FICO Survey: Are Millennials Embracing Mobile Payments?

Blog: Enterprise Decision Management Blog

Millennials love their smartphones—so much so that in recent research, millennials ranked them as more important than a toothbrush or even deodorant. It is a good thing 90% of millennials have smartphones!

Of course, many of our clients want to know more about millennial banking habits. FICO’s latest US consumer research survey found that large numbers of millennials are using their bank’s mobile application regularly. Some 66% use the app several times a week, and 30% use it daily.

This is great news for banks because it provides them an amazing opportunity to play a central role in the lives of their customers. I’ll spend some time in a future post talking about using those phones for different types of financial-related communications, but today I wanted to focus on mobile payments.

If millennials love and have phones, and trust them to conduct banking transactions, how do they feel about using them for mobile payments? That is a really mixed story.

The Good: Peer-to-Peer Payments

As millennials flock to peer-to-peer mobile payments, Venmo has seen explosive growth. The quarterly payment volume processed by Venmo grew 154% last year from $1.26B in Q1 2015 to $3.2B in Q1 2016. When we interviewed millennials, they talked about Venmo and the ease of use.

This sentiment shouldn’t be surprising. Venmo is free to consumers, is really easy to use, removes the friction in peer-to-peer payments (of which millennials do a lot), and transfers money faster than banks. It even makes money transfers fun, as part of the social network. Paypal is smartly leveraging that loyal user base to enable its consumers to pay merchants via the service, which the area where mobile payments have fallen short of the hype.

The Bad: Mobile Merchant Payments

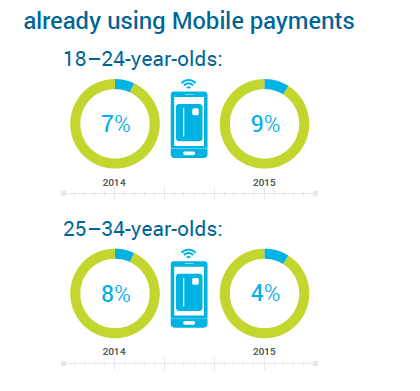

Our same research asked millennials about their use of mobile payments (Apple Pay, Samsung Pay, etc.). Usage was in the single digits. In fact, actual usage among older millennials (25-34 years old) dropped between 2014 and 2015.

So if millennials love their phones more than anything and use them for just about everything, why aren’t they jumping in two feet with mobile payments? It really boils down to convenience: Are the new offerings pervasive enough and compelling enough to make it more convenient for me to switch my habit of using my plastic card today?

In his book The Power of Habit, Charles Duhigg underscores that 40% of the actions that people perform each day aren’t actual decisions but habits, with our brains trying to save effort for more complex issues. I propose that our payment behavior is an engrained habit, characterized by Duhigg’s habit loop—the cue (or trigger that kicks the brain into habit mode), the routine (the action taken) and the reward (which helps us remember the loop for the future). While there are many reasons that all the big players in payments are not making it easy for consumers, I proposed that real change will occur when one or more firms is able to modify the traditional payment habit loop, as Venmo has for peer-to-peer payments.

Part of Venmo’s success is that they leverage a core concept that Duhigg highlights to change habits, peer pressure and social ties. Because Venmo is part social network, it helps drive conformity to group expectations.

To learn more about FICO’s research on millennials and banking, download our Digital Generation eBook, entitled: How Quickly Are Consumers Adopting Mobile/Online Payments and Peer-to-Peer Lending?”

The post FICO Survey: Are Millennials Embracing Mobile Payments? appeared first on FICO.

Leave a Comment

You must be logged in to post a comment.