FICO Survey: APAC Banks Expect Rise in Tax Evasion

Blog: Enterprise Decision Management Blog

Its been a year since the Panama Papers were leaked to the public. The leak of 11.5 million digital records exposed the dark deeds of dirty money and tax evasion and burst the bubble of pretense that the world is effective at dealing with corruption. Investigations were launched in 80 countries , with twelve national leaders among 143 politicians, their families and close associates from around the world known to have been using offshore havens to dodge taxes and hide assets.

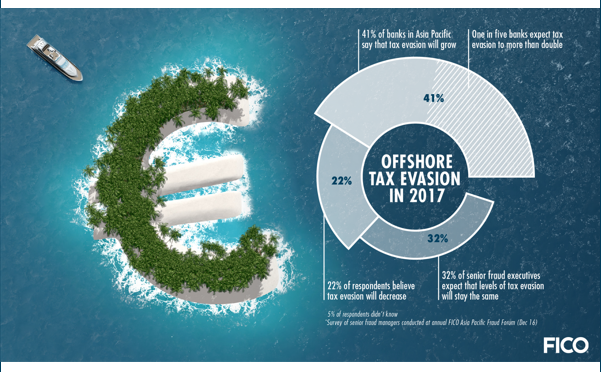

As the fallout out continues to ripple across the world, we decided to ask 37 executives from financial institutions across the Asia Pacific about tax evasion and how they thought it would impact the region.

One in five banks in Asia Pacific say that they expect tax evasion to increase 100 to 500 percent over last year’s levels according to a recent poll by FICO. This is despite new reporting regulations being introduced this year to arrest the problem. A further one in five senior fraud managers surveyed said they expect the increase to be up to double last year’s levels. While only 22 percent of respondents felt tax evasion would decrease this year.

This outlook comes at a significant point in time, with only five months to go until a new international standard is rolled out that governs how tax authorities in participating countries exchange data relating to the bank accounts of taxpayers.

“The goal is to make offshore tax evasion impossible,” said Dan McConaghy, president for FICO Asia-Pacific. “More than 100 jurisdictions have already signed up to the automatic exchange of information (AEOI) as part of a common reporting standard (CRS). Its introduction this year will see the initial wave of Asian countries start to share tax information on individuals from September.”

India and Korea will be the first countries to commence reporting in 2017, with Australia, New Zealand, China, Japan, Indonesia, Malaysia, Brunei, Macao, Hong Kong and Singapore due to start in September 2018.

The AEOI requirement will see bank account information reported by the banks to the domestic tax authorities, who will then exchange the data with tax authorities in partner countries.

“Tax evasion was thrust into the spotlight following the Panama Papers scandal last year,” said McConaghy. “Closer to home we have also seen high-profile tax evasion stories in Korea and India. In order to facilitate the exchange of information required, many financial institutions will need to enhance their tax compliance methods. By adopting an automated compliance process, banks will be able to implement the various identification, classification and reporting requirements in a way that is future-proof.”

For more information on how FICO is helping in this area, read the Offshore Tax Evasion release or visit the FICO Tax Compliance solution page.

The post FICO Survey: APAC Banks Expect Rise in Tax Evasion appeared first on FICO.

Leave a Comment

You must be logged in to post a comment.