How the Focus on NPL Is Changing Europe’s Debt Market

Blog: Enterprise Decision Management Blog

Are we making the progress we want to see — and regulators demand — on non-performing loans (NPL)?

That’s the topic I explored with banking leaders from across the Europe, Middle East and Africa at our EMEA Risk Leadership Summit in May. Taking a step back from all the activity going on in this space, it’s clear that major shifts are occurring, but there are some surprising gaps.

Why Focus on NPL?

High volumes of NPL can cause a significant drag on a bank’s performance in the form of

- reduction in net interest income

- Increase in impairments costs

- Additional capital requirement for high-risk-weighted assets

- Lower ratings and increased cost of funding, adversely affecting equity valuations

- Reduced appetite for new lending

- Additional management time and servicing costs to resolve the problem

Banks have put significant resources and effort into action in the last few years to deal with this. Some have set up separate dedicated in-house NPL units. Banks are identifying, categorising and provisioning NPL more rigorously, and working on standardising and improving work-out, legal enforcement and underwriting processes. They are also developing additional restructuring products to meet the needs of customers with NPL.

European banks have set NPL target rates and plans to achieve these. The biggest tool these banks will have to reduce their exposure to NPL will be to parcel them together and sell the portfolios, removing the loans from their balance sheets. Some of the banks with larger exposure are targeting a 60% reduction in their NPL stock in the coming years. Many banks in countries that have already under gone heavy restructuring are still in need of further reduction and have also set targets.

These efforts are having an effect, and the total NPL volume fell from its €1 trillion high in 2016, but still exceeds € 840 billion. The majority of these NPLs are corporate, but a significant proportion are consumer debt. Banks’ asset quality remains a major concern for the European banking system.

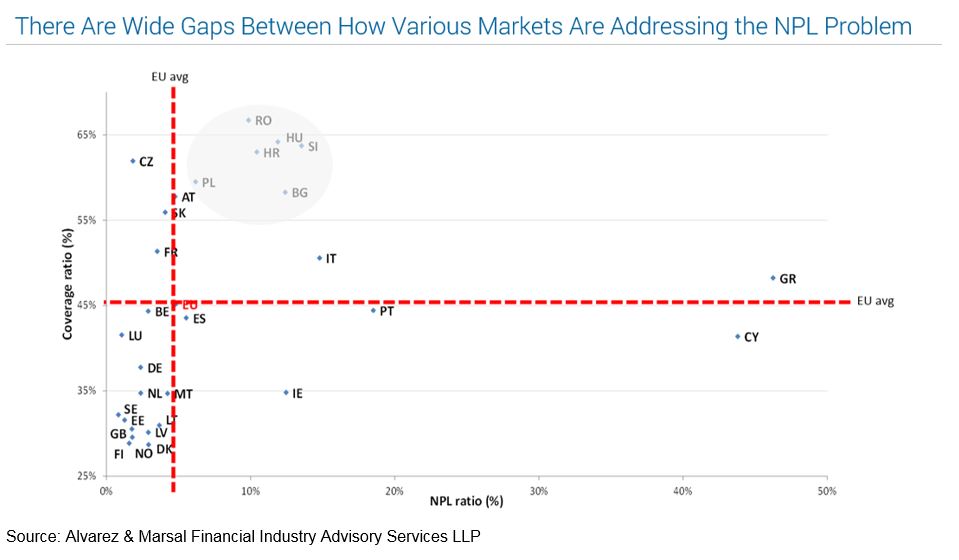

NPL Divides Europe

You can analyse the European landscape by dividing the countries into 3 blocks.

Block 1 — Countries with NPL ratios > 20%

This block, which includes Greece and Cyprus, has seen little movement in the past three years in average NPL ratios and coverage percentages. Systematic barriers are in place restricting progress, such as restrictions in Greece on loan book sales. The vast majority of future loan book sales is likely to come from this block. The Loan Servicing Platform, a framework in Greece comprising investors and 3rd party servicers overseeing the effective restructuring and management of NPLs for a large number of banks in Greece, is expected to have an impact.

Block 2 — Countries above the EU average NPL rate (5%) but below 20%

This block, which includes Ireland and Spain, is seeing the most improvement over the past three years, with falling NPL rates and increasing coverage ratios. These countries are actively addressing their issues through state Asset Management Companies, bad bank units and loan book sales. A large percentage of debt sale transactions originated from this block during last few years.

Italy is the stand-out country in this group. Although its NPL rate is 14.8%, due to its size, the actual stock number is extremely large at over €300 billion.

Block 3 — Countries at or below the EU average

This block, which includes the UK, Germany, the Netherlands and France, has a similar trend to Block 2 but a much lower NPL rate. These countries have decreased their rates in past 3 years while increasing coverage to over 45%.

This block includes large, systematically important countries to the EU. They were largely protected from massive NPL rates due to tighter lending laws before the crash.

Note: The NPL data in this article are from a presentation by Alvarez & Marsal Financial Industry Advisory Services LLP at our EMEA Risk Leadership Summit in May.

Changing the Debt Purchasers Market

One of the big changes we see as a result of the NPL activity is in the debt purchaser market, where some of the larger firms — such as B2 Holdings and Hoist — have grown rapidly, as banks look to shed unprofitable portfolios. Debt purchasers and debt collection agencies are consolidating, innovating and in some places become the preferred location for financially vulnerable customers. This is driven to a large degree by regulatory pressures on banks to reduce their NPL, and also by a new force: IFRS 9.

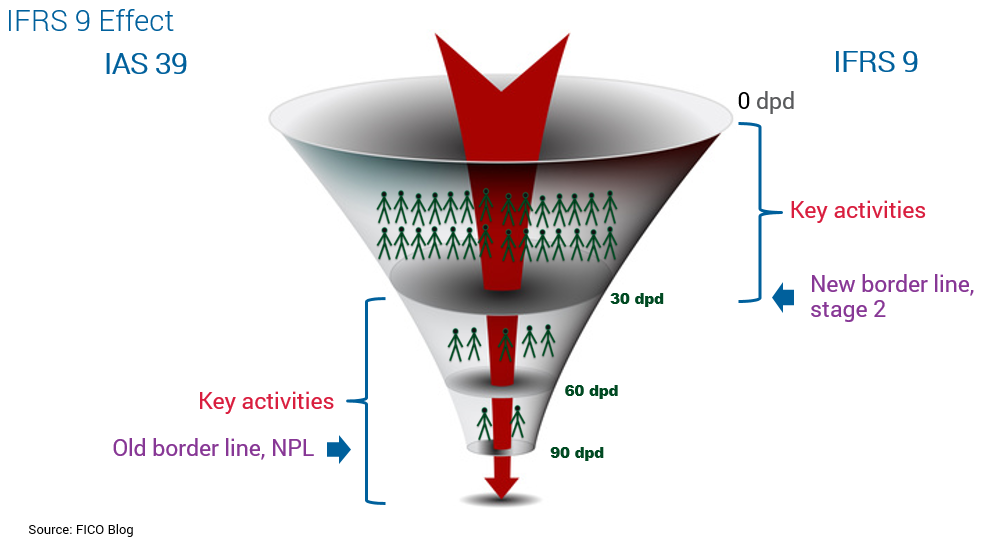

IFRS 9 accounting rules have effectively drawn a new border line for concern. Under previous regulation IAS 39, this border was at 90 days past due, when loans are classed as NPL. Under IFRS 9, this border has moved way up in the funnel, to 31 dpd, when customers (and all their accounts with the bank) move from Stage 1 to Stage 2 in terms of risk. At this point, the bank must increase impairment for the customer’s accounts from 12-month expected credit losses to lifetime expected credit losses. That’s a cliff-edge banks are naturally keen to avoid.

From NPL to NPE

Whilst focus may be on IFRS 9 and NPL, the reporting of NPE (non-performing exposures) will also cause changes in the creditor customer treatment strategies and that will impact the 3rd party sector. We are likely to see NPE as a primary group for debt sales, because creditors can’t afford to hold the capital coverage NPE will necessitate but do want to prove that there is performance value in these NPL that warrants stronger purchase pricing.

In my next post, I’ll discuss six steps banks should consider to focus on NPL and NPE.

The post How the Focus on NPL Is Changing Europe’s Debt Market appeared first on FICO.

Leave a Comment

You must be logged in to post a comment.