Dynamic Spread Calculation with the FX Dealing Accelerator

Blog: The Tibco Blog

Trading floors can be frenetic and boisterous environments, complete with a constant stream of audio alarms, news announcements, and traders shouting to each other in code to accept or reject orders. There are grids of screens stacked 4×4, displaying instruments ticking up or down, charting price movements, displaying positions, and Profit and Loss. Everyone is acutely focused on the task at hand. The IT team often sits in this area, charged with supporting and developing trading systems. The last thing they want to hear above all of this cacophony is a trader screaming “Why have I just been hit in CABLE, where are my PRICES!” (CABLE=GBP/USD)

Providing a robust system capable of delivering reliable, at market pricing is fundamental to the success of traders, and ultimately those who deliver their trading applications.

Delivering Scalable Robustness

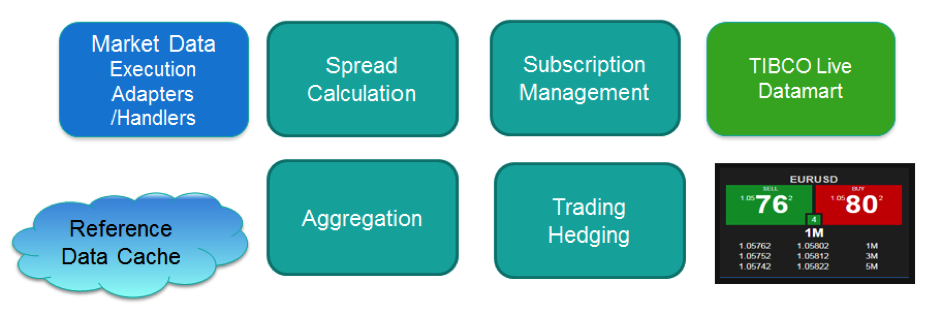

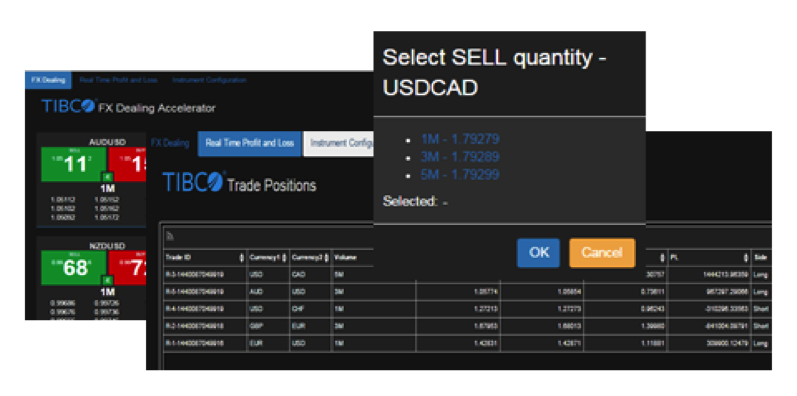

TIBCO StreamBase and Live Datamart provide a platform for FX pricing and dealing systems that truly delivers the level of service necessary in volatile markets. TIBCO recently announced its accelerator program, as further introduced by Mark Palmer here. Within the program, we’ve also developed the FX Dealing Accelerator (FXDA). The FX Dealing Accelerator (FXDA) wraps key components: Market Data & Execution Adapters/Handlers, components for aggregating prices, sample spread calculation modules, and Live Datamart tables into one quick start project available in TIBCO StreamBase 7.6. A sample HTML5 trading application is also provided, which is intended to be extended in each specific implementation.

The first stage in building an FX trading system is to consume market data from the Liquidity Providers (LPs). The FX Dealing Accelerator uses StreamBase Trading Components with access to Market Data and Execution services from 25 LPs. There is no centralized exchange in FX dealing, so in order to know what level the market price is, at any point in time, data from multiple LPs is consumed to calculate an “at market” price.

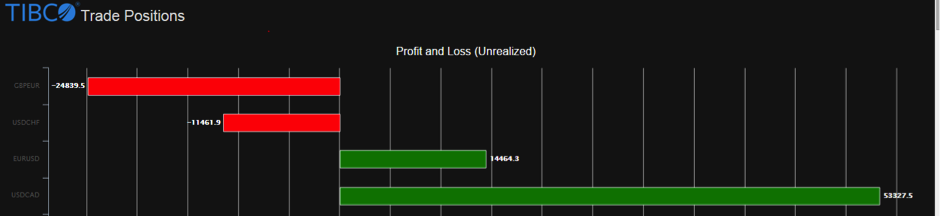

FX dealing firms use these prices both as a source of prices to their customers, as well as internally to decide whether to accept or reject a trade. Clearly being “at market” is essential. Any delay in price data directly affects the P and L (Profit and Loss). From these multiple price sources, we build our aggregated book or our view on the market.

Once we have our market price, we propagate this through to the spread calculation modules. In the Accelerator (FXDA), we leverage the TIBCO Live Datamart as both an in-memory cache for our prices and trades, as well as the bridge, from the JavaScript API to the Dealing UI. These prices and trades are also available for ad-hoc query and analysis via the LiveView web client and desktop.

Dynamic Reaction in Volatile Market Conditions

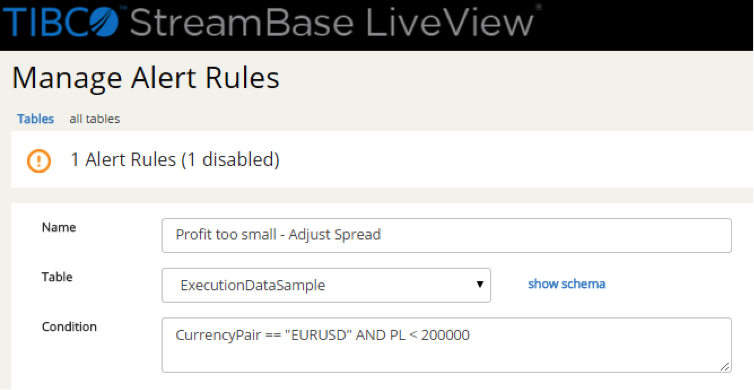

Our FX Dealing Accelerator manages the full cycle from Market Data ingest, through customized pricing, to trade management. The published prices, trade requests, and execution reports are stored in Live Datamart. This gives the unique ability to monitor the performance of our platform in real time, and to adjust any of our spread parameters in real time. Live Datamart surveys and monitors both the prices and the trades in a feedback loop. We can set up alerts based on real-time Profit and Loss calculation and take appropriate action. In a volatile market, we can alter the spreads when making a profit to increase revenue opportunity.

We can also monitor the latency performance of LPs. If we find during events such as Non-Farm Payroll that a particular LP is providing stale prices, they can be dynamically disabled from our aggregated view. We can create alerts in Live Datamart either through a web UI, or through LiveView Desktop. Responding to these alerts can be either automated or manual.

To respond automatically, we configure the alert to send new spread parameters to the pricing engine, thus dynamically altering FX prices offered, based on the prevalent market conditions. This built-in monitoring of the FX Dealing platform greatly bolsters the resilience of the system and enhances risk management.

The TIBCO StreamBase platform is a graphical development tool that greatly reduces the development lifecycle. Leveraging this platform in the FX Dealing Accelerator further shortens the time to results for our customers. This white box approach to developing an FX Dealing system offers the ability to rapidly adapt to volatile market conditions. Such inherent agility creates a platform where new business ideas, updated Execution Algorithms or configuration can be deployed to production during the trading session if needed.

The combination of FX Dealing Accelerator for price and trade processing and Live Datamart for 360-degree system monitoring provide IT teams with a system they can trust, and one traders can generate revenue from. Getting back to our team on the trading floor, they will still be surrounded by frenetic activity, bells, and cries, but calls more like: “I’ve just made 10 large on CABLE!”

To learn more about “FX Pricing: Responding to Your Market,” check out our on-demand webinar.

Leave a Comment

You must be logged in to post a comment.