Getting The Claims Outcomes You Want With ML/AI and Digital Decisioning

Blog: Decision Management Solutions - Decision Modeling

Neal Silbert of DataRobot had an interesting post on the DataRobot blog last week – Outcome-Based Claims Assignment: The “New Grail” of Insurance. He talks about using ML and AI to improve the assignment of claims adjusters to commercial claims. As he says “why make exceptions [to ensure the best assignment] when you can make an optimal assignment the rule?”

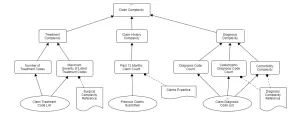

We have built several systems that handle assignment to specific adjusters or adjuster groups as part of a broader claims handling decision. Generally these systems ensure that a claim is ready to be processed (deciding if all the necessary documentation has been provided), auto-approve or auto-decline some claims (less in commercial, more in auto) and then assign the rest for manual review or fraud investigation. These review assignments are based on things like the complexity of the claim as well as various risk factors. Neal’s discussion of “outcome-based” adjuster assignment takes this one step further to ensure the assignment is to the “adjuster best prepared to reach an optimum settlement on an individual claim”.

So what does it take to develop such an approach?

Develop a decision model of your claims handling decision. Be clear how you decide on claims today – how do you decide a claim should be auto paid, auto-declined or reviewed? What makes it need review by a senior adjuster or one with specific skills? When does it go to fraud investigation? Building decision models directly with the business experts drives amazing insight about how you decide.

Develop a decision model of your claims handling decision. Be clear how you decide on claims today – how do you decide a claim should be auto paid, auto-declined or reviewed? What makes it need review by a senior adjuster or one with specific skills? When does it go to fraud investigation? Building decision models directly with the business experts drives amazing insight about how you decide.- Use a Business Rules Management System to automate the basics of this decision. This ensures consistency, generates data about how you decided and enables some immediate cost savings with Straight Through Processing of some claims (even if only the simplest and most obvious).

- Now, look for ways to use ML and AI to improve the decision. As Neal says, conduct “a systematic and highly granular analysis of closed claims” to find the particular aptitudes of each adjuster. The decision model will show which kinds of insight can readily be used to improve the decision and the use of business rules for automation will allow the ML and AI algorithms to be immediately effective in operations.

- Your work with ML and AI might find unexpected insights too that won’t fit immediately into the current approach to decision-making. The decision model can be used to see how much change would be necessary to use these insights, ensuring they don’t get wasted in a perpetual pilot.

- Finally gather data about how well this is working and put in place a continual improvement cycle. As you change assignments you will get different outcomes. Rebuild your algorithms regularly to learn from this data. Look at the good and bad outcomes and refine the decision-making approach and business rules. Test, learn, improve.

This is the basic approach to digital decisioning -managing, automating and improving the decisions in your increasingly digital business.

Drop us a line if you’d like to discuss this – or indeed any other assignment use case you have.

The post Getting The Claims Outcomes You Want With ML/AI and Digital Decisioning appeared first on Decision Management Solutions.