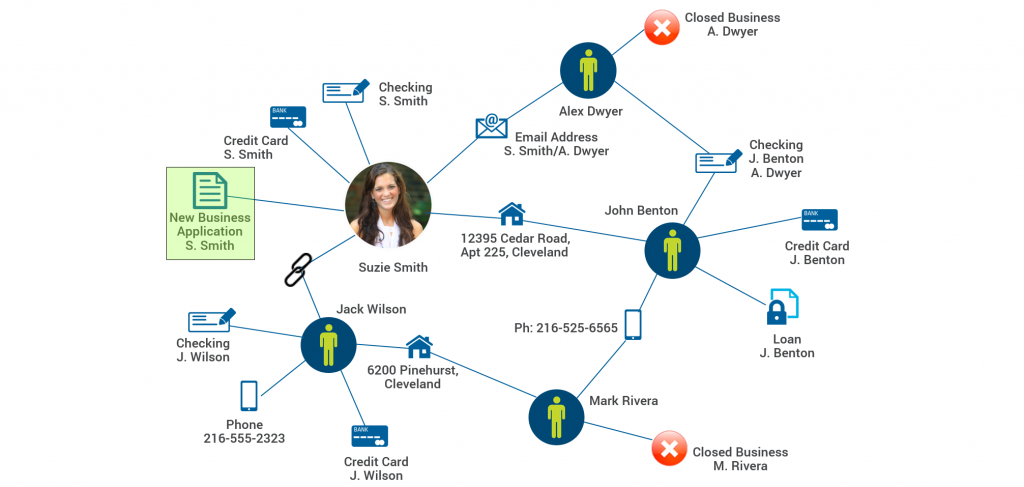

A Social Network Analysis can automatically compare the new registration in real-time to previously closed businesses. The SNA will create a risk score to show the proximity of the new business to ones previously closed by the department. In the example below, Suzie Smith has a direct relationship with one closed business and a second degree relationship with another closed business. This could trigger the state to deny the new registration or conduct additional investigations in a cost effective manner.

- Identify Fraud Rings. Once an instance of fraud is identified, the SNA can identify related businesses. This could include businesses with related addresses, bank accounts, phone numbers, email addresses, or other identifying characteristics. Through the use of an SNA investigative tool, a revenue agent can identify additional individuals and/or businesses that may be related to the same fraud ring, saving the investigator time and effort.

- Assisting with Locating a Delinquent Debtor. SNA’s are frequently used during the debt collection process to identify related individuals. Collectors have utilized manual tools along these lines for years, contacting next-door neighbors (for example) in an attempt to locate a debtor. This tool can greatly enhance and automate this effort, by finding people who share the same physical address, phone number, email, etc.

- Finding Successor Businesses. When a business ceases operation, the business can re-open in a new location or under new ownership. When the original business owes money, the government can in many cases pursue that debt if there is a successor business. Through the SNA tool, successor businesses can be quickly identified. Businesses and individuals can be identified that have relationships with the prior businesses, such as those sharing bank accounts, physical address(es), phone numbers or other identifying criteria. This can save the collector a significant amount of time for what otherwise would require significant manual research.

Gathering Data to Limit Tax Fraud and Compliance Issues

Tax agencies are data rich organizations, meaning they have a considerable amount of data at their fingertips (e.g., tax returns, business registration form, access to secretary of state records, etc.). While this provides a great picture of the taxpayer and related parties, this information can be supplemented with third party data (e.g., Accurint, CLEAR, Experian) to provide additional information about bank accounts, phone numbers, beyond that which is included with tax returns and registration forms. This supplemental information can help fill in and strengthen the SNA picture. These data sources can easily integrate with the SNA tool, and help the Government agency conducting the analysis.

Conclusion

Social Network Analysis presents significant new opportunities for tax agencies to reduce fraud and increase compliance. Tax agencies are data rich organizations, and analytics solutions like Social Network Analysis will allow them to identify more fraud and potential non-compliance situations well before a liability occurs. Currently these efforts can be cost prohibitive due to the manual workloads required, but with an automated SNA solution, a risk score can be automatically determined based on their proximity to other non-compliant individuals and businesses, and the tax agency can focus on the fewer higher-risk situations for compliance activities.

[1] Crime Data Mining: A General Framework and Some Examples, Professor Hsinchun Chen, et. al., https://hub.hku.hk/bitstream/10722/45461/1/91939.pdf

The post Identifying Tax Fraud through Social Network Analysis appeared first on FICO.

Leave a Comment

You must be logged in to post a comment.