Fraud and Security Policies, Do They Turn Customers Away?

Blog: Enterprise Decision Management Blog

Fraud departments must juggle fighting financial crime with providing customers with an excellent experience – at the same time they must improve efficiency and drive down costs. We wanted to know more about the impact fraud and security policies have on your customers and so we commissioned the independent research of 2,000 US adults to find out:

- What they think about fraud and security

- What they do when fraud and security causes inconvenience

- What the fraud department can do to improve customer satisfaction

Frustration with Fraud and Security Policies

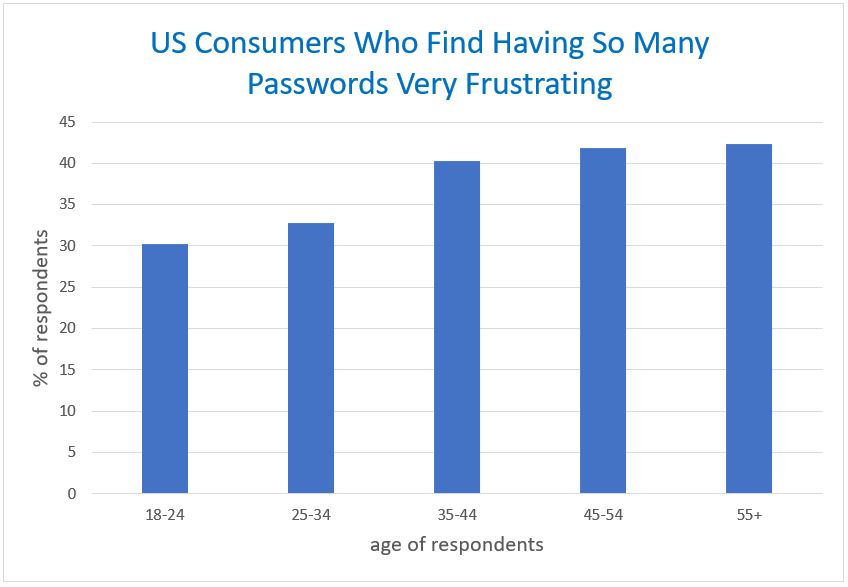

When we asked about accessing accounts, it became clear that current security methods are a source of irritation for many customers. While the largest proportion of respondents – 32% – selected the username and password option as the most secure way to log in to a bank account, 78% struggle to keep track of their passwords. 40% report being very frustrated by having so many passwords; the older the person the more likely they were to find this frustrating.

44% are also very frustrated when they have to change passwords because they can’t remember them; again the older the person the more likely they were to be frustrated.

While 96% say they understand the need for security measures, over 70% think there are too many security measures and 80% find security over-complicated.

The message seems to be that your customers want security but they want it to be easier for them.

What Happens When Security Gets in the Way?

We can see that customers are frequently frustrated by security measures that require them to take action – but does their frustration actually cost you business?

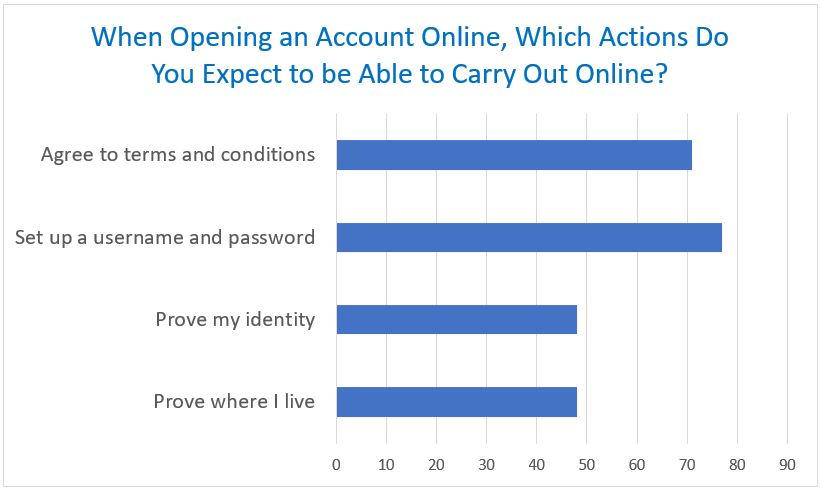

While 23% of people say they wouldn’t open a bank account online, those that would expect to be able to carry out most, if not all necessary actions without using another channel.

Not enabling customers to carry out these actions online will have implications for you. When setting up an online account, if asked to take a telephone call, post some documents or visit a branch, 10% say they would give up and do without the account and another 12% would give up with you and try another provider.

Your customers are also likely to leave if they feel an incident of fraud is poorly dealt with. Almost 25% would close their account and a further 25% would also close any other account they held with that bank. The older the account owner, the more likely they are to close all their accounts if they feel a fraud incident has been poorly dealt with. (This is especially true if they feel they have been victims of personal identity theft. Read our post on Three Things an Identity Fraud Platform Needs) Over 50% of those aged over 55 would close all accounts with that provider, compared to just 25% of 18-24 year olds.

Do Your Customers Expect Too Much?

The statistics in our study certainly show that frustrations can run high, but there’s also good news. Most customers don’t think fraud protection is just the bank’s responsibility, in fact 19% say that the responsibility is mostly theirs and another 55% think it is a joint responsibility. Over 96% say they take both online and offline security seriously.

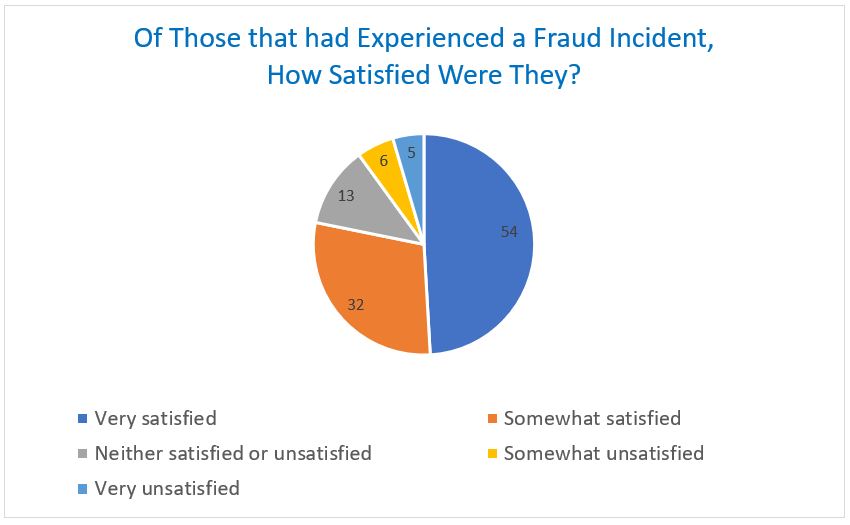

Customers are generally satisfied with the steps banks take to verify identities and look for signs of fraud – only 11% think banks aren’t doing enough. When it comes to victims of fraud, 55% of people have dealt with suspicious activity with their bank, of those most were generally satisfied with how well their bank dealt with the matter.

How Can the Fraud Department Improve Customer Satisfaction?

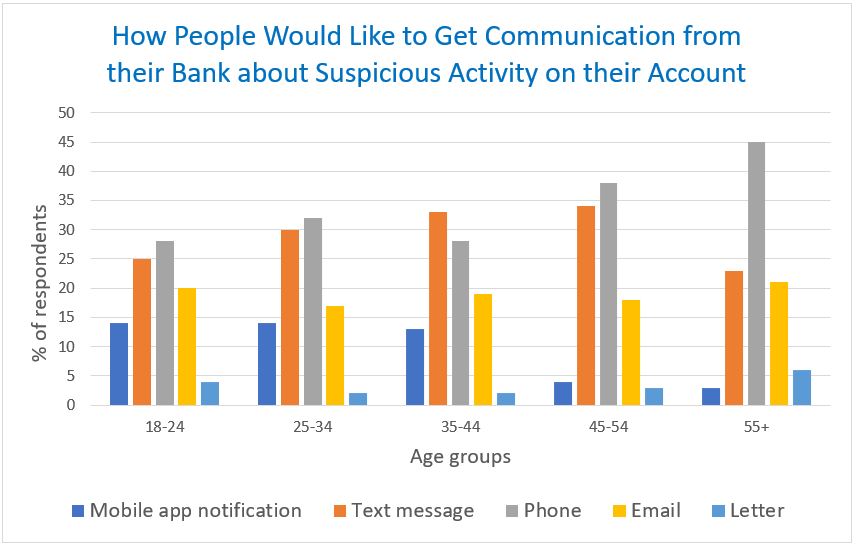

When we asked people how they would like to be contacted if their bank spots suspicious activity, ‘by phone’ was the top preference for 37%. Different age groups did have different preferences but these weren’t perhaps as divergent as you might expect.

Respondents also had preferences for services related to security they’d like to see from their banks. 48% would like to be able to turn on or off their credit or debit card at different types of merchants and 41% would like to be able to set controls for the countries their cards can be used in.

Want More Detailed Statistics?

This article uses the statistics from a survey of 2,000 US adults, it’s part of a bigger project that also includes a survey of 2,000 UK adults. Data can be broken down by age range, gender and geographical region. We’re happy to provide our customers with the source data from this survey – if you’d like to see a spreadsheet of all the statistics email: FICOBulletin@FICO.com.

The post Fraud and Security Policies, Do They Turn Customers Away? appeared first on FICO.

Leave a Comment

You must be logged in to post a comment.