FinTechs Excel at Customer Experience

Blog: Capgemini CTO Blog

Bank Channels Evolve

The banking industry has been slow to evolve. It wasn’t until 1967 that bank-teller operations were automated as ATMs made their debut. Dial-in telephone service followed and branch-based customer support was dramatically reduced. Moreover, online banking gradually became mainstream throughout the past 20 years as customer centricity became increasingly important. The smartphone irreversibly changed the way banks and customers interact. Today’s customers increasingly expect personalized banking products and have more financial services’ choices than ever before.

Challenges Weigh Down Banks

Although traditional banks have faced competition from credit unions, post offices, brokerages, and internet banks, the threat from FinTechs may be the most potentially disruptive to long-held business practices. During an interview for the 2017 World Retail Banking Report (WRBR), a program manager for a leading bank’s accelerator said: “Now with new players emerging, many banks witness totally new approaches to the finance space, and at first some of those might be hard to understand as a competitor.”

FinTechs emerged with customers at the heart of their value proposition—promoting convenience, lower fees, high-quality user experience, and innovation. Another executive interviewed for the WRBR 2017, a leading bank’s chief digital officer, said: “FinTechs found their proposition on strong, innovative ideas and a different customer view.”

Traditional banks, on the other hand, are weighed down by burdensome post-financial crisis regulations, aging legacy systems, and cultural resistance to change. All these challenges—combined with low-interest-rates—have prevented banks from quickly and sufficiently beefing up customer experience, the very area in which FinTechs excel.

FinTechs’ Provide Superior Experience

Compared to banks, FinTechs are generally built on less expensive infrastructure, come without the baggage of legacy systems, and follow an agile approach to processes and work culture. This makes it easier to adapt to fast-changing market demands. All these factors, along with the smart use of digital tools and technologies, have helped FinTechs provide a superior customer experience. For example, in the UK, app-based Atom Bank uses gaming software for making customer interactions more engaging.[1] And, the UK’s mobile-only Starling Bank asks customers to record talking videos for biometric identification.[2]

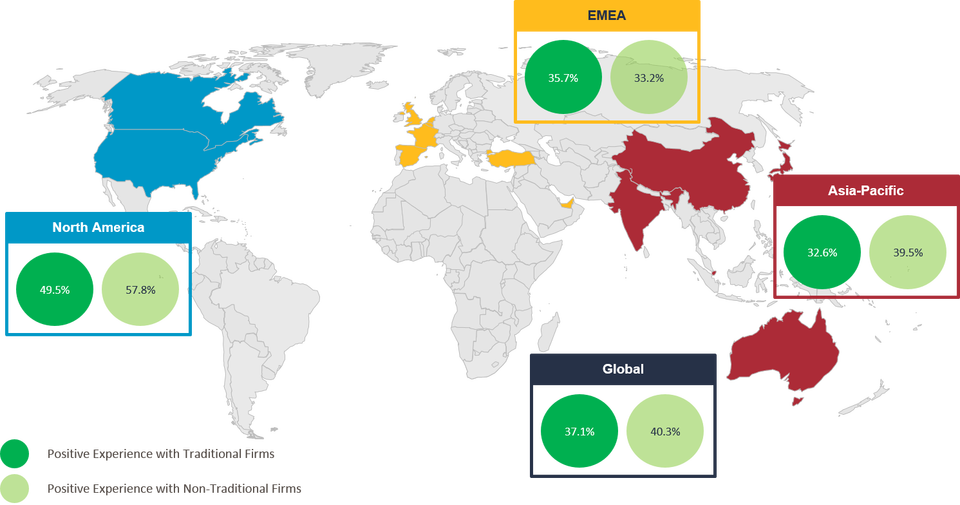

As noted in WRBR 2017, FinTechs across the globe have surpassed banks in delivering positive customer experience. FinTechs performed exceedingly well in North America, offering positive experiences to 57.8% of customers, while only 49.5% of customers had positive experiences with traditional banks. This was even though more than 40% of banks in the United States have devoted at least 25% of their IT budget to digital transformation.[3] FinTechs beat their traditional counterparts in Asia-Pacific as well, providing positive experiences to 39.5% of customers (versus only 32.6% by banks). This was primarily driven by China, home to some of the top FinTech unicorns.[4] The only exception was Europe/Middle East/Africa, where 33.2% of customers had positive experiences with FinTechs, compared to 35.7% with banks.

Positive Customer Experience for Traditional and Non-Traditional Firms (%), 2017

- Note: Country boundaries on the diagram are approximate and representative only; Non-Traditional Firms are predominantly challenger banks and FinTechs (new firms, mostly less than five years old, with a relatively small, but growing customer base).

- Source: Capgemini Financial Services Analysis, 2017; Capgemini and LinkedIn World FinTech Report Voice of Customer Survey, 2017

The Way Forward

For financial services transactions, customers have higher expectations than ever before and expect their financial services provider to provide customized products and services. They want processes and services that are fast, seamless, intuitive, and easy. FinTechs have made incremental gains within these areas and are reaching a critical mass of bank customers by setting new standards for innovation and customer experience.

Therefore, it goes without saying that to retain customers and match FinTech levels of customer experience, banks will need to provide an omnichannel experience and deep-dive into all types of experience-enhancing features—such as quick account opening, real-time payments, biometric security, gamification, interactive personal financial management, etc. Banks must become customer-focused and provide a more personalized experience. Regional preferences are also a consideration, so banks must holistically evaluate consumer needs as they invest in customer-facing front-end enhancements, and digital products and services.

[1] INDEPENDENT, “ATOM APP: IS THIS THE FUTURE OF BANKING?” February 3, 2016, http://www.independent.co.uk/life-style/gadgets-and-tech/features/atom-app-is-this-the-future-of-banking-a6851996.html.

[2] TechCrunch, “Starling Bank, a digital-only UK challenger bank, launches beta,” March 16, 2017, https://techcrunch.com/2017/03/16/starling-bank-a-digital-only-uk-challenger-bank-launches-beta/

[3] THE FUTURE OF BANKING: Growth of innovative fintech banking services, Business Insider, December 15, 2016, http://www.businessinsider.com/the-future-of-banking-growth-of-innovative-banking-fintech-services-2016-12?IR=T

[4] A unicorn is a startup company valued at more than USD 1 billion.

Leave a Comment

You must be logged in to post a comment.