HELOC Resets: Greater Risk on the Horizon?

Blog: Enterprise Decision Management Blog

In the run-up to the Great Recession, millions of US consumers borrowed large amounts via home equity lines of credit (HELOCs). Since these loans are about to hit their 10-year reset marks, I’ve been sharing research findings from our latest study on HELOCs. We’ve found good evidence that, after these HELOCs hit their reset dates, borrowers are indeed paying more and/or refinancing.

This begs the question: do HELOCs that continue beyond their reset date have a drop in credit performance? In other words, are higher payments causing more borrowers to default on these loans?

To answer this, we examined HELOC one-year delinquency rates (90 or more days past due) across three different points in time, comparing a recent timeframe to one at the height of the Great Recession and another prior to the recession.

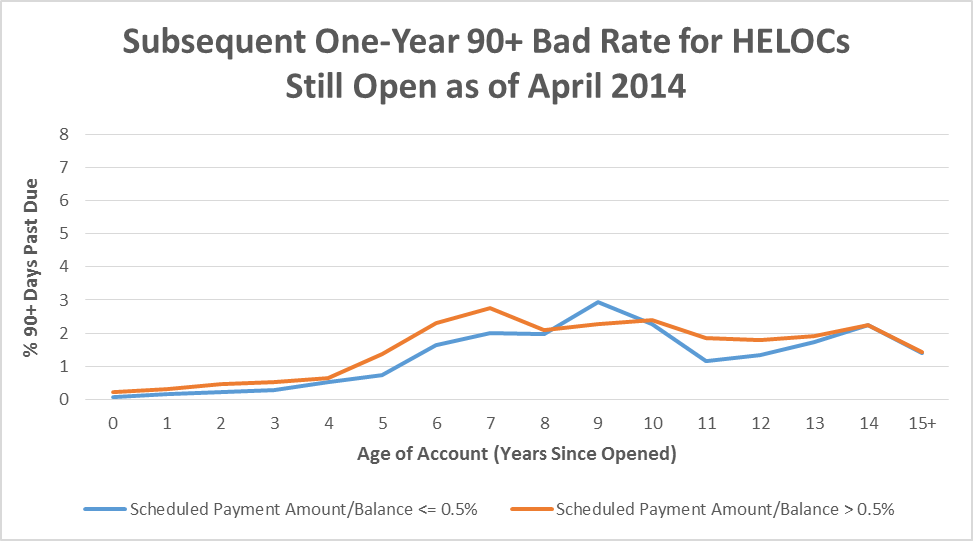

Here’s the recent snapshot:

While bad rates start to increase around the fifth year of maturity, they do not appreciatively increase after year 10. And there is not much difference in bad rates between loans with lower versus higher scheduled payments. This could be the upshot of the reasonably good economic conditions in the past year.

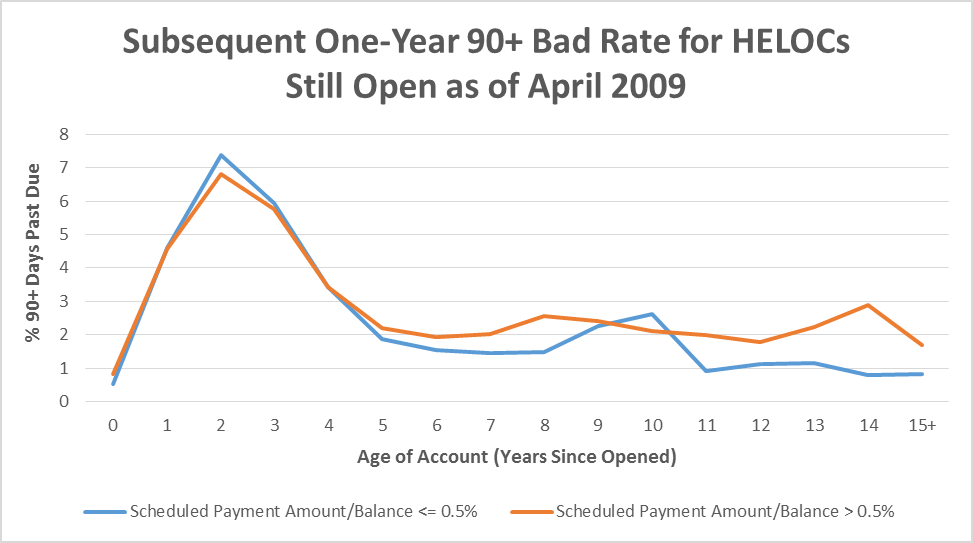

Here’s the same credit performance snapshot at the height of the recession:

HELOC loss rates were indeed up. But the driving factor does not appear to be loans hitting their reset date. Instead, decreasing home prices, which leads to negative equity, had a far greater impact on credit performance. HELOCs booked in the few years prior to the recession – when house prices were valued higher than subsequently during the recession – experienced loss rates several times higher than mature HELOC portfolios.

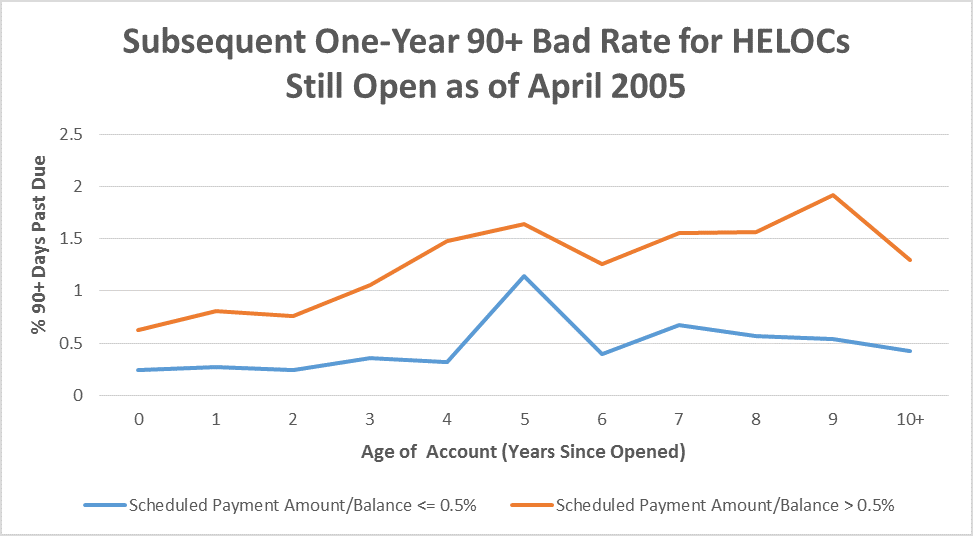

Here’s the third credit performance snapshot for a period prior to the recession:

There are similarities between this snapshot and the 2015 snapshot, with HELOC loss rates just slightly lower during this period. Once again, we observe no significant spikes in bad rates when HELOCs reached the 10-year maturity mark. (Note: we grouped all accounts older than 10 years into a single category due to low counts.)

The main difference on this snapshot is that there was a greater distinction between loss rates on loans with lower versus higher scheduled payments. In this higher interest rate environment preceding the recession, it’s not surprising to see customers with lower payments going bad at lower rates than those with higher payments. When interest rates are higher, there tends to be a wider range in interest rates and payments that can be used to price for risk. That means higher-risk customers would have higher rates and, therefore, higher payments.

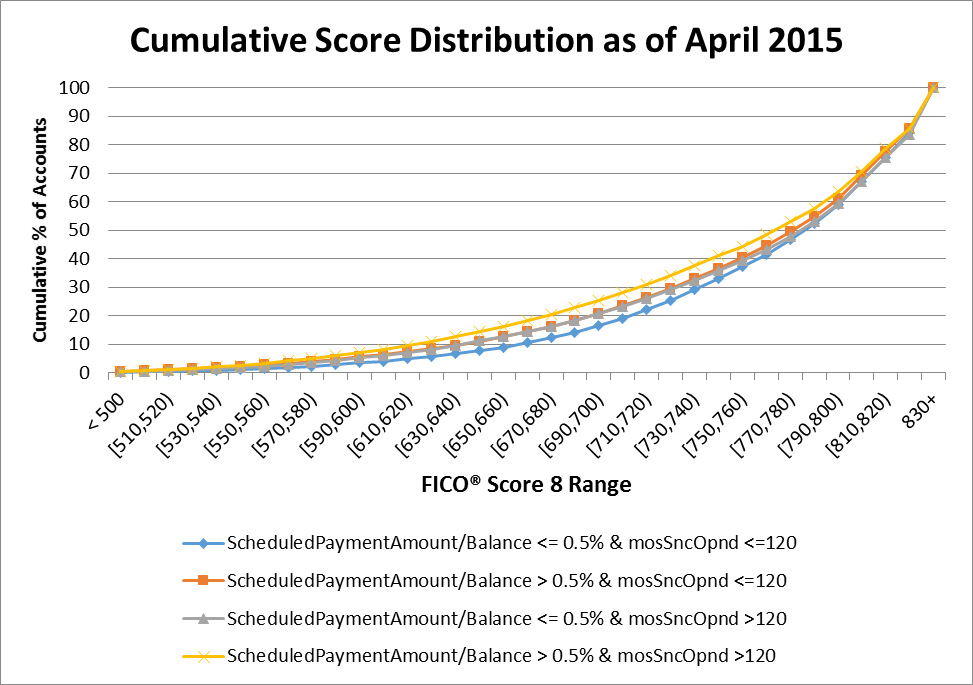

Next we examined FICO® Score distributions for these different groups as of April 2015:

A few notes on reading this chart: A cumulative distribution shows the percent of accounts that score less than a given score. Thus, groups with more consumers with lower scores (and higher risk) will have higher curves on the chart.

As one might expect, consumers with HELOCs over 10 years old and paying more than 0.5% of that balance each month have somewhat lower FICO® Scores compared to consumers who pay less than 0.5%. However, the difference is not overly pronounced. For example, only 11.1% of consumers in this higher payment group with 10+ year HELOCs have FICO® Scores of less than 620, compared to 8.5% for those with less than 10-year loans.

Ultimately, our research shows that consumers with HELOCs that have passed their reset date do appear to represent slightly elevated credit risk. Still, we would not expect, for instance, the loss rates on such accounts to double once the reset date is reached.

It’s important to note that there very well may be an increase in losses because of the heavy volume of HELOCs hitting their reset date. However, our analysis of prior trends suggests that as long as house prices are stable or increasing and employment remains healthy, any increase in loss rate should be mild.

In my next blog post, I’ll share research findings that answer the question: are consumers once again over-leveraging their homes?

The post HELOC Resets: Greater Risk on the Horizon? appeared first on FICO.

Leave a Comment

You must be logged in to post a comment.