FICO Research: Are Millennials Really Abandoning Credit?

Blog: Enterprise Decision Management Blog

Nothing fascinates us more in the world of demographics than what the Millennial generation think, do and how they act. One thing for sure is that, as they vie with the Baby Boomers to be the largest demographic group here in the USA, what they do is important. And we don’t need to be statisticians to know that the Baby Boomer generation isn’t going to be getting any bigger.

The question for many in financial service boils down to this: Are Millennials really abandoning us?

The topic came to mind for me recently as I was asked to be part of a panel discussion on credit and the economy at an ABS East conference. Since much of what gets said about Millennials seems to be more opinion than fact, I decided to look at a few stats and see if we could cast any light on what might be happening.

The topic is large, so I looked at three aspects of Millennial behavior: what kind of credit do they have, how much do they have and what do their FICO Scores look like relative to others? To make the figures more relevant I looked at the current group of 18-24 year-olds and compared their profile to the profile of 18-24 year-olds back in 2005.

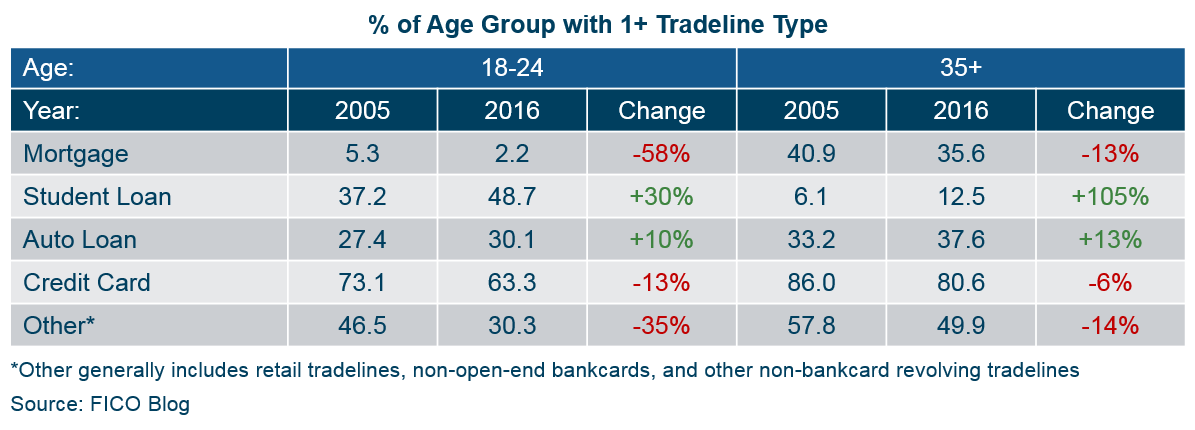

Let’s start by looking at the level of financial participation. Table 1 shows the percentage of Millennials who have at least one tradeline in different categories. The findings are probably in line with expectations: Compared to 10 years ago, mortgages are down and student loans are up. But these trends are similar for folks over 35, even if the percent changes are different. The absolute numbers make the percentages a bit difficult to interpret, but we see growth in student loans and auto loans for both groups.

Table 1

So there is some truth in the assertions about Millennials reducing their participation in financial services relative to their cohorts a decade earlier, but the same is also true for the older generation.

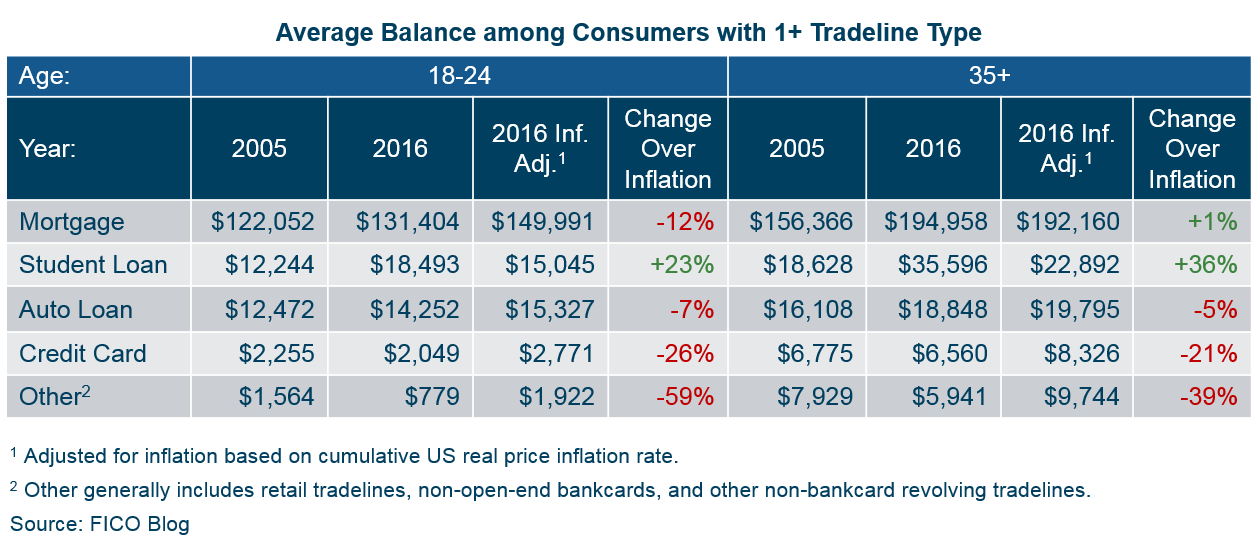

Participation is a function of both number of accounts and balances on those accounts. Table 2 looks at average balances for the same groups. To get some sense of the extent of the movement between the two periods, I have compared the balances to what they would have been had they increased in line with the general level of inflation.

Table 2

Again, there is perhaps some unexpected consistency between the two groups. Student loans have outpaced inflation — this is not news, as we know how education costs have far outstripped general inflation. The percentage increase is greater in the older group, probably because the 18-24 years are still accumulating student debt. Elsewhere, although Millennials have lower balances, both age groups demonstrate that borrower levels have not kept pace with inflation, which suggests that the deleveraging that occurred after the recession is continuing to hold.

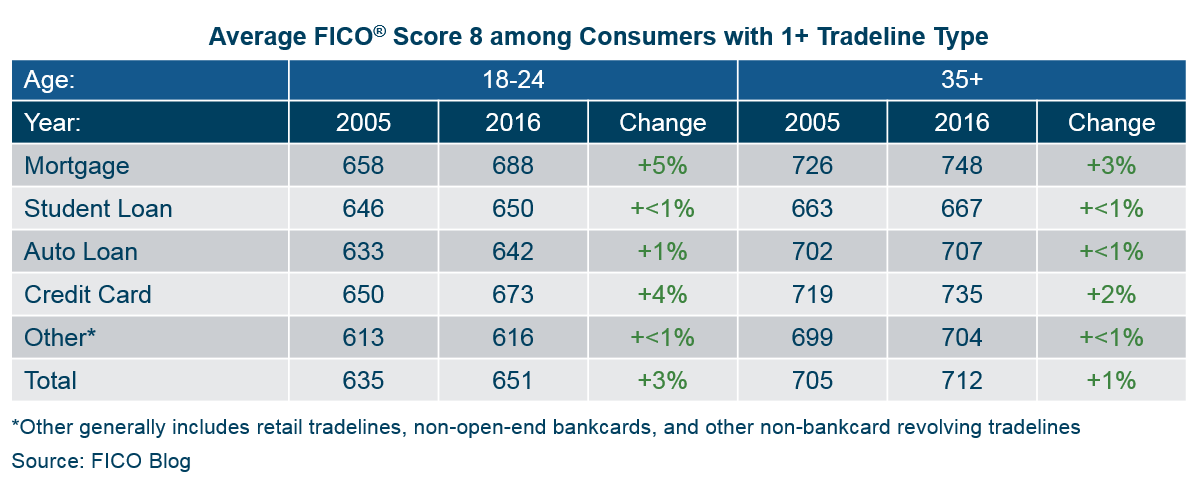

Lastly, I was curious as to how much of the change might be demand-driven and how much is a function of supply, i.e. tightened underwriting. This is a difficult thing to unravel from a credit report because we don’t see a full picture of applications with inquiry data from a single CRA. Looking at the average score in each category and its movement relative to that for the particular sub-segment gives some idea of what might be going on.

Table 3

From a recent blog post, we know that the average FICO score has been edging upwards. This data bears that out. Given that the older group is already above the overall average, we don’t see much of a change. Millennials’ FICO Scores are up 16 points on average, or 3%.

The most interesting thing we see is almost no change in the average score for consumers with student loans. This reflects the fact that there are more government-backed student loans that are not dependent on the applicant’s credit quality.

The other interesting thing here is a disproportionate increase in the score for mortgage holders. This is consistent with the known tightening in mortgage underwriting that occurred during the Great Recession. To the extent that we can associate higher scores with supply-side factors, we can conclude that the reduction in debt isn’t all demand. The same effect can be seen in the credit card sector, where average scores are up 4%.

So are Millennials all that different from the rest of the population? It is clearly not true that they have withdrawn from financial services. The pattern of their credit activity has changed relative to 18-24 year-olds a decade ago, but it has changed in a way that is directionally similar to trends observed over the past decade among their older cohort. With the exception of student loans, credit account participation and balances are down. Credit quality looks higher with evidence that it is a requirement for certain trade line types.

Though inflation-adjusted average auto loan balances are down for Millennials, participation in auto loans has actually increased over the past 10 years. At least for 30% of Millennials, the American love affair with the automobile is still alive and well.

The post FICO Research: Are Millennials Really Abandoning Credit? appeared first on FICO.

Leave a Comment

You must be logged in to post a comment.