How to Create Your Banking Digital Transformation Strategy

Blog: Kofax - Smart Process automation

It’s a well-documented fact that most banks and financial organizations don’t yet have a digital transformation strategy. This is curious, given recent widespread media coverage about digital transformation in banking. Although many banks do not yet have a well-developed digital transformation strategy, recent banking trends now include incremental pockets of adoption of digital technologies, such as mobile and online banking applications, the emergence of digital payments, and the evaluation of potential technologies, such as Blockchain.

The need for a cohesive, bank-wide digital transformation strategy

Banks continue to evolve through mergers and acquisitions, but their disconnected, paper-based legacy systems are no longer meeting the demands of today’s digitally minded customers. The need for a cohesive, bank-wide, digital transformation strategy is apparent.

A cohesive strategy means making sure your bank does not initiate a myriad of one-off projects sponsored from the bottom up. A successful bank-wide strategy must be aligned with strategic bank objectives and other, higher-reward opportunities, from the top down.

Assuming that your bank has garnered the executive and organizational support needed for an enterprise-wide strategy like digital transformation, here are three keys to orchestrating a successful, bank-wide approach throughout the transformation.

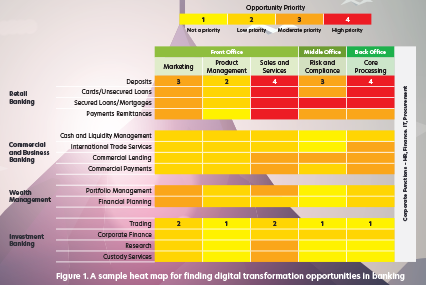

- Use a heat map to discover digital transformation opportunities

Teams within your organization can leverage a digital transformation heat map (as shown below) to reveal prioritized digitization opportunities for all banking segments and product lines. This includes the supporting functional areas from product management through sales and service and operations. Your teams can then rank the priority of each opportunity in its respective functional area – from a low priority to a high priority.

Each ranking should factor in an assessment of each opportunity’s alignment with your bank’s business objectives, process digital maturity, potential ROI, and digital and organization readiness. Ask yourself, “Do we have the appropriate resources and capabilities to address this opportunity?”

Using a heat map like this provides you with:

- A method to pursue a phased approach – given limited resources

- An executive-level view of priorities

- A structured method that ensures all facets of the bank and customer journey are evaluated

- Start with customer-facing processes and lines of business that impact your bottom line

The starting point for identifying and prioritizing opportunities depends on the degree to which your bank’s products and services are, or could be, digitized by your competitors. New technologies are changing the way customers engage with non-banking products and services. At the highest level, you should start by evaluating and digitally transforming, as required, the customer-facing processes and lines of business which are the primary contributors to your bottom line.

- Find additional opportunities for digitization within your organization

You can find other high impact, high priority opportunities in lines of business that are supported by large volumes of paper and/or large numbers of personnel who perform routine tasks such as data entry, data, and document verification, and redundant manual checks for compliance purposes.

Another place for initial consideration is an operations process riddled with a high number of exceptions, resulting in significant manual rework and-and/or customer impact through long cycle times and errors.

Now is the time – is your organization ready to take the next step?

Banks that have already invested in customer-facing technologies, such as mobile devices and online banking platforms are off to a good start on their journey to bank-wide digital transformation. A key component for any bank-wide digital transformation is organizational readiness. In fact, a recent study by MIT indicates 90% of employees surveyed believe digital technologies have the potential to fundamentally transform the way they work. Additionally, over 75% of respondents believe digital technologies and capabilities are “important” today, with the importance changing to “very important” in three years for 70% of respondents.1

Learn how to create your banks’ digital future including transforming customer engagement, mitigating risk, increasing efficiency and reducing costs by downloading the informative paper, Banking on a Digital Future – a Guide to Digital Transformation today.

1 MIT Sloan Review – “Strategy, Not Technology, Drives Digital Transformation

Leave a Comment

You must be logged in to post a comment.