How to Prepare Your Bank for Gen Z

Blog: ProcessMaker Blog

Generation Z is defined as people born between 1995 and 2015. Gen Z holds up to $143 billion in spending power, but they aren’t tied to a specific brand or product as they tend to not have brand loyalty like in previous generations. Their complete lack of experience in a pre-digital world is what sets Gen Z apart from Millennials.

Most Gen Z’ers haven’t even started using financial products other than a bank account. For banking providers, attracting these young customers represents an opportunity to capture lucrative lifelong relationships.

Understanding what makes Gen Z ticks is critical for financial services looking to cater to the younger demographic and build a suite of products, services, and tools that they’ll want to adopt. In this article, we’ll lay out the foundations to make your bank prepared for Gen Z.

How to prepare your bank for Gen Z

While most pundits like to group Gen Z and Millennials, Gen Z is turning out to be its own self and inheriting attitudes from older generations.

Banking Cafes

A recent CivicScience study on consumer’s uses of branches found that Gen Z is the heaviest user, often visiting branches several times a week. This rate is higher than Millennials and four times the rate of those older than 55. The study also finds that Gen Z is more apt to be daily users of their bank location due to the lack of zeroes they have in their bank account.

Due to their daily or weekly visits to their branches, Gen Z overwhelmingly favors the idea of branches that have cafes inside, hold events, and host other activities- for example, Capital One Cafe’s offer a hip new spin on branches of the past.

“Taking into account free food and community, perhaps a free cup of coffee and the opportunity to buy a croissant — assuming all else is equal — might be all it would take for a bank to gain a young customer for life,” CivicScience concludes.

Gen Z wants to be taught

Research indicates that Gen Z wants financial education online. Whether it be via podcasts, blogs, or videos, Gen Z wants to be informed about their finances. Where do you reach them? On YouTube. Gen Z spends 23 hours per week on video content. Gen Z uses YouTube (64%) which edges out Instagram (63%), which in turn edges out Facebook (61%).

By creating content based on their buyer persona and user journey, banks can easily gain a loyal customer.

Gen Z wants innovation

50 -80% of smartphone-owning Gen Z are already using mobile banking. Ensuring that your mobile banking platform is top-notch will require ongoing investment by banks to stay cutting edge.

As far as customer service goes, Gen Z still wants traditional options. When it comes to call centers, banks need to ensure they are offering top-notch customer service online but also use artificial intelligence. “Banks still need to ensure that their call centers are offering excellent customer service, but they also need to invest in Artificial Intelligence and other technologies that can seamlessly address customer questions and needs, without requiring a phone call, and without becoming a frustration point,” says Betsy Graseck, Morgan Stanley U.S. Large-Cap Bank Analyst and Global Head of Banks and Diversified Finance Research, “Mobile or digital chats with customer service representatives are critical for this generation which prefers texting to an intrusive phone call.”

Invest in a workflow solution

Since Gen Z is completely digitized, shouldn’t your bank’s workflows be too? By automating paper-intensive tasks, your branch can focus on nurturing Gen Z. A proper workflow software will integrate with legacy systems and:

- Automate formerly manual processes

- Streamline requests and approvals

- Centralize all banking documents and data into a platform

- Enhances bank-wide information sharing

- Supports digital-first access

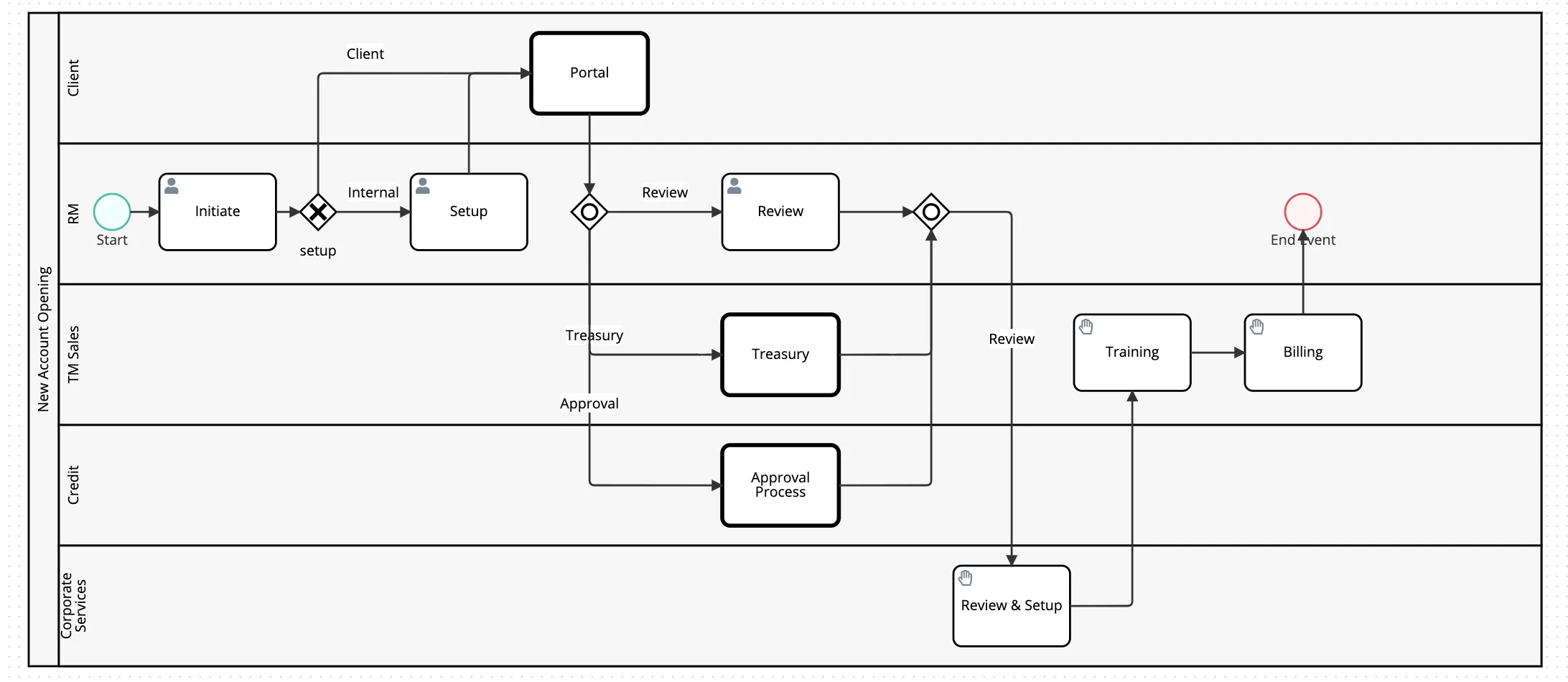

Below is an example of a banking workflow:

This will help branches give a consistent omni-channel customer experience and enhance outreach with real-time customer analytics, personalization, and retention.

Conclusion

As Gen Z brings a shift in customer behaviors and expectations, digital technologies in banking must follow suit. Banks that embrace and adapt to changing consumer behavior and digital technologies will thrive in the future digital environment. With the proper workflow software in place and by offering experiences that use interactive tools, personalized videos, and in-person events, banks can garner the attention of Gen Z.

The post How to Prepare Your Bank for Gen Z appeared first on ProcessMaker.